Robinhood (NASDAQ: HOOD) stock has been on fire, surging 87% higher over the past twelve months. The company gained notoriety for its role in the meme-stock-fueled frenzy, which sent its shares up to $85 in the days following its 2021 IPO.

Despite the recent rally, Robinhood stock is still 80% below its all-time high. The company has made progress in improving its bottom line in recent quarters. However, it has some big questions it still needs to address. Here are a few things you’ll want to consider before buying Robinhood.

Robinhood has innovated finance in several ways

Founded over a decade ago, Robinhood set out to “democratize finance for all” and make investing more accessible and affordable for retail investors. The company ushered in zero-commission trading, turning traditional brokerage profit models on their head. It also popularized fractional shares, and its innovation has spurred brokerages to change.

The company has also faced its fair share of scrutiny. For example, it’s faced criticism for its gamification of investing, which some say leads to impulsive behavior and overtrading and was a key part of the meme stock frenzy a few years back.

Robinhood has also received criticism for its business model, in which it sells customers’ order flows to a market maker, earning a small fee in return. While this allows for commission-free trading, some argue it creates a conflict of interest, and customers aren’t getting the best prices possible.

Growth in recent years has been lackluster

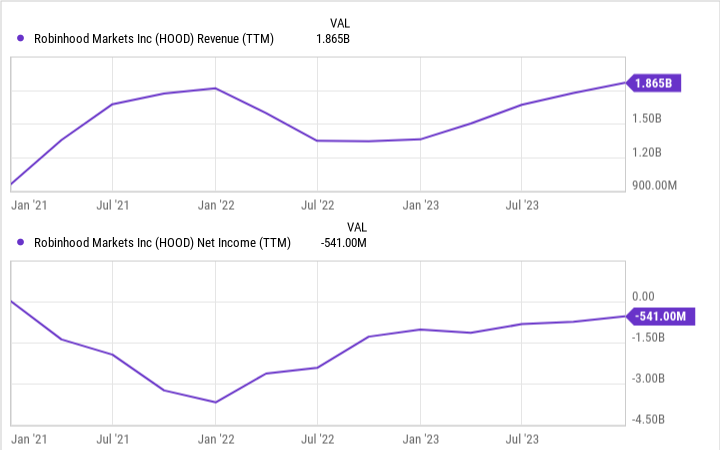

Last year Robinhood brought in $1.9 billion in revenue, which grew 37% from the prior year, which was a challenging one for the company. Its revenue was around 3% above 2021, when it benefited from a flurry of stock market activity.

The company has struggled to turn a profit. Last year it lost $541 million, which was actually an improvement from its $1 billion loss and $3.7 billion loss in the two years prior.

The company has also seen slow growth in its customer base. Last year, the number of funded customers was 23.4 million, up 1.7% from the previous year. Also, the number of monthly active users was 10.9 million, down 4.4% from the previous year and 37% from 2021.

Here’s how the broker plans to win customers

Robinhood is taking steps to attract more customers to its platform. For one, it allows its Robinhood Gold customers to earn 5% interest on invested brokerage cash. It also offers traditional individual retirement accounts (IRAs) and Roth IRAs, and matches customer payments to encourage them to be long-term account holders. It also offers 24-hour trading across hundreds of stocks, five days a week.

The company has taken several steps to diversify its business and attract more customer funds to its platform. It’s seen good growth in assets under custody, which increased 65% from last year to $102.6 billion. However, this represented growth of just 5% above its previous high-water mark in 2021.

Robinhood faces stiff competition and hasn’t gained a foothold with key customer groups. According to a survey by The Motley Fool, Block‘s Cash App is the most popular investment app among respondents at 38%. The next highest were Fidelity (11%), Coinbase (10%), Acorns (9%), JPMorgan (9%), and finally Robinhood (9%).

It’s also the fifth-most-used app among the key Gen Z and Millenials demographics, showing its moat isn’t very strong, and that it has its work cut out for it to gain market share.

Is it a buy?

The company has turned a profit in two of the past three quarters, showing that it’s made progress in improving its bottom line. However, there are two metrics where I’d like to see it show stronger growth: the number of funded customers and assets under custody. Its growth has slowed down considerably compared to just a few years ago, and stiff competition in the brokerage industry will make it difficult to gain market share.

The company is still early on in its growth story, which still has an uncertain outcome, making it a very speculative investment right now. Most investors are best off avoiding the stock for the time being.

Should you invest $1,000 in Robinhood Markets right now?

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Block, Coinbase Global, and JPMorgan Chase. The Motley Fool has a disclosure policy.

Is Robinhood Stock a Buy? was originally published by The Motley Fool