Apple (NASDAQ: AAPL) has had a challenging start to 2024, with its shares down 9% year to date. Macroeconomic headwinds caught up with the company last year, which led to four consecutive quarters of revenue declines. Its first quarter of 2024 finally broke the streak, with the tech giant posting revenue growth of 2% year over year to $120 billion as it beat Wall Street forecasts by more than $1 billion.

However, outperforming estimates haven’t been enough to quell investor concerns about other areas of its business. In the first quarter of 2024, Apple’s iPhone division reported a 6% rise in total sales, yet fell 13% in China. The East Asian country has increased restrictions on the iPhone, threatening business from Apple’s third-largest market.

Then, on March 4, Apple’s stock slipped 3% in early trading after news broke that the European Commission had hit the company with a $2 billion antitrust fine over concerns for its music streaming service.

Despite recent headwinds, Apple remains a leader in tech with dominating brand power and immense financial resources. A recent stock dip could be the perfect time to make a long-term investment in its business and profit from its potential over the next decade.

So here are two reasons to buy Apple stock like there’s no tomorrow.

1. The brand power and financial resources to overcome current headwinds

Apple is a behemoth in consumer tech, with leading market shares in most of its product categories, from smartphones to tablets, smartwatches, and headphones. In fact, the company holds the third-largest market share in e-commerce in the U.S., only after Amazon and Walmart, despite having a significantly smaller range of products.

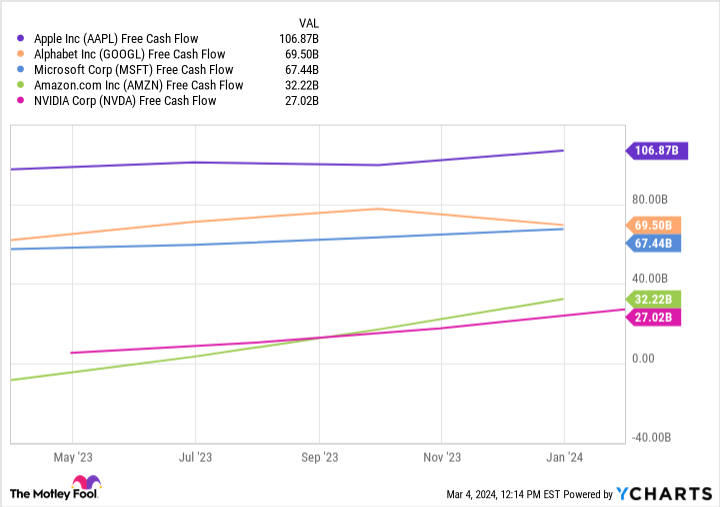

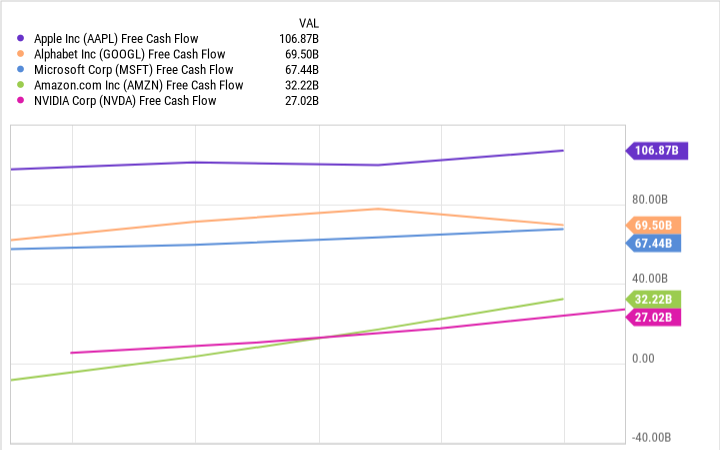

The popularity of Apple’s offerings has instilled reliability in its business and given it the funds to overcome unexpected headwinds. This chart shows Apple’s free cash flow is considerably higher than some of the top names in tech. Apple’s free cash flow actually increased 10% in 2023 despite hits to its revenue, allowing it to continue investing in its business.

While declining sales in China are concerning for now, growth in other regions could offset losses over the long term while the company gradually reshapes its business to rely less on the iPhone. In Q1 2024, product sales in Europe, Apple’s second-largest market, posted revenue growth of 10% year over year. Meanwhile, sales in Japan soared 15%.

Moreover, the recent launch of Apple’s first virtual/augmented reality (VR/AR) headset, the Vision Pro, could become a key growth catalyst in the coming years. The VR market on its own is projected to expand at a compound annual growth rate of 31% until at least 2030. Apple may be new to the industry, but it has a reputation for entering new sectors and quickly rising to dominance.

As a result, an investment in Apple today could be an investment in the future leader of the $20 billion VR market.

2. Trading at a better value than its rivals

The tech market is booming, with the Nasdaq-100 technology sector up 11% year to date. Wall Street has grown bullish about the vast potential of artificial intelligence (AI) and improvements in e-commerce, sending countless tech stocks soaring. While this has been beneficial for current investors, it has raised the price of entry for new ones.

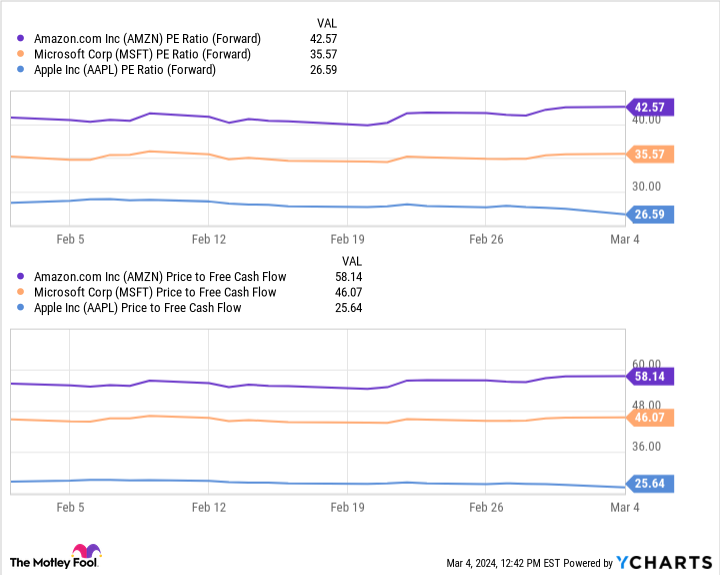

However, recent headwinds have kept Apple’s stock at an attractive price point. This chart below shows that Apple’s forward price-to-earnings (P/E) ratio and price-to-free cash flow are significantly lower than those of its rivals, Microsoft and Amazon. The figures indicate that Apple’s shares are trading at a bargain by comparison, offering considerably more value.

These are useful metrics for determining a stock’s value as they take into account a company’s financial health. Forward P/E is calculated by dividing an organization’s current share price by its estimated future earnings per share. Meanwhile, price-to-free cash flow divides market cap by free cash flow.

Apple has faced repeated hits to its business over the past year. However, it’s on a promising growth path. The company is playing the long game with its venture into VR/AR and expansion in other smartphone markets. Additionally, it has funds to invest heavily in its development.

A recent stock tumble has boosted the value of its shares and made it low risk, with Apple worth buying like there’s no tomorrow.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Reasons to Buy Apple Stock Like There’s No Tomorrow was originally published by The Motley Fool