The stock market is off to a good start in 2024. The S&P 500 index is setting new record highs and is up roughly 19% over the past year. With signs that macroeconomic conditions are improving, the market’s run has many thinking it could continue.

While the possibility of sustained bullish momentum in the near term is good to hear, it’s the long-term opportunities in the market that more often contribute to making investors richer. With that in mind, read on for a look at two top stocks I’ve purchased in 2024 and plan to hold for the long haul.

1. StoneCo

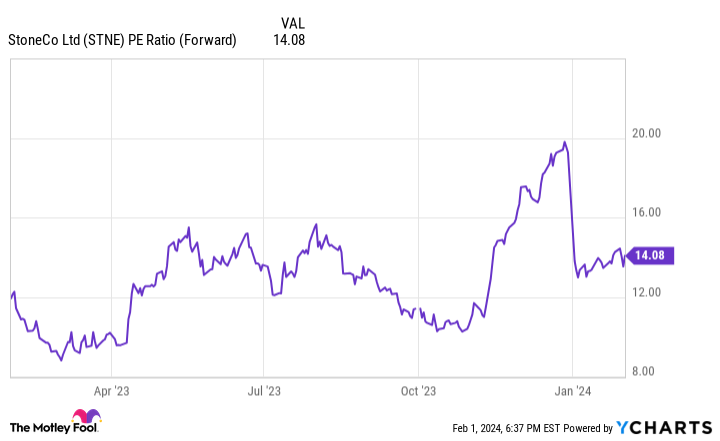

StoneCo (NASDAQ: STNE) is a Brazil-based financial technologies company that provides leading payment-processing solutions and other services for small and medium-sized businesses. While the company’s valuation has been kept down by challenges that impacted its lending unit, the fintech has now overcome these issues — and it’s trading at levels that leave room for investors to see explosive returns.

Valued at just 14 times this year’s expected earnings, StoneCo stock looks downright cheap in the context of recent momentum for the business. Revenue increased 25% year over year in the third quarter, and the company’s adjusted net income more than quadrupled in the period.

While the big earnings growth in Q3 was partially attributable to starting from a relatively small amount of profit in last year’s term, it looks like strong momentum will continue for the business. The company’s forward guidance points to big upside return potential.

From 2024 through 2027, StoneCo expects that it will grow its adjusted net income at an average annual rate of 31%. Even if the company were to only grow its profits at half that rate across the stretch, its shares would be significantly undervalued based on a price-to-earnings-growth analysis. If the company even comes close to hitting its growth target, there’s a good chance shares will trade far above their current level.

2. Take-Two Interactive

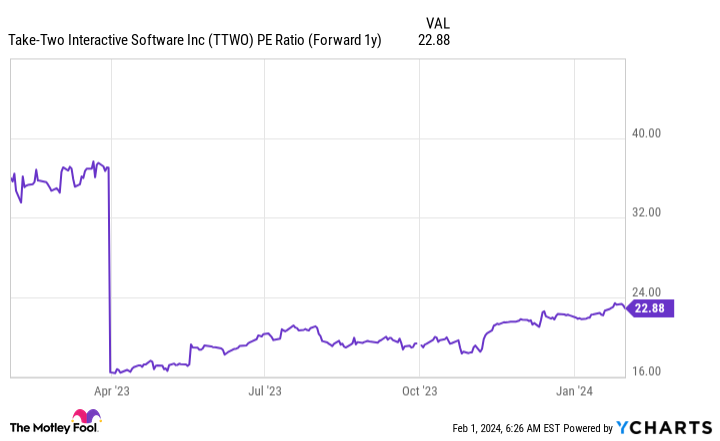

Take-Two Interactive (NASDAQ: TTWO) is a leading publisher of video games. While the company also produces hit franchises including NBA 2K and Red Dead Redemption, it’s best known for its massively successful Grand Theft Auto (GTA) series.

In particular, Take-Two’s Grand Theft Auto V has been a massive hit for the company. With more than 185 million copies shipped and billions in additional revenue generated from the title’s online mode, GTA V is the most profitable video game in history. Even more impressive, it’s the most profitable entertainment product ever released.

Now Take-Two is gearing up to release Grand Theft Auto VI. The title is forecast to be released in next year’s first quarter, and it’s set to supercharge the game maker’s financial performance.

For the company’s current fiscal year, which ends March 31, Take-Two’s midpoint guidance calls for bookings of roughly $5.5 billion and unrestricted adjusted operating cash flow of $1 billion. Jump ahead to next fiscal year, which will likely play host to GTA VI‘s release, and Take-Two expects to record over $8 billion in bookings and more than $1 billion in unrestricted adjusted operating cash flow.

Crucially, Grand Theft Auto VI won’t be a one-time performance driver. GTA V first released in 2013 and has been a strong seller for more than a decade. With its sequel on the horizon, Take-Two looks poised for a new growth phase.

Currently, Take-Two stock is trading at roughly 23 times the midpoint analyst target for next year’s expected earnings. That’s a fair price to pay for a company that looks poised to deliver rapidly expanding profits, and I think there’s a good chance that current earnings projections are significantly underestimating the performance boost that GTA VI will deliver.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Keith Noonan has positions in StoneCo and Take-Two Interactive Software. The Motley Fool has positions in and recommends Nvidia, StoneCo, and Take-Two Interactive Software. The Motley Fool has a disclosure policy.

2 Stocks I’m Loading Up on in 2024 was originally published by The Motley Fool