Shares of Microsoft (NASDAQ:MSFT) have been rolling downhill in 2025, having been buffeted by multiple headwinds over the past few months.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks’ Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts’ recommendations with Your Smart Portfolio

Slowing growth from the Azure cloud computing platform, worries over breakneck AI competition, and of course, the DeepSeek revelations all combined to depress share prices.

In particular, investors wondered if the DeepSeek dip would prove to be a gamechanger for the AI industry. The Chinese start-up claimed to deliver an open-source-based AI chatbot that required a fraction of the computing power previously thought necessary, putting into question the massive capex spending from hyperscalers such as Microsoft.

And yet, despite these concerns, Microsoft should be just fine, explains investor Chetan Woodun, who believes that the company is well-placed to weather any DeepSeek-related storms.

“With its AI leadership position, Microsoft should continue to benefit as organizations transform their IT into super smart apps to deliver more automation,” asserts the 5-star investor.

Woodun details that Microsoft’s investment in OpenAI gives the hyperscaler first access to GPT-4 Turbo and future technological breakthroughs. In addition, the investor continues that Microsoft has the ability to offset open-source competition by relying on its world-class security, compliance, and support offerings.

Of course, that’s not even mentioning Microsoft’s globally-adopted slate of software products. Woodun points out that Microsoft sells its Windows, office products, and business apps as bundled packages, allowing the company to market its wares to a willing audience of existing customers.

“It is Microsoft’s integrated ecosystem with products like Office 365, Azure, and Windows which explains why the company is so profitable,” says the investor. “By leveraging existing customer relationships, it spends less marketing dollars, and it is more profitable.”

On that note, Woodun notes that despite Amazon’s larger market share of cloud computing, Microsoft has better profit margins. Microsoft has another advantage over Amazon at present, as its Forward Price/Earnings multiple of 31.09x is lower than Amazon’s 36.14x.

“The (DeepSeek) downside may represent an opportunity due to the way the software giant owns and controls the AI stack through its substantial investment in OpenAI,” adds the investor, who is rating MSFT a Buy. (To watch Woodun’s track record, click here)

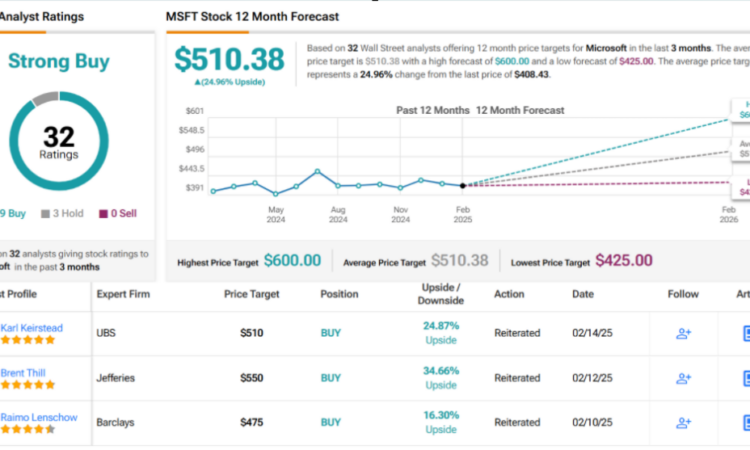

Wall Street seems plenty satisfied with Microsoft as well. With 29 Buy and 3 Hold ratings, Microsoft holds a consensus Moderate Buy rating. Its 12-month average price target of $510.38 would translate into gains of ~25% in the coming year. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link