Both of these stocks have lucrative dividend yields, but only one of them seems like a smart investment.

“The market is often stupid, but you can’t focus on that. Focus on the underlying value of dividends and earnings.” – John C. Bogle

While that’s putting it bluntly, Bogle isn’t wrong. The markets can and do absolutely move up and down with little rhyme or reason — not to say certain moves aren’t justified by developments.

But the value of dividends and reinvesting them to drive the power of compounding is one of, if not the best, ways to build wealth over the long term.

With all that said, here is one excellent dividend stock yielding more than 6% that deserves investor attention, and another high-yield dividend that could grow stale.

Image source: Getty Images.

A unique income play

Long-term investors scouring the market for dividend stocks might not consider Altria Group Inc. (MO +0.15%). That’s fair, because at first glance owning shares of Altria means you own a company with a declining cigarette volume market — cigarette volumes declined 6% annually between 2019 and 2024 according to Euromonitor — and a company that operates in a space with increasing taxes and tightening regulations.

So what keeps the company churning out its impressive dividend? A dividend yielding an impressive 6.5% and with 60 dividend increases over the past 56 years under its belt.

The answer lies in the still lucrative U.S. market, where the market size has remained in the mid-$90 billion range for several years, according to Morningstar, as rising tobacco prices help offset declining volume. In fact, while the U.S. market is mature in volume, it’s actually a highly affordable market relative to other developed markets — leaving room for price increases and growth for years to come.

Further, while the company’s attempts to diversify haven’t gone perfectly, it’s still a prudent long-term move and Altria owns stakes in cannabis and vaping producers. Eventually, assuming the company successfully diversifies and acquires or innovates the next big category, it’s well-positioned with a massive and intricate distribution system that few competitors can match — perfect for launching a next-generation product.

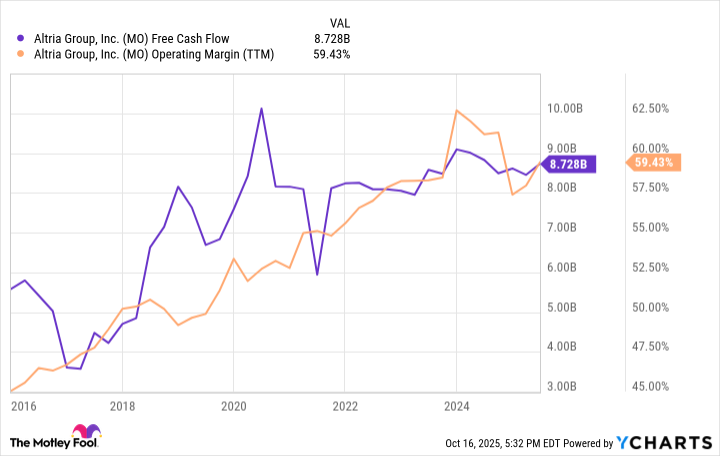

MO Free Cash Flow data by YCharts

Cigarette volume may be in decline, but as you can see in the graphic above, the company’s margins are expanding and its free cash flow is consistently rising — and that’s what matters to dividend investors.

Today’s Change

(0.15%) $0.10

Current Price

$64.67

Key Data Points

Market Cap

$109B

Day’s Range

$64.54 – $64.97

52wk Range

$49.73 – $68.60

Volume

4.5M

Avg Vol

8M

Gross Margin

71.63%

Dividend Yield

0.06%

Steer clear of a stale business

Conagra Brands (CAG 0.97%) is a packaged food company that operates predominantly in the U.S. market. The majority of its revenue comes from frozen food with recognizable brands such as Marie Callender’s, Healthy Choice, Banquet, and Birds Eye, among others.

But wait, there’s more — the company also sells snacks and refrigerated food through brands such as Duncan Hines, Hunt’s, Slim Jim, Orville Redenbacher’s, and many more.

For investors, the company has evolved its growth strategy. Previously, the company had taken steps such as its 2012 acquisition of Ralcorp to boost its private-label exposure, which was later divested at roughly half the purchase price — oops — to its current vision of growth through brand investment.

The problem with that is the company spends notably less in product development and marketing, which goes against brand building. Plus, it lacks the number of strong brands needed to drive pricing power or to become a deeply entrenched retail partner/supplier.

Frozen food is the most important category for Conagra, but it is likely to struggle to stand out amid intense competition, especially spending less on marketing and product innovation. Further, while frozen food has been a fast growing grocery category, the market has also historically posted volume declines following inflation-related price increases — that means consumers aren’t willing to pay a premium for frozen products, limiting growth.

Conagra’s pivot to brand building was the right move, in my humble opinion, but until the company puts its money where its mouth is to truly invest in its brands as the competition does, investors would be wise to find more promising high dividend-yielding investments.

What it all means

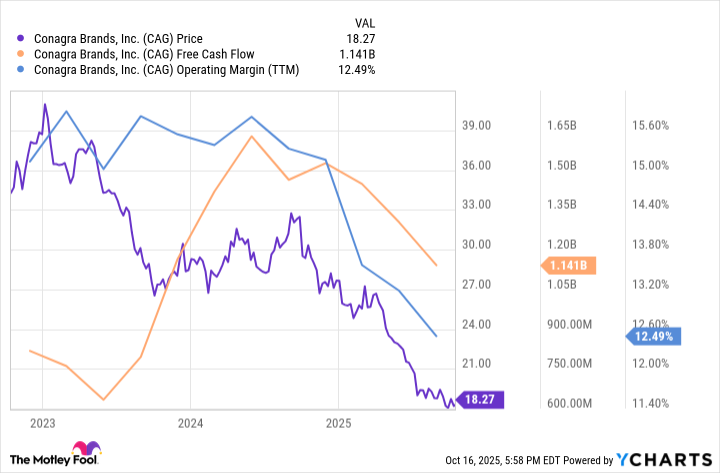

Remember the first graphic example highlighting Altria’s expanding margins and rising free cash flow? Well, as you can see in Conagra’s graph above, it can’t claim the same. Not all dividend stocks are created equal, despite the vast majority of them being more mature businesses and consistently returning value to shareholders.

Even with declining cigarette volume in the U.S., Altria is driving margin expansion while Conagra is failing to invest in the very brands it expects to improve its margins — invest accordingly.