A version of this post first appeared on TKer.co

Stocks made record highs last week, with the S&P 500 climbing 1.2% to close at 4,839.81. The index is now up 1.5% year to date and up 35.3% from its October 12, 2022 closing low of 3,577.03.

The stock market will often fall on its way up, a foundational truth that long-time TKer readers will recall from our debut publication in October 2021.

The S&P was last at a record high in January 2022. Wall Street was bullish coming into 2022, with most strategists convinced the S&P would end the year north of 5,000. However, high inflation — widely believed to be transitory — persisted and continued to heat up in early 2022, as hot demand remained out of balance with tight supply chains.

Consequently, monetary policy tightening from the Federal Reserve became much more aggressive than initially expected. Fed Chair Jerome Powell even warned winning the fight against inflation could require economic “pain.”

All this was a conundrum for the stock market, as hawkish monetary policy meant tighter financial conditions — which meant higher interest rates, tighter lending standards, and pressure on stock market valuations. It became clear that Fed-sponsored market beatings would continue until inflation rates improved.

Fortunately, inflation rates peaked and began to cool in mid-2022, and they’ve continued to ease ever since.The stock market bottomed in October 2022, months before the Fed stopped hiking rates and even before it clearly signaled a dovish pivot in its approach to monetary policy — which makes sense when you remember the stock market is a discounting mechanism

For the remainder of 2022 and all of 2023, inflation rates continued to cool amid tight monetary policy. Impressively, economic growth persisted during this time, and evidence mounted suggesting the emergence of a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy sinking into recession.

Meanwhile, the stock market surged in 2023, with the S&P 500 booking an impressive 24% gain.

Wall Street came into 2024 relatively constructive, mostly predicting mid- to high-single digits gains for the S&P for the year. But the market once again caught many on their heels: Strategists at Goldman Sachs, RBC, and UBS have already revised up their year end targets, and January isn’t even over yet.

As I wrote on Friday, the simplest explanation for why stocks are rallying is that the outlook for earnings growth — most important long-term driver of stock prices — is positive.

Zooming out

Will the rally continue? In the near-term, that’s anyone’s guess.

The experience of the past two years is a reminder of TKer Stock Market Truth No. 2: You can get smoked in the short-term, but also TKer Stock Market Truth No. 1: The long game is undefeated.“

[T]he S&P 500 Index has hit 1,176 new highs since its 1957 inception,” Invesco’s Brian Levitt observed on Friday. “That’s the equivalent of a new high every fortnight, or 14.3 days. History suggests that investors should expect the market to ascend to many new highs over their lifetimes, even if the path isn’t always a straight one.”

Maybe things will get bumpy again in the coming days, weeks, or months.But history continues to show that the stock market rewards investors who are able to put in the time.

There were a few notable data points and macroeconomic developments from last week to consider:

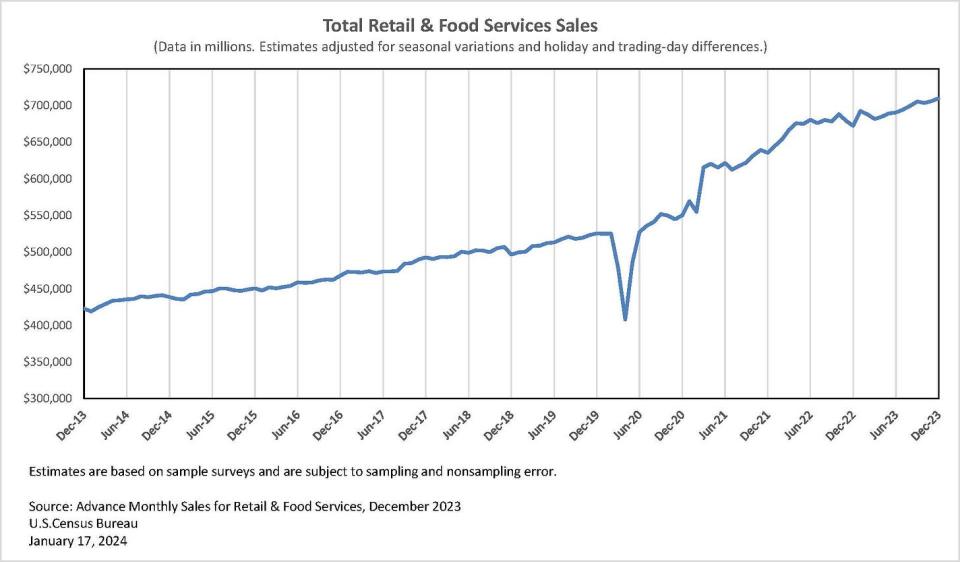

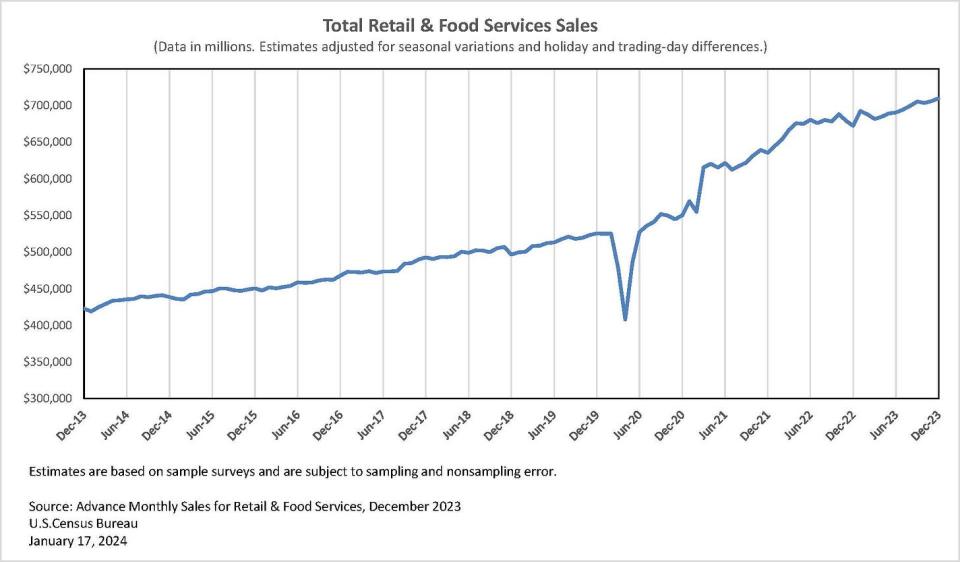

🛍️ Consumers are spending. Retail sales increased 0.6% in December to a record $709.9 billion.

Categories leading growth included department stores, online, clothing, cars and parts, and building materials. Gas stations, furniture, and electronics saw declines.

Consumer sentiment surges. The University of Michigan’s consumer sentiment index jumped in January. From the survey: “Consumer sentiment soared 13% in January to reach its highest level since July 2021, showing that the sharp increase in December was no fluke. Consumer views were supported by confidence that inflation has turned a corner and strengthening income expectations. Over the last two months, sentiment has climbed a cumulative 29%, the largest two-month increase since 1991 as a recession ended.”

Unemployment claims fall. Initial claims for unemployment benefits fell to 187,000 during the week ending January 13, down from 203,000 the week prior. This is barely above the September 2022 low of 182,000, and it continues to trend at levels historically associated with economic growth.

Gas prices tick up. From AAA: “The national average for a gallon of gas squeaked out a two-cent gain since last week to $3.09. A likely culprit could be wintery weather, which hampers refining operations and gasoline distribution. This has resulted in some frigid regions seeing pump price jumps.”

Mortgage rates tick down. According to Freddie Mac, the average 30-year fixed-rate mortgage fell to 6.60% from 6.66% the week prior. From Freddie Mac: “Mortgage rates decreased this week, reaching their lowest level since May of 2023. This is an encouraging development for the housing market and in particular first-time homebuyers who are sensitive to changes in housing affordability. However, as purchase demand continues to thaw, it will put more pressure on already depleted inventory for sale.”

Home builder sentiment improves. From the NAHB’s Alicia Huey: “Lower interest rates improved housing affordability conditions this past month, bringing some buyers back into the market after being sidelined in the fall by higher borrowing costs… Single-family starts are expected to grow in 2024, adding much needed inventory to the market. However, builders will face growing challenges with building material cost and availability, as well as lot supply.”

New home construction data was mixed. Housing starts declined 4.3% in December to an annualized rate of 1.46 million units, according to the Census Bureau. Building permits rose 1.9% to an annualized rate of 1.49 million units.

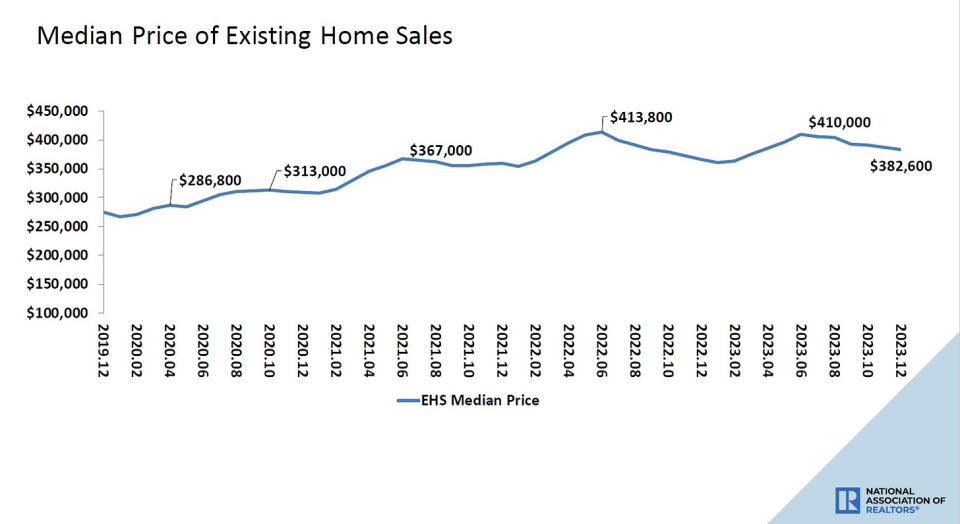

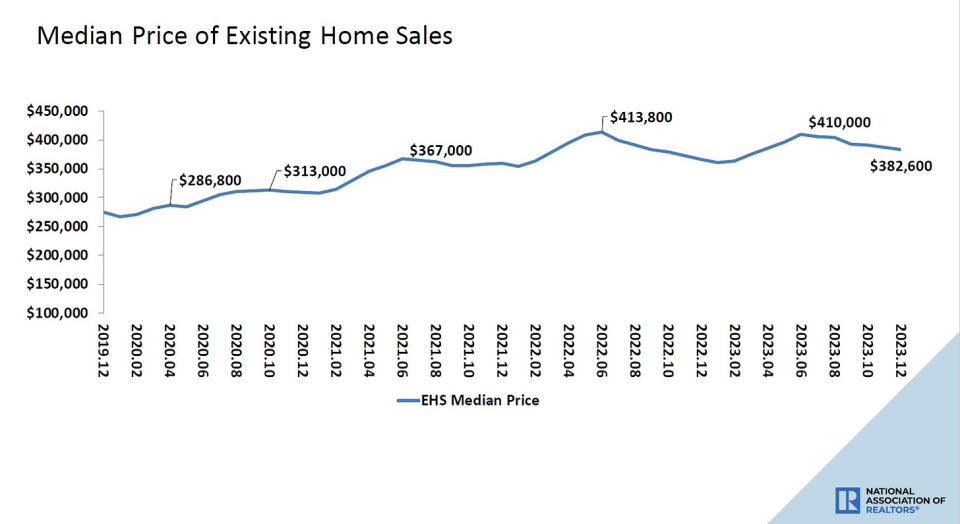

Home sales cool. Sales of previously owned homes declined 1.0% in December to an annualized rate of 3.78 million units. From NAR chief economist Lawrence Yun: “The latest month’s sales look to be the bottom before inevitably turning higher in the new year. Mortgage rates are meaningfully lower compared to just two months ago, and more inventory is expected to appear on the market in upcoming months.”

Home prices ticked lower. Prices for previously owned homes declined month over month, but were up from year-ago levels. From the NAR: “The median existing-home price for all housing types in December was $382,600, an increase of 4.4% from December 2022 ($366,500).“

Regional business surveys continue to look dismal. The NY Fed’s Empire State Manufacturing Survey’s January General Business Conditions index fell to its lowest level since May 2020.

The Philly Fed’s Manufacturing Business Outlook Survey’s January current activity ticked up, but still signaled contraction. Meanwhile, the future activity index sunk to its lowest level since May.

Keep in mind that during times of stress, soft data tends to be more exaggerated than actual hard data.

Industrial activity picks up. Industrial production activity in December rose 0.1% from November levels, with manufacturing output climbing 0.1%.

The pros are worried about stuff. According to BofA’s January Global Fund Manager Survey, fund managers identified “geopolitics worsen” as the “biggest tail risk.”

The truth is we’re always worried about something. That’s just the nature of investing.

Near-term GDP growth estimates look good. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.4% rate in Q4.

Putting it all together 🤔

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.