Before deciding to buy or sell, it’s key to consider your investment strategy.

All investors have had their eyes on Nvidia (NVDA 2.96%) in recent quarters — whether they’re invested in the stock or not. That’s because the company plays a key role in what may be the biggest growth industry today: artificial intelligence (AI). Nvidia is the dominant AI chip designer, and thanks to this position and its close relationship with customers and their order books, has been able to offer investors valuable visibility into the AI market and what may be on the horizon.

So, any update from Nvidia has been important for all investors. And of course, these updates have been particularly important for those who own Nvidia stock or consider buying the shares. That’s why, ahead of a big day for Nvidia on Nov. 19, you may be wondering if you should buy or sell the stock. Let’s find out.

Image source: Getty Images.

AI customers rush to Nvidia

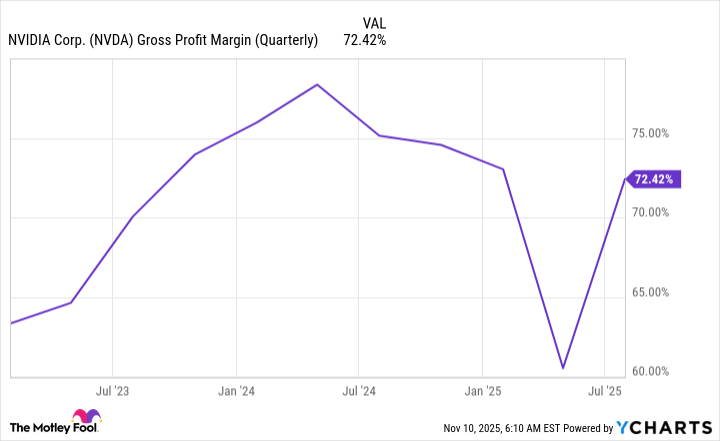

Before answering that question, though, here’s a quick summary of Nvidia’s AI story so far. As mentioned, Nvidia has constructed a leading position in the AI chip market, and that’s helped it generate double- and triple-digit quarterly revenue growth in recent years. Customers aiming to win in AI are looking for the fastest chips around to power their projects, and they’ve flocked to Nvidia. Importantly, Nvidia also is showing strong profitability on sales through gross margin that’s generally surpassed 70%.

The company also has expanded into a wide variety of AI products and services and even offers specialized platforms for industries like healthcare and automobile. All of this has extended its position as an AI market giant.

Now, let’s consider what’s happening on Nov. 19. After the market closes, Nvidia is scheduled to report third-quarter earnings for the 2026 fiscal year. The company’s track record is solid, having reported positive surprises over at least the past four quarters.

Clues about Nvidia’s earnings report

And clues Nvidia and others have offered us in recent times also give us reason to be optimistic. For example, Nvidia says total cumulative shipments of its Blackwell platform, the upcoming Rubin update, and networking products over 2025 and 2026 are totaling about $500 billion. Taiwan Semiconductor Manufacturing, the company that actually produces Nvidia chips, said in its earnings report a few weeks ago that demand in the quarter was strong. And Nvidia’s AI customers — from Amazon to Alphabet — have spoken of high demand from their customers and their own intentions to continue investing heavily in AI infrastructure.

All of this sounds great — and could lead to yet another earnings home run for Nvidia. This doesn’t mean the stock will soar following the report, however. Expectations for Nvidia are extremely high, so any small disappointment could weigh on performance, and recent worries about a bubble in the AI market also might put pressure on the stock — regardless of the quality of Nvidia’s report. So, it’s very possible that Nvidia’s stock may slip, stagnate, or not rise as much as investors hope when the market opens on Nov. 20.

Today’s Change

(-2.96%) $-5.89

Current Price

$193.16

Key Data Points

Market Cap

$4837B

Day’s Range

$191.30 – $195.42

52wk Range

$86.62 – $212.19

Volume

176M

Avg Vol

182M

Gross Margin

69.85%

Dividend Yield

0.00%

Should you buy or sell?

Now, let’s get back to our question: Considering all of these elements, should you buy or sell Nvidia stock right now?

This depends on your investment strategy and individual situation. I consider Nvidia a buy, and the stock, trading for 41x forward earnings estimates, remains reasonably priced if you take into account its future prospects. So, it’s not too late to get in on this AI winner, and even if the stock falters following the earnings report, this is unlikely to impact your returns if you hold on for several years. It’s important to set aside short-term trends and turbulence and consider the long-term picture when investing.

But, if you’ve already held Nvidia for a number of years and need some cash to diversify your portfolio, you might consider locking in some gains and using the proceeds to do just that.

If you don’t necessarily need to free up cash and your portfolio already is well diversified, it’s still a great idea to hold onto Nvidia stock. The company is a confirmed leader in AI and has expanded its reach into many related areas, setting itself up for more success well into the future.