I’ve seen some wild swings in my Stocks and Shares ISA holdings lately. This volatility has been driven by worries about a US recession.

For example, this is how some of my stocks reacted following each firm’s most recent earnings:

-

Rolls-Royce rose 11% after the company upped its 2024 profit outlook and reinstated the dividend

-

Diageo fell 10% following worse-than-expected results and weak guidance

-

Moderna plummeted 21% when the pharmaceutical company lowered its sales forecast

-

MercadoLibre soared 10% as the e-commerce juggernaut’s net profit doubled year on year

-

Shopify rocketed 23% after beating estimates and predicting sales growth of its AI-enabled tools

-

Axon Enterprise surged 24% to an all-time high as the Taser-maker lifted its 2024 revenue forecast

These are big moves. Lord only knows what shares of CrowdStrike (NASDAQ: CRWD) will do later this month!

Anyway, to take advantage of this volatility, here’s a stock I’ve bought and one I plan to snap up.

Dip buying

Recently, I added to my position in CrowdStrike, the leading endpoint-cybersecurity provider. I didn’t bet the farm though as we still don’t know the damage (both financial and reputational) from the infamous buggy software update that caused the global IT outage in July. Things could get worse in the near term.

Over the long run though, CrowdStrike’s total addressable market should expand rapidly as cybersecurity solutions become more essential, especially in the coming age of artificial intelligence (AI).

If the incident was a cyberattack, so a failure of the firm’s AI-powered Falcon platform, I’d be more worried. But this was a self-inflicted software snafu, albeit a very significant one.

I thought a 30% drop in the share price was worth taking advantage of.

Airbnb

The other stock I’m going to add to is Airbnb (NASDAQ: ABNB). Offering homestays in 220+ countries, the company has reached enormous scale. Yet the shares have dropped 25% in the past month.

The chief culprit for this fall was weak guidance given for Q3 in the firm’s recent Q2 earnings. It said: “We are seeing shorter booking lead times globally and some signs of slowing demand from US guests.”

This stoked fears about the impact of a US recession on the company’s growth. While this is a legitimate concern, I don’t find this slowdown surprising. Most firms are reporting weak consumer confidence.

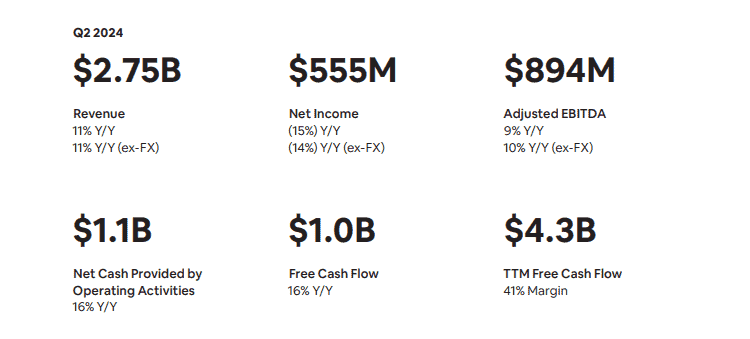

So I think this may be an overreaction. Q2’s numbers looked solid, with revenue rising 11% year on year to $2.75bn. Earnings did dip slightly but margins remained very healthy.

Plus, Airbnb is still growing faster than rival Booking Holdings, which posted 7% growth in Q2 revenue and nights booked.

CEO Brian Chesky said this on the earnings call: “For everyone who books an Airbnb, about nine people book a hotel. And so if we can get just one of those guests to book on Airbnb that’s currently booking at a hotel platform, we would go from nearly 0.5bn nights a year to 1bn nights a year.”

Finally, the stock is trading at around 26 times forecast earnings for 2024. If these prove accurate, I’d say that’s reasonable for a high-quality business like Airbnb.

Pair that valuation with an excellent balance sheet and asset-light business that continues to grow, and I reckon the stock looks like an attractive option.

The post Here’s what I’m buying in my ISA as the stock market goes crazy! appeared first on The Motley Fool UK.

More reading

Ben McPoland has positions in Airbnb, Axon Enterprise, CrowdStrike, Diageo Plc, MercadoLibre, Moderna, Rolls-Royce Plc, and Shopify. The Motley Fool UK has recommended Airbnb, Axon Enterprise, CrowdStrike, Diageo Plc, MercadoLibre, Rolls-Royce Plc, and Shopify. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024