Topline

The U.S. looks all but certain to dodge a recession, American stock indexes are trading at record levels and even riskier investments like bitcoin are at their highest prices ever, but gold, arguably the world’s oldest investment—often viewed as a hedge against market losses elsewhere—keeps gaining value.

Key Facts

Gold traded at an all-time high of $2,195 per ounce Friday, extending its year-to-date gain to 5% and 12-month gain to a blistering 19%, moving in the same direction as the American benchmark stock index S&P 500’s 8% year-to-date and 31% 12-month return.

The gold rush may come as a surprise for American investors, considering the “safe haven” precious metal’s record run-up does not coincide with prior events which sparked all-time highs for gold, such as the late 2000s financial crisis and the Covid-19 pandemic.

A key factor behind gold’s rally is things are looking far less bright for many non-U.S. markets: The U.S.’ 2.1% projected economic growth this year outpaces the sub-1% projected growth of other developed economies like Germany, Japan and the United Kingdom—while stocks listed on large foreign exchanges have largely underperformed their American counterparts, with Hong Kong’s Hang Seng index losing 18% over the last year and Britain’s FTSE 100 down 3%.

“The western investor is not behind” the gold rally, according to Metals Daily CEO Ross Norman, attributing the gains to “phenomenal” demand from Chinese investors looking to hedge against the potential economic instability of the world’s second-largest economy amid a commercial real estate crisis in China.

Within the U.S., there are several other explanations for the gold bump, as some investors look for ways to bet against the potential of worse-than-expected inflation, reposition their portfolios following the stock surge and safeguard against geopolitical instability, with issues such as the wars between Israel and Hamas and Russia and Ukraine, along with November’s presidential election looming on the minds of investors.

What To Watch For

Incoming cuts to interest rates, which will cause yields for U.S. government bonds to fall and thus make the returns less appealing of another typically safe asset class. Five-decade high gold purchases by central banks globally and the potential for Republican presidential candidate Donald Trump to heighten tensions between the U.S. and China are also all reasons to remain bullish on gold moving forward, Solita Marcelli, UBS Global Wealth Management’s chief investment officer, Americas, said in a Friday note to clients.

Big Number

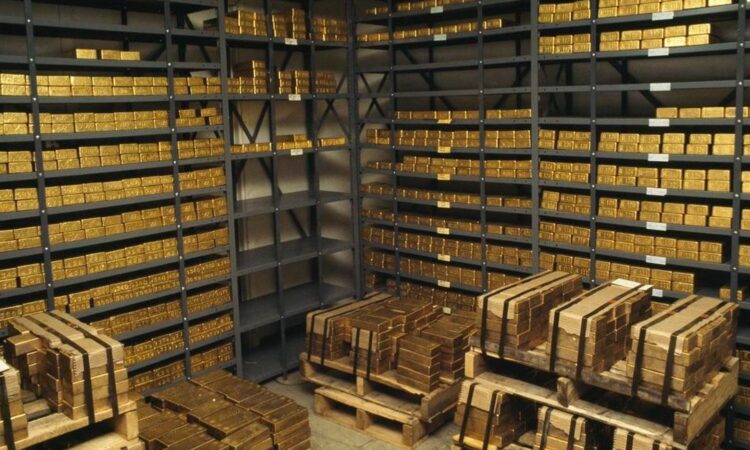

$3.3 trillion. That’s the amount of gold held by investors, according to JPMorgan Chase strategist Nikolaos Panigirtzoglou. That accounts for about 1.4% of the value of all global investments.

Surprising Fact

About half of all gold shipments in January went to Hong Kong and mainland China, according to UBS.

Key Background

Gold’s popularity as an investment tracks its centuries-long history of retaining value through bouts of inflation and periods of conflict across the globe. American investors’ faith in the precious metal hit its highest level since 2012 last year, and a Gallup poll showed respondents were more confident investing in gold than stocks. Gold’s rally coincides with a fairly flat U.S. dollar, which also typically gains value during times of market distress; the DXY, which tracks the dollar against a basket of other top global currencies, is up 1% year-to-date and down 2% over the last year. Gold has added 394% in value over the past 20 years, according to FactSet data, below the S&P 500’s 522% return over the two-decade period, but still a remarkable feat considering gold is an inorganic material without the potential to return profits to shareholders as a stock would.