(Bloomberg) — Asian stocks fell, weighed down by Chinese and Australian shares, while the yen weakened as markets awaited the outcome of the Bank of Japan’s two-day policy meeting.

Most Read from Bloomberg

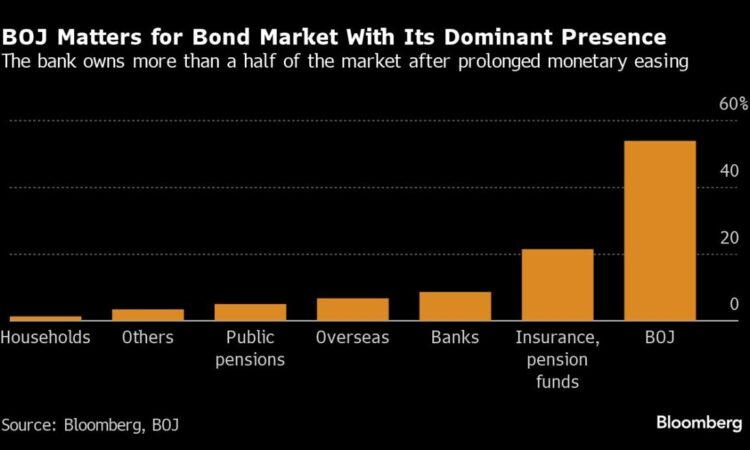

The MSCI Asia Pacific Index pared a loss of as much as 0.4%, while the Japanese currency dropped for a fifth day in the past six. The Bank of Japan is widely expected to consider reducing bond purchases but the policy board will hold its benchmark rate in a range between 0 and 0.1%, according to economists surveyed by Bloomberg. Traders are also on alert for any signals on the prospect of an interest rate hike next month.

Japan’s Topix index shook off initial declines to trade as much as 0.4% higher. Strategists expect any hawkish commentary from the Japanese central bank to be broadly positive for stocks in Asia’s second-largest economy.

“Japan’s equity market is in pretty good shape and we expect monetary policy normalization to continue,” said Yue Bamba, head of active investments at BlackRock Japan Co., on Bloomberg Television. “That is a positive and stock markets will like that.”

Australian shares slid along with equity benchmarks in Hong Kong and China. The losses in Asia put the regional MSCI stock gauge on track for its third decline in the past four weeks. Mainland Chinese shares extended a drop into a fourth week, with calls growing for the nation’s central bank to ease policy to boost sentiment and support a soggy economy.

US stock futures were little changed in Asia after the S&P 500 notched a fourth straight record, led by a surge in tech shares. Broadcom Inc. led a rally in US chipmakers following solid earnings and a 10-for-1 stock split. GameStop Corp. also climbed as Keith Gill, known as “Roaring Kitty,” posted on X. Elsewhere, Adobe Inc. soared 15% in late trading after projecting strong future sales for its creative products, while Tesla Inc. jumped after Elon Musk said shareholders backed his compensation package.

Still, only a little more than a third of S&P 500 components advanced to comprise the overall gain, and the upward sentiment didn’t flow into Asia. The breadth of the US rally was “poor” and limited to tech stocks, said Chris Weston, head of research at Pepperstone Group in Melbourne. “The weights of tech stocks on Asian equity markets is far lower.”

Australian and New Zealand yields fell as Treasury yields held Thursday’s decline. The US producer price index unexpectedly declined the most in seven months, adding to evidence that inflationary pressures are moderating. Several categories that are used to calculate the Fed’s preferred inflation measure — the personal consumption expenditures price index — were softer in May than a month earlier.

“The latest data in hand nudges the door a little wider open for the Fed to begin making an interest rate cut later this year,” said Bill Adams at Comerica Bank, which forecasts Fed reductions in September and December.

Strong Start

Elsewhere, the European Union’s bonds got hit Thursday as bets they would soon be added to key sovereign benchmarks received a blow, undermining the bloc’s efforts to broaden the appeal of its debt. Heightened political risk in France drove the premium on the nation’s 10-year bonds to the widest since 2017 over German peers. The euro held Thursday’s loss as French election worries weigh.

In commodities, oil fell as US economic data signaled inflation is cooling. Gold was steady.

Key events this week:

-

Bank of Japan’s monetary policy decision, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

-

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 11:07 a.m. Tokyo time

-

Nasdaq 100 futures were little changed

-

Japan’s Topix rose 0.3%

-

Australia’s S&P/ASX 200 fell 0.4%

-

Hong Kong’s Hang Seng fell 0.1%

-

The Shanghai Composite was little changed

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0742

-

The Japanese yen fell 0.1% to 157.22 per dollar

-

The offshore yuan was little changed at 7.2697 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $66,699.51

-

Ether rose 0.2% to $3,484.75

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu and Michael G. Wilson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.