The Nasdaq sank on Monday to lead a stock sell-off on Wall Street as a Chinese startup rattled faith in US leadership and profitability in AI, taking a hammer to Nvidia (NVDA) and other Big Tech stocks.

The tech-heavy Nasdaq Composite (^IXIC) sank 2.2%, while the S&P 500 (^GSPC) dropped 1.4%. The Dow Jones Industrial Average (^DJI) fell just below the flatline on the heels of a winning week for the major gauges.

Markets have been rattled by claims by China’s DeepSeek that its AI assistant uses cheaper chips and less data than leading models, but performs equally well. A surge in DeepSeek’s popularity has spurred investors to question bets that AI demand-driven growth will keep fueling gains for stocks.

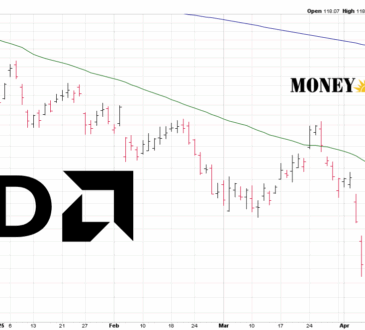

AI bellwether Nvidia’s shares plunged over 13% as chip-related names took a bruising. ASML (ASML) lost over 6%, while Broadcom (AVGO), and Micron Technology (MU) also got hammered.

Shares of Microsoft (MSFT) dropped more than 2% amid worries about megacaps’ hefty investment in AI. Google parent Alphabet (GOOG, GOOGL), Meta (META), and Amazon (AMZN) also lost ground as tech names faltered.

Big Tech earnings season kicks off this week, highlighted by results from Apple (AAPL), Tesla, Meta, and Microsoft. Eyes will be on guidance for future profit as DeepSeek raises questions about prospects for revenue.

Investors started to flock to assets seen as safe as stocks plunged. The 10-year Treasury yield (^TNX) fell as much as 12 basis points to 4.50%, the lowest level in over a month, while haven currencies including the yen and the Swiss franc surged.

In the background, trade war concerns revived during a face-off between President Donald Trump and Colombia over the weekend. Trump threatened to impose 25% tariffs on the country’s goods in a row over deported migrants before putting the duties on pause after a deal was reached.

The dispute underlined concerns that Trump won’t hold back on turning to tariffs as a way to push through a range of policy aims.

The Federal Reserve will hold its first policy meeting of 2025 this week, with officials are already on watch for quick-fire moves by Trump that could pose challenges to the central bank. The president has called for the Fed to lower interest rates, signaling a coming clash with policymakers, who begin their two-day gathering on Tuesday.

LIVE 8 updates

-

Apple outperforms amid tech sell-off

Apple (AAPL) shares outperformed on Monday, gaining more than 2% while many tech names tumbled as AI fears spooked the markets.

The major averages declined over concerns about US dominance and AI spending following Chinese startup DeepSeek’s AI model release.

Unlike its Big Tech peers, Apple has refrained from allocating billions of dollars to AI capex spending. The iPhone maker is expected to report earnings on Thursday.

Meta (META), a big spender on AI data centers, rose into green territory by 11:00 a.m. ET as Wall Street analysts questioned the market reaction to DeepSeek buzz.

Shares of the social media giant could also be getting a boost from a bullish analyst call. In a recent note Guggenheim raised its price target on Meta to $750 from $665, maintaining a Buy rating.

-

-

-

-

-

-

-