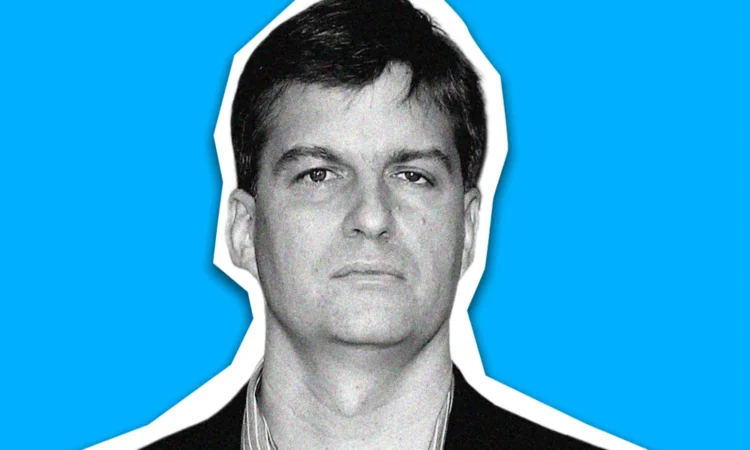

Michael Burry has been opening up to the world after he stopped running money for Scion Asset Management, with a more active social-media presence and a new Substack, and he just had an interview with the person who made him famous in the first place: Michael Lewis, author of “The Big Short.”

In the “Against the Rules” podcast, Burry explained why he deregistered his hedge fund last month.

“I think that we’re in a bad situation in the stock market. I think the stock market could be in for a number of bad years,” he said.

Burry noted that so much money in the stock market is now passively invested.

“In the United States, I think when the market goes down, it’s not like in 2000, where there was a bunch of stocks that were being ignored and they’ll come up even if the Nasdaq crashes. Now, I think the whole thing’s just going to come down. And it would be very hard to be in a long stocks in the United States and protect yourself,” he said.

“And so that’s why I decided to get out,” said Burry.

Burry added that he immediately went and did the same trades for his own account, notably put options on Nvidia NVDA and Palantir Technologies PLTR.

His bet against Nvidia has been widely discussed, but Burry also explained why he thinks Palantir’s stock will fall.

“They keep saying they’re the only ones. But IBM does basically the same thing. Their business is actually bigger than Palantir’s,” he said.

He criticized Palantir’s stock-based compensation, noting five billionaires came out of a company with revenue of $4 billion.

More broadly, Burry said, the stock market peak during the dot-com bubble — what he called a data-transmission bubble — came before companies were even halfway done with capital expenditures. “And what’s happened is we’ve gotten into this part of the phase where if you announce a dollar of capex on AI, your market cap goes up $3 for every dollar you had,” he said.

Burry said if there is anything to buy, it would be out-of-favor healthcare stocks.

One other he made was the folly of betting against the U.S., even with worries about the state of government finances. “I’ve always put it in terms of, you know, waiting for Castro to die. It’s not a strategy,” he said.