Recession Forecasting: Fiscal Policy And Liquidity Drive Stock Market Direction (Part 4)

NanoStockk/iStock via Getty Images

We are going to cover, in detail, what the differences are between monetary policy and fiscal policy – in practical terms – and what this means for investors in 2024 and beyond. Then to pay back that investment of mental time and energy, we will discuss the Net Liquidity model and how and why it correlates particularly well with the stock market.

In Part 1 we focused on the Yield Curve and why a more detailed reading of the measure is required to understand how this measure can be used for forecasting. In Part 2 I argued that we should be taking a contrarian approach to modern recession forecasting and ignore a great deal of the mainstream media, including the NBER dating committee. We then focused on helpful indicators like Heavy Truck Sales and the FSI index in Part 3.

In this piece we want to both build our knowledge of how the financial system works, and to understand what Liquidity is and how it can help us to make sense of the multitude of fiscal programmes that are out there while giving a sense of the impact they have on the stock market.

An ambitious set of targets – let us get started!

Policy – Two Big Levers

One of the biggest concepts that investors misunderstand is the fact that there is not simply one individual component or metric that can be focused on in isolation. The market is much more efficient now than it was in the past: which means you need multi-factor models and greater depth of understanding to have an edge. Basic moving averages and technical analysis alone are not enough. The financial system, and in particular fiscal policy, fits together as part of a large and broad house that works together.

Starting with basic features of that house – there is Fiscal policy and Monetary policy. These are the tools that the government and central banks use to influence the economy in significant ways.

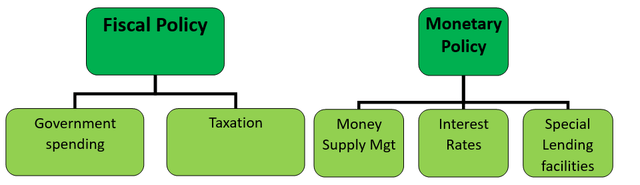

Let’s use a chart to illustrate the differences between the two:

David Huston – Policy

Imagine these levers may be pushed forwards (stimulative) and backwards (reducing aggregate demand).

It is fiscal policy that is really in the driving seat. Money drives the market and I intend to go through what monetary policy is, then end with what fiscal policy is and show that it is significantly more predictive for asset prices and the stock market.

Monetary Policy

Starting with Monetary Policy. I suspect that investors have had a crash course in monetary policy recently. The aim of said policy is to achieve objectives that are set out in the Federal Reserve’s mandate as the central bank. That mandate is defined by the Federal Reserve Act:

The Federal Reserve Act mandates that the Federal Reserve conduct monetary policy ‘so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.’1 Even though the act lists three distinct goals of monetary policy, the Fed’s mandate for monetary policy is commonly known as the dual mandate.

The reason is that an economy in which people who want to work either have a job or are likely to find one fairly quickly and in which the price level (meaning a broad measure of the price of goods and services purchased by consumers) is stable creates the conditions needed for interest rates to settle at moderate levels.2”

Source:

Frederic S. Mishkin (2007), “Monetary Policy and the Dual Mandate,” speech delivered at Bridgewater College, Bridgewater, Va., April 10

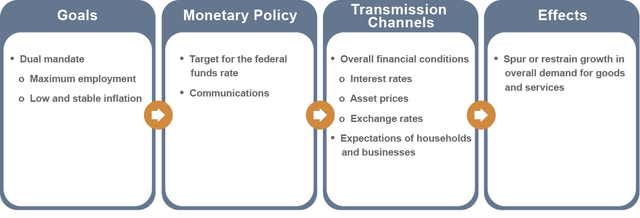

They enshrine their goals and the instruments or “transmission channels” that they use to achieve those goals very clearly in Mishkin’s paper, and I include an extract here:

Mishkin 2007 Monetary Policy speech

As we have discovered in 2022-2023, though; there is an inordinate amount of attention given to monetary policy. Millions of investors tune into Powell’s speeches and eagerly await any nuggets of wisdom that they can get regarding the future direction of policy. When will they start cutting rates? Can anybody trick Powell, through crafty questions, into revealing when the first interest rate cut will be?

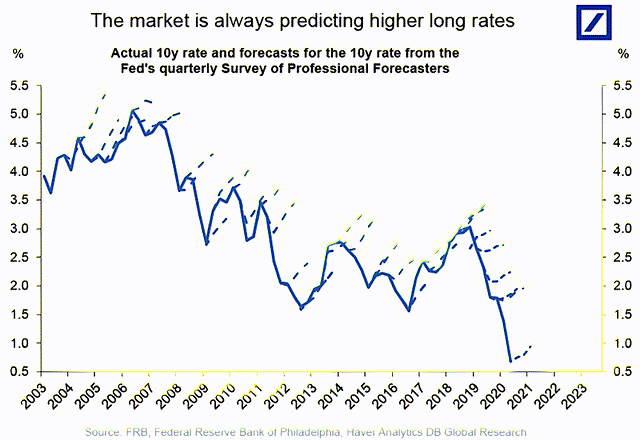

What fascinates me about this is that it is so futile. Monetary policy forecasts – by the Fed, by independent economists, by hedge funds and banks – all tend to be wrong and certainly no better than a coin flip. The direction of monetary policy does not fundamentally drive the stock market – meaning, it’s not as strong a lever as investors tend to believe because you can’t easily act on it to make money.

As Haver Analytics and the Federal Reserve Bank itself points out, forecasts are (nearly) always wrong and often too high:

Haver Analytics DB Global Research 2021

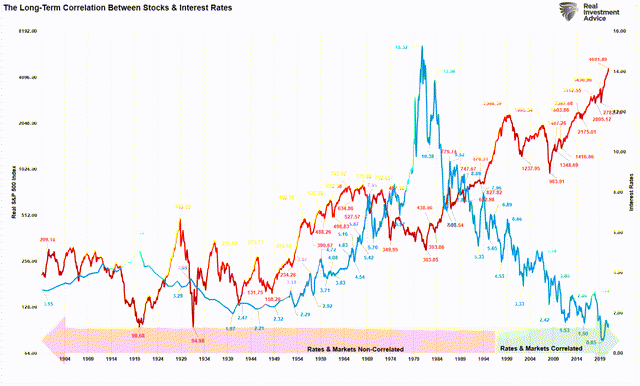

Despite what you may read in the news, for most modern history in the US stock market, there was simply no sustained correlation between the stock market and interest rates. For instance, during the 1930s through to the 1960s rates moved up in tandem with the stock market and the reverse was true in modern times:

Real Investment Advice, Lance Roberts 2021 from Advisor Perspectives

So, we get what Monetary policy is, some reasons for why it gets the majority of the focus, and the fact that when you look at the data it doesn’t really tell you that much regarding the short and intermediate term direction of asset prices. If it does it is with long and variable lags that make it difficult to act on, which is why monetarists were so certain that we’d get a recession in 2023 and were clearly wrong.

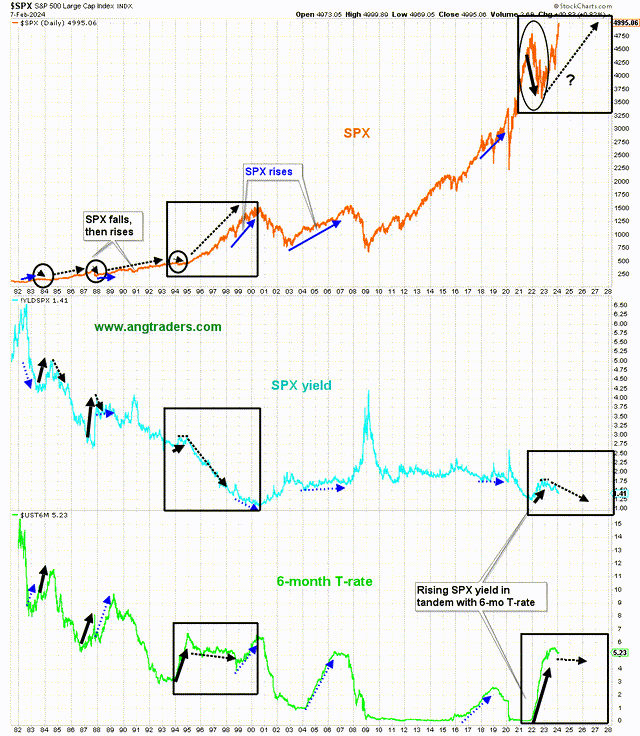

In fact in the 1990s we had a similar phenomenon – rising, then flat rates and an enormous bull market in risk assets. The same could happen again:

ANG Traders 2024

One more point before we move on. There is a persistent belief that higher rates are bad for the stock market. What is interesting is that the opposite is true and has been proven to be true over the past 18 months: higher rates have been stimulative for the market. They increase the interest that banks receive on their reserve balances. This is called Interest on Reserve Balances or IORB and it now sits at 5.4%.

We are not talking about small figures here. Reserve Balances currently sit at $3,526.23 billion dollars, or $3.5 trillion. That equates – through IORB – to $189 billion dollars in interest that is paid out to the banks subject to the Financial Services Regulatory Relief Act of 2006 and authorised by the Federal Reserve Banks.

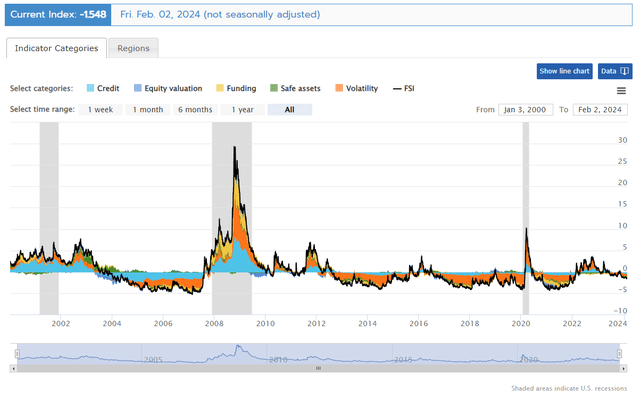

This is one of many reasons why financial conditions are fairly loose and if we look at balanced measures like the OFR’s Financial Stress Index we can see that there’s little stress in the financial system to worry about at present. This runs contrary to the deafening noise about rates being too high:

OFR Financial Stress Index 2024

As we demonstrated in previous articles, despite a swell above 0 (representing tighter conditions) in 2022, they are firmly in the “green” and below 0. This is because in totality Congressional and Fed policy has actually loosened financial conditions, not tightened them. Looser policy is good for asset prices and is much more predictive of the stock market than the Federal Funds Rate in isolation.

We understand what monetary policy is (broadly), what it does, and a measure for how tight or loose conditions are. In a basic sense there’s some good evidence that monetary policy doesn’t drive the economy in isolation.

What about Fiscal Policy?

Fiscal Policy Definitions

The government could do a much better job in educating the public on fiscal policy, because it has been a principal driver of the stock market particularly since 2003 and even more so since 2008, when the Fed became more involved in providing backstop support to the stock market.

Fiscal policy is when Congress agrees on levels of government spending and taxation, and once they do the Fed implements those policies in line with their own mandate. This is – as we will come on to discuss – a very influential tool for the economy and the stock market. The government controls its level of spending and can use it as a lever to stimulate demand in the economy. It can do so at will, provided Congress approves spending, which is their mandate. We saw this during the Covid-19 pandemic when large scale stimulus was approved by Congress and enacted by the Fed to rescue the economy in March 2020.

One could argue this is the far more important wing of the house, where we bring our distinguished guests!

Fiscal Policy – How it Works

The Fed knows that the monetary policy tools have limited immediate effect, and as Powell repeatedly states, long and variable lags, measured in years. What they also know though is that the economy and the stock market track fiscal policy very well – and that the market is far more reactive to this and the wonderful smorgasbord of fiscal policy tools at their disposal. This has a daily and weekly impact on the stock market that is measurable and tangible, with a direct causal link to the stock market.

The elephant gun is Congressional approved deficit spending and the amount allocated to deficit spending. The larger the deficit spend, the more money that is transferred into the economy and private bank accounts, which in turn drives the stock market and the economy to higher levels (as we have seen this past year!)

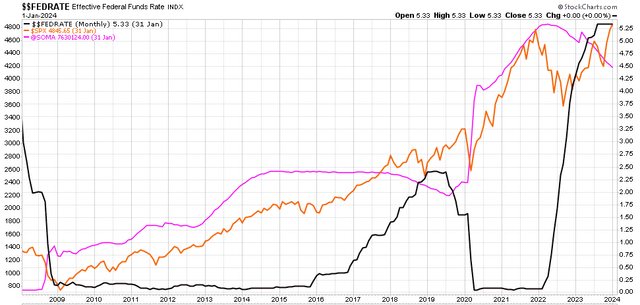

Let’s just take one example and look at the S&P 500 index and the Federal Funds rate, as well as the SOMA balance sheet. The Federal Reserves System Open Market Account (SOMA) contains dollar denominated assets to the tune of $7 trillion and it is comprised of US Treasury Notes, TIPS, Agency Backed Mortgage Securities and other assets:

ANG Traders – Stock charts

What has a bigger impact – the FFR (black line) or the SOMA balance sheet? As you can see each time we hit a difficult period – like the Global Financial Crisis or the Covid-19 shutdowns, Congress has approved large stimulus programmes that have in turn given the Fed authority to significantly expand their balance sheet. In turn that expansion drives long, persistent increases in asset prices.

This is not the entire picture of fiscal policy, this is a basic starting point. The SOMA is the biggest measure in dollar terms, but there are multiple programmes that sit on top of it which both add and subtract from demand and the dollars available to the private sector. We will conclude this article with a look at the “bigger picture” through net liquidity, however, before we get there, we have one final stop.

The Deficit

Despite extraordinarily strong mainstream views about the debt, government debt represents financial assets that find their way into the private sector and have an important role in maintaining liquidity and driving growth.

The US government is a monetarily sovereign state and as such can “afford” to print money and spend in its own currency. Since the currency (US dollar) is tightly controlled by US policy and Central Banks there is no risk of “going broke” by printing too much money like, say, a household or corporation. They can create money at will. Those who decried the large stimulus signed off at the trough of the Covid-19 pandemic in March 2020, would have to think carefully about the depression that would have resulted had of the government not acted.

As Stephanie Kelton describes in her book the Deficit Myth, government spending is not borrowing in the sense that the market understands it. Rather than being a burden on future generations as many mainstream economists believe (including the National Institute of Economic Research here), expansion of the debt in line with a growing economy opens up funding for the private sector and provided it is spent in the right way, continues to drive growth.

Definition – Liquidity

Now that we know the difference between fiscal and monetary policy, and the relative importance of fiscal policy, we can look at how we put together multiple systems to understand whether there is a positive or negative Net Transfer into the economy that would stimulate demand and drive an upward (or downward) movement in asset prices.

What should interest investors is not the size of the debt, or the SOMA balance sheet, or any of the multitude of programmes run by the Fed. It’s whether they – together – are stimulating demand or reducing demand.

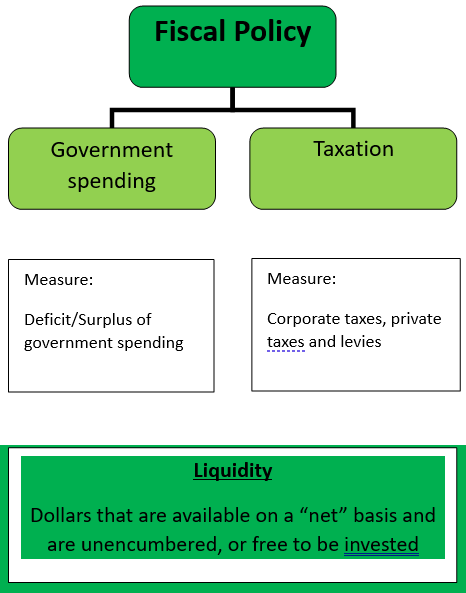

It’s helpful again to visualise this in a simple chart:

David Huston

Money drives the Market. By assessing all of the policies of the government and spending in totality we can define the Liquidity available on a net basis to stimulate growth.

We can have loose fiscal policy and be increasing the debt – which is positive, and stimulates the economy – but what really impacts the stock market is the net spending that allows dollars to circulate in the economy, driving growth. That’s Liquidity.

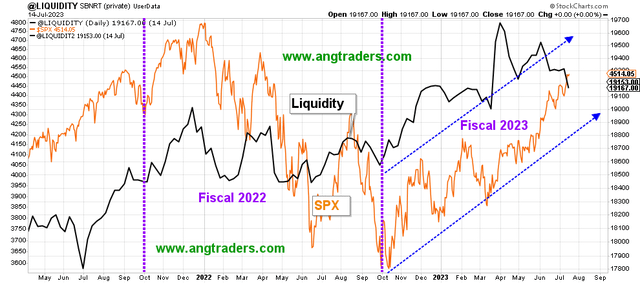

The failure of the past year by mainstream economists and market pundits to see a turnaround in the stock market is a failure to recognise and understand the importance of Liquidity in the market:

ANG Traders

Since July 2022 liquidity has been ample and we have seen a very close relationship between the increase in liquidity in the market and the overall direction of asset prices.

Suddenly it becomes clear: Economists and investors are obsessed with monetary policy and obsessed with the path of interest rates, real rates, R* and the impact on the bond market. These things are all tradeable and interesting to follow – but it’s the flow of money and liquidity that really matters most. It was poor in 2022 and we saw major drawdowns in assets. It was pretty decent in H2 2023 and the stock market has been rallying since then.

In the penultimate article of the series we’re going to show a wider range of values for liquidity and a back-test of a system that trades it on a daily and weekly basis.

Real World Outputs – The Consumer

How do we know, tangibly, that this money is out there having a positive impact on people and the economy? In other words what is the output of this spending – the people and consumers in society, who are either consuming (and creating an economy) or not consuming and representing a shrinking economy?

This money finds its way into the pockets of consumers, businesses, and large and small enterprises and in turn helps the economy to grow and prosper. Here’s a simple way of illustrating, with a fair measure, what the health of the consumer and individual household is in the US and it’s a measure very closely followed by the Fed.

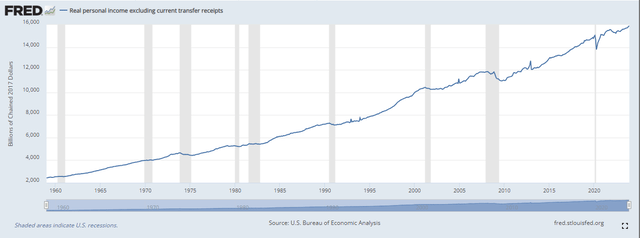

Fred 2024 – Real personal income excluding current transfer receipts

If we look at the Fed’s reporting on Real personal income excluding transfer receipts, we get to see a gauge of the real income of individuals and households that is adjusted for, or accounts for, government transfer payments. The grey bars represent real recessions, when real personal incomes tend to flat line or fall. Here are a few definitions:

- Real refers to inflation adjusted – these are income ($) adjusted for the erosion in purchasing power over time.

- Government transfer receipts – payments provided by the government such as unemployment benefits, food stamps, social security and housing benefits.

By looking at people’s inflation adjusted income, we can see how people are coping and therefore how they are able to meet their needs and go out and do what the economy needs, which is a lot of consumer spending.

According to this measure the consumer is in great shape. We had a dip between November 2021 and a bottom in June 2022 – the Fed adjusted policy to reign in inflation, and the consumer experienced a fall in real personal income (or purchasing power). For a recession to come, we would expect to see a material fall in this measure: either by excessive inflation, which erodes purchasing power, or through a big hit to demand by people changing their spending habits.

Summary

The consumer is in great shape and the economy is doing fine. Monetary policy is tighter than it was in 2021, but there has not been a meaningful translation into tight financial conditions as measured by the Financial Stress Index. We would be in worrying territory if this measure were to rise and sustain above 0.

Fiscal policy has a much more profound and immediate impact on the stock market. The fiscal fund flows and spending has been, on balance, solid since October 2022 and July 2023. It took the market a while to cotton on, but now asset prices are jumping up again.

In our next and penultimate part of the series we will cover the Net Liquidity index in further detail.