(Bloomberg) — Stocks declined from their all-time highs, with concern about tighter US restrictions on chip sales to China spurring a selloff in the industry that has powered the bull market.

Most Read from Bloomberg

From the US to Europe and Asia, chipmakers came under heavy pressure. American powerhouses Nvidia Corp., Advanced Micro Devices Inc. and Broadcom Inc. drove a closely watched industry gauge down 5%. Across the Atlantic, ASML Holding NV tumbled over 10% even after the Dutch giant reported strong orders. Those moves followed a plunge in Tokyo Electron Ltd., which led a slide in Japan’s Nikkei 225 Stock Average.

The Biden administration has told allies that it’s considering the most severe restrictions if companies such as Tokyo Electron and ASML keep giving China access to advanced semiconductor technology. The US is also weighing additional sanctions on specific Chinese chip firms linked to Huawei Technologies Co.

“This news on the chip front is the kind of UFO (UnForeseen Occurrence) that could indeed create the kind of selling that could be the catalyst for a tradable correction in the stock market,” said Matt Maley at Miller Tabak + Co. “Broad indices have become very overbought.”

In fact, the move in stocks represents just a pullback after a stellar run of gains, fueled by soft inflation data and optimism that the Federal Reserve will cut rates. Governor Christopher Waller said the economy is getting closer to a point where the central bank can reduce borrowing costs, but indicated he’d like to see a “bit more evidence” inflation is on a sustained downward path.

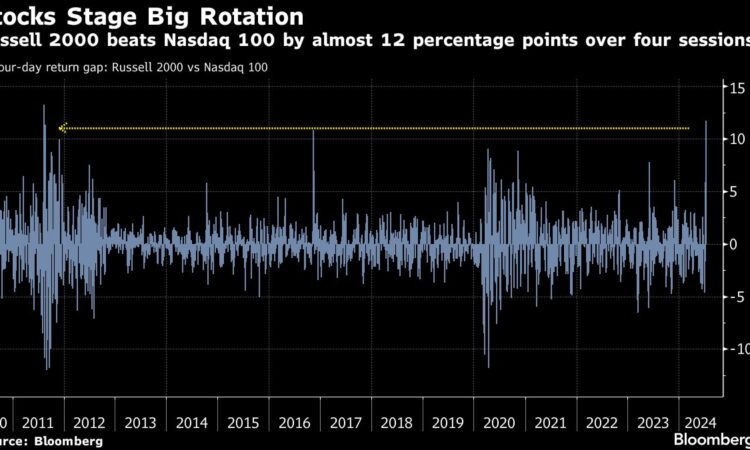

The S&P 500 fell almost 1.5%, while the Nasdaq 100 dropped 2.8%. A gauge of the “Magnificent Seven” megacaps slipped 3.5%. The Russell 2000 of small firms slid 1%. Wall Street’s “fear gauge” — the VIX — spiked toward the highest since early May.

Among the few chipmakers defying the selloff were Intel Corp. and Globalfoundries Inc. And the Dow Jones Industrial Average climbed for a sixth straight day — set for another record. Financial shares outperformed, with U.S. Bancorp surging on solid results.

Treasury 10-year yields were little changed at 4.16%. The dollar fell against most major peers, with the yen up 1.2%.

The Biden administration is in a tenuous position. US companies feel that restrictions on exports to China have unfairly punished them and are pushing for changes. Allies, meanwhile, see little reason to alter their policies when the presidential election is just a few months away.

“Normally, the impact of these types of headlines isn’t long-lasting, but in this case, we would note that semis have been underperforming the broader market for the last couple of weeks now,” said Bespoke Investment Group strategists. “So that’s something to watch.”

The tech underperformance is coming after a first half which saw megacaps like Nvidia, Microsoft Corp. and Alphabet Inc. propel the market higher, stretching valuations for these names and leaving them with a tougher setup for the rest of 2024.

At Goldman Sachs Group Inc., Scott Rubner says “I am not buying the dip.”

The tactical strategist bets the S&P 500 has nowhere to go from here but down. That’s because this Wednesday, July 17, has historically marked a turning point for returns on the equity benchmark, he said, citing data going back to 1928. And what follows, he says, is August — typically the worst month for outflows from passive equity and mutual funds.

Jonathan Krinsky at BTIG says the market is “nearing the end of the typical bullish window.” Sentiment remains extremely complacent on the surveys and transactional indicators, he noted.

“While the rotation out of megacap tech into cyclicals and small-caps is encouraging, it felt a bit forced happening in such a short period of time,” Krinsky said. “Even if this is going to be a more long-lasting rotation, we likely won’t be able to see that new leadership until after we see a higher correlation correction and then see what leads coming out of that.”

Corporate Highlights:

-

Tesla Inc. forming an autonomous taxi platform will be the catalyst for a roughly 10-fold increase in its share price, Ark Investment Management LLC’s Cathie Wood said, echoing years of bullish predictions about a business the carmaker has yet to stand up.

-

Boeing Co.’s largest union is holding a rally and strike-sanction vote on Wednesday, ratcheting up pressure on company negotiators as contract talks enter a crucial phase ahead of a potential walkout in September.

-

Amazon.com Inc.’s marketing portal for merchants crashed Tuesday night, according to multiple Amazon sellers and consultants, fouling up one of the online retailer’s biggest sales of the year.

-

Morgan Stanley became the latest big Wall Street bank to tap the US investment-grade market Wednesday after reporting earnings, as strong investor demand helps lenders borrow at lower yields than would have been possible at the start of the month.

-

Cassava Sciences Inc.’s chief executive officer resigned, the latest turmoil at the biotech company being investigated by US watchdogs.

-

Johnson & Johnson’s second-quarter profit beat Wall Street projections on strong pharmaceutical sales while the company cut its full-year forecast to account for a spate of recent acquisitions.

-

Roche Holding AG’s experimental weight loss pill showed meaningful weight reduction in an early stage study among obesity patients, setting up the Swiss drugmaker as a challenger in the field.

-

Elevance Health Inc. warned medical costs will likely be at the higher end of what they’d previously forecast for the year.

-

Spirit Airlines Inc. said second-quarter revenue will be lower than expected and that operating losses will be worse due to competitive pressure on baggage fees and other non-ticket charges.

Key events this week:

-

ECB rate decision, Thursday

-

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 1.3% as of 12:29 p.m. New York time

-

The Nasdaq 100 fell 2.8%

-

The Dow Jones Industrial Average rose 0.5%

-

The MSCI World Index fell 0.9%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.2% to $1.0925

-

The British pound rose 0.2% to $1.3001

-

The Japanese yen rose 1.2% to 156.47 per dollar

Cryptocurrencies

-

Bitcoin fell 0.5% to $64,354.51

-

Ether fell 1.1% to $3,402.09

Bonds

-

The yield on 10-year Treasuries was little changed at 4.16%

-

Germany’s 10-year yield was little changed at 2.42%

-

Britain’s 10-year yield advanced three basis points to 4.08%

Commodities

-

West Texas Intermediate crude rose 2.4% to $82.68 a barrel

-

Spot gold fell 0.6% to $2,453.49 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Cecile Gutscher and Sujata Rao.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.