This stock genuinely offers investors an opportunity to buy into a growth story at a very reasonable valuation.

It’s no secret that the stock prices of many software companies have come under pressure over the last year. It’s not just that investor focus has shifted toward stocks like Nvidia and other artificial intelligence (AI)-related companies; there’s also fear that AI poses a threat to industrial software companies like PTC (PTC 0.79%).

When compounded with the slowing growth in PTC’s key metric — the annual run rate (ARR) — the stock’s 10% decline over the last year is understandable. However, I think the market is wrong, and this is a great buying opportunity.

Image source: Getty Images.

PTC’s declining growth and the AI threat

The company is a leader in product lifecycle management (PLM) and computer-aided design (CAD) software that enables companies to create a digital thread for a product from design through production, servicing, and ultimately, disposal. These processes create a huge amount of digital data.

PTC’s preferred metric is ARR, or the “annualized value of our portfolio of active subscription software, SaaS, hosting, and support contracts.” More ARR means more subscription revenue, which translates to more cash flow.

Unfortunately, PTC’s ARR appears to be slowing, with management forecasting adjusted organic ARR growth at constant currency of 7.5% to 9.5% in its financial 2026. That’s fine in itself, but it’s a long way from the mid-teens constant-currency ARR growth management previously predicted for 2026, just a few years ago.

In addition, the market is concerned about the potential for AI models to generate real value from PTC’s data or even for autonomous AI agents to take over design and manufacturing.

Today’s Change

(-0.79%) $-1.23

Current Price

$154.27

Key Data Points

Market Cap

$18B

Day’s Range

$151.64 – $155.18

52wk Range

$133.38 – $219.69

Volume

33K

Avg Vol

1M

Gross Margin

82.60%

AI is actually a major opportunity for PTC

As anyone who has wasted time fact-checking AI-generated content knows, controlling what data AI sources is as important as the output it produces. As such, PTC’s digital systems of record are the key data that AI needs to make ongoing actionable insights from a customer’s digital thread. That’s why PTC is embedding AI in its systems.

Indeed, according to CEO Neil Barua on a recent earnings call:

“Entering 2026, it became clear that customers don’t want AI as another stand-alone system or workflow. They want AI embedded directly into the systems of record they already trust for their enterprise workflow. That’s exactly where PTC Inc. is focused.”

AI isn’t so much a threat to PTC as a major opportunity because when embedded in its systems, it will add value.

ARR growth is coming

As for the slowing ARR growth, it appears to be a near-term event, as management expects a steep change in ARR starting in the fourth quarter of the 2026 fiscal year, driven by large deals that aren’t yet reflected in its ARR. To flesh out this point, Barua noted that deferred ARR (from contracts committed to but not yet starting) in the fourth quarter was “about triple what we had” entering the last fourth quarter.

For reference, Barua reorganized PTC’s go-to-market strategy in late 2024 to focus the company on generating larger-scale enterprise deals in its key industry verticals, using more specialized sales teams.

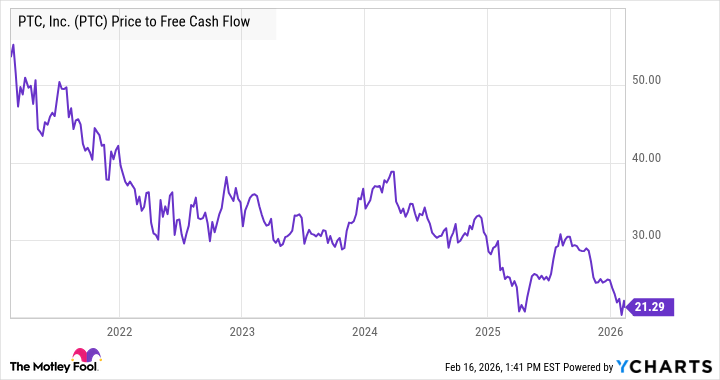

PTC Price-to-Free-Cash-Flow data by YCharts.

Management expects to hit $1 billion in free cash flow in 2026, which, based on the current market cap of $18.7 billion, would put it on a free-cash-flow multiple of 18.7. This represents a highly favorable valuation not seen in years.