Last week was characterized by strong economic data, weaker asset prices and guidance from the Federal Reserve to investors that they should moderate expectations of near-term cuts in interest rates.

Correspondingly, the estimated probability among investors of at least four quarter-point interest rates cuts by the close of 2024 has fallen from 49.7% a month ago to 21.4% at the end of last week, according to CME FedWatch. Investors can be slow to incorporate new information and so we may not see the impact of this change in expectations immediately, but it is likely to act as a headwind to further rises in the valuation of stocks.

What Will Interest Rates Do?

As expectations of falling interest rates diminished, government bond yields continued to climb with the two year treasury bond yield rising to 4.76% by the end of the week. While the path of inflation and interest rates is naturally uncertain, for Morningstar’s view, check out senior US economist, Preston Caldwell’s second quarter economic outlook here.

QT Has Replaced QE

Alongside the management of interest rates, another key challenge faced by the Fed is how to unwind the so-called quantitative easing that was used to support asset prices and economic activity over the last 15 years. (The unwinding is known as quantitative tightening.)

While seen as necessary by many economic commentators at the time, addressing the consequences could have a significant impact on asset prices. Given the importance of this topic, Morningstar Wealth’s, Marta Norton has devoted her most recent ‘From the Desk of the CIO’ column to the topic. You can find it here.

Energetic Stock Prices

Investors welcomed higher than expected employment growth on Friday with the Morningstar US Market Index rising 1.1% on the day. However, that same index fell 1.01% over the week as investors adjusted their expectations. A bright spot for investors were the gains in the price of energy companies with the Morningstar US Energy Index up 3.69% over the week and 17.42% over the year to date. This places it well ahead of the Morningstar US Technology and Communication Services Index, up 12.44% year to date, which is dominated by such admired companies as Microsoft MSFT, Apple AAPL and Nvidia NVDA. This is an important reminder that the most popular companies do not always deliver the highest returns. Morningstar analysts continue to see attractive opportunities in this part of the market. Energy analyst Stephen Ellis provides his views here.

The Earnings Game Starts Again

There is likely to be lots of news to keep the headline writers busy this week with the Consumer Price Index report on Wednesday, comments by several Fed Presidents towards the end of the week and the start of the quarterly company reporting season. Financial services take center stage this week with JPMorgan Chase JPM, Citigroup C, Wells Fargo WFC, State Street STT and Blackrock BLK all reporting on the same day. As ever, companies will be seeking to lower expectations ahead of results in order to create a ‘surprise’ which they hope will subsequently boost their stock price.

While this tedious game is what passes for entertainment on Wall Street, it has little to do with investing. Reporting season is instead an opportunity to compare the most recent results of companies against an investor’s long term investment “thesis” and consider whether the results fall within the normal variation of business performance or confounds that thesis. This naturally implies that the investor has such a thesis. For those lacking such a thesis, the reporting season primarily provide an opportunity to make mistakes through over-reaction.

This Week’s Key Market and Investing Events:

Wednesday, April 10 – March Consumer Price Index report.

Thursday, April 11 – March Producer Price Index report.

Friday, April 12 – Q1 Earnings season starts with reports from BlackRock, JPMorgan Chase, Wells Fargo, Citigroup.

Click here for our weekly calendar of economic reports and corporate earnings.

Stats for the Trading Week Ended April 5

- The Morningstar US Market Index fell 1.04%.

- The best-performing sectors were energy, up 3.66%, and communication services, up 0.90%.

- The worst-performing sector was healthcare, down 3.03%.

- Yields on 10-year US Treasury notes rose to 4.39% from 4.20%.

- West Texas Intermediate crude prices rose 3.25% to $86.69 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 166, or 24%, were up, two were unchanged, and 536, or 76%, were down.

What Stocks Were Up?

Dell Technologies DELL, Newmont NEM, Sabre SABR, ChampionX CHX, and Liberty Energy LBRT.

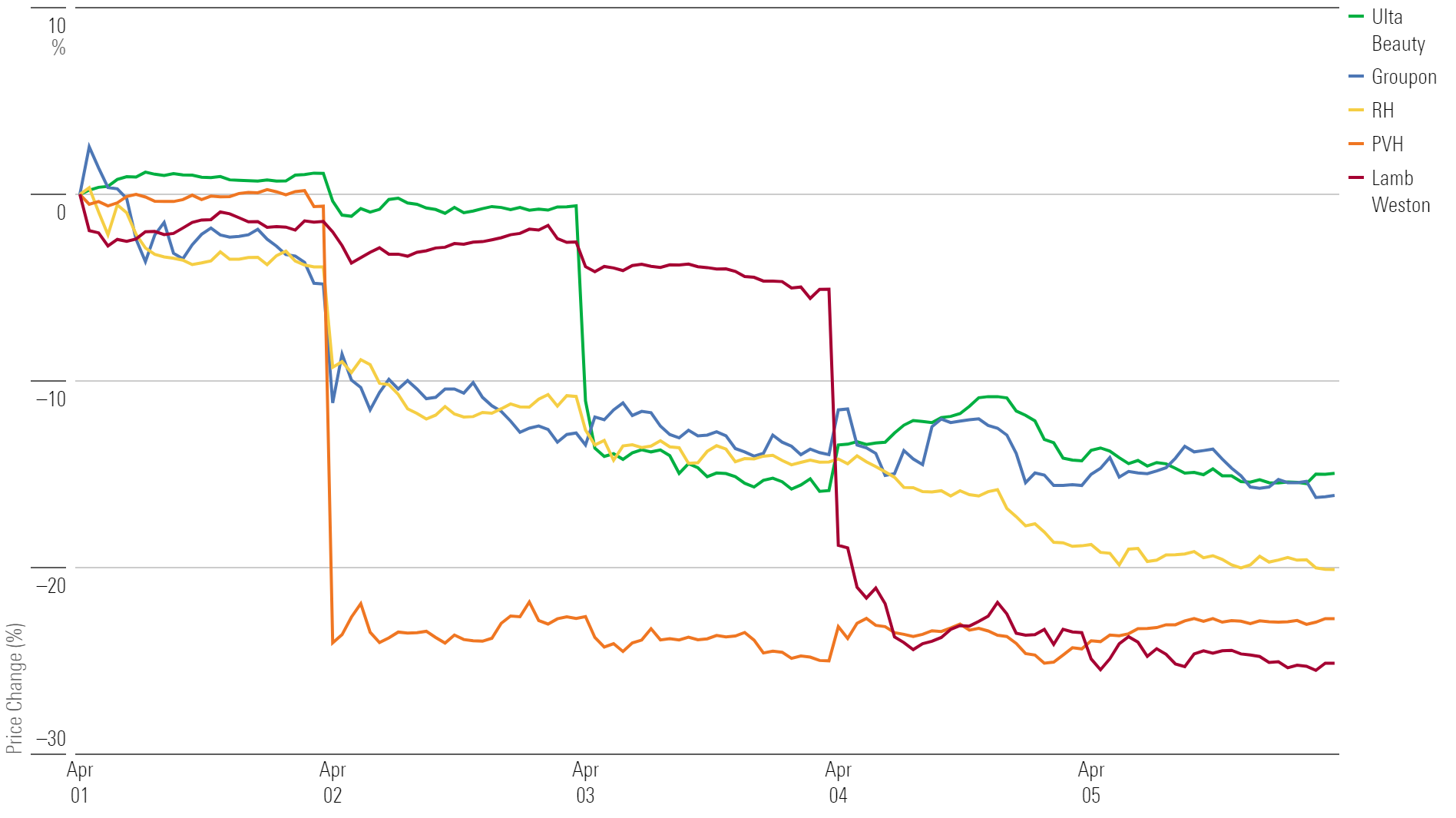

What Stocks Were Down?

Lamb Weston LW, PVH PVH, RH RH, Groupon GRPN, and Ulta Beauty ULTA.