Sensex Today | Market Close Highlights: Sensex ends 610pts down, Nifty at 22,330; Bank, metal, realty, O&G, lose most

Sensex Today Live : Closing Bell

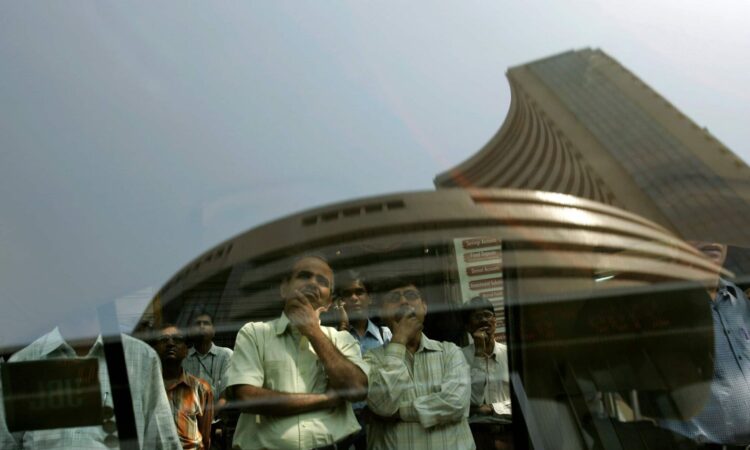

Sensex Today Live : In a day marred by weak sentiments emanating from global peers, Indian benchmark indices closed drastically down on Monday.

Sensex, which had opened lower at 74,175.93, and touched a low of 73,433.91, during the day, pared some losses to close at 73,502.64, down 616.75 points, or 0.83%

Meanwhile, Nifty 50, which had also opened lower at 22,517.50, touched a low of 22,307.25 during intraday trade. At close, it was at 22,332.65, down 160.90 points, or 0.72%.

Power Grid Corp., Tata Steel, SBI, IndusInd Bank and NTPC, were the top drags on the Sensx, while Nestle India, Bajaj Finserv, Bajaj Finance, Asian Paints, and JSW Steel, were the top gainers at close.

On the Nifty 50, Apollo Hospital Enterprises, Nestle India, SBI Life, Cipla, and Dr Reddy’s, were the top gainers, while Tata Consumer Products, Power Grid Corp., Bajaj Auto, Tata Steel, and SBI, were the top losers.

The affect of the weak sentiment in the markets today was also witnessed in the sectoral indices, with most of the heavyweight indices closing in the red. The Bank Nifty closed down 1.06%, while Metal was down 1.44%. Realty and Oil & Gas indices also closed down more than 1%, while Media closed down 2.91%. Sector indices like Auto, Financial Services, FMCG, and IT, also closed in the red, while Pharma and Healthcare, were the only two sectoral indices which ended the day in green.

The broader market was also under pressure, with the BSE SmallCap index closing down 2.01%, and the BSE MidCap index closing down 0.24%.

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : The affect of the weak sentiment in the markets today was witnessed in the sector indices too, with most of the heavyweight indices remaining in the red through most of the day. The Bank Nifty was down 1.02%, while Metal was down 1.41%, and Media was down 2.72%.

Sector indices like IT, Realty, FMCG, Auto, and Financial Services, were also in the red.

Sensex Today Live : Broader market indices heat map

Sensex Today Live : The broader market was under pressure, with the BSE SmallCap index down 1.81%, and the BSE MidCap index down 0.08%.

Sensex Today Live : Gainers and Losers on Nifty

Sensex Today Live : On the Nifty 50, Apollo Hospital Enterprises, Nestle India, SBI Life, Cipla, and Bajaj Finserv, were the top gainers, while Tata Consumer Products, Power Grid Corp., Ajaj Auto, Tata Steel, and SBI, were the top losers.

Sensex Today Live : Gainers and Losers on Sensex

Sensex Today Live : Power Grid Corp., Tata Steel, SBI, IndusInd Bank and HDFC Bank, were the top drags on the Sensx, while Nestle india, Bajaj Finserv, HCL Tech, Bajaj Finance, and JSW Steel, were the top gainers.

Sensex Today Live : 3 pm Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 3 pm, Sensex was down 391.79 points, or 0.53%, at 73,727.60, and Nifty was down 107.75 points, or 0.48%, at 22,385.80.

Sensex Today Live : Mahindra & Mahindra Financial Services board finalises fund raise of nearly ₹2,000 crores through NCDs

Sensex Today Live : In an exchange filing today, Mahindra & Mahindra Financial Services, said that its board has approved the fund raise of ₹500 crore, with a green shoe option to raise another ₹1,500 crore.

It said in the exchange filing, the company’s board has “has approved the offer and issuance of Secured, Rated, Listed, Redeemable Non-convertible Debentures on private placement basis as per the details given in Annexure I, within the overall borrowing limits approved by the shareholders and authorization granted by the Board in this regard.”

Sensex Today Live : PSP Projects gets order worth ₹410.06 crore to build another Gift City building

Sensex Today Live : PSP Projects informed the exchanges today that it has received an additional order to build a fintech buildging in Gift City, Gandhinagar, worth ₹333.06 crore.

It stated in an exchange filing, “we are pleased to inform that the company is in receipt of new Work Orders worth INR 410.06 Crores (excluding taxes).”

The filing further noted, “With receipt of the above order, the total order inflow during the financial year 2023-24 till date amounts to INR 3422.91 Crores. (This includes additional scope of work worth INR 77 Crores from the existing contracts).”

Sensex Today Live : Solar Industries receives export order worth ₹455 crore

Sensex Today Live : Solar Industries India informed the exchanges that it has received an order worth ₹455 crore from an overseas client to supply products for two years for use in defence products.

Sensex Today Live : 2 pm Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 2 am, Sensex was down 331.65 points, or 0.47%, at 73,767.74, and Nifty was down 88.85 points, or 0.4%, at 22,404.70.

Sensex Today Live : Why has Kotak Mahindra Bank stock’s valuation de-rated?

Sensex Today Live : Kotak Mahindra Bank has recently affirmed the stance of the Reserve Bank of India (RBI) governor, expressed during the policy meeting in February, that the full impact of the stringent monetary policy is yet to be realized.

It’s evident that the majority of banks have so far underestimated the RBI’s determination to combat inflation through a strict monetary policy, as they have avoided aggressive increases in deposit rates to preserve their profitability. However, Kotak Mahindra Bank has now aligned itself with other banks that have started to raise their deposit rates. (Read the full story here.)

Sensex Today Live : India’s chip ambitions are about to get larger

Sensex Today Live : The government is set to increase incentives for the chip sector from the existing ₹76,000 crore, anticipating a surge in chip fabrication and testing facilities across the nation in the coming years.

Ashwini Vaishnaw, the IT minister, said in an interview that India is on track to become one of the world’s top five semiconductor ecosystems within the next five years. This growth will be fueled by investments from international giants who are progressively looking at India as a potential location for establishing fabrication units and other facilities.

Vaishnaw, who also oversees the telecom and railways portfolios, further added, “Over the next five years, India is projected to see the establishment of approximately 4-6 additional fabs, 6-10 compound semiconductor fabs, 1-2 display fabs, and 8-10 ATMP units. The complete design, fab, and ATMP value chain will be set up here in Bharat. In the next five years, Bharat is poised to rank among the world’s top five semiconductor ecosystems.” (Read the full story here.)

Sensex Today Live : Rally in PSU stocks flawed, book profit, says Kotak Institutional Equities

Sensex Today Live : Brokerage firm Kotak Institutional Equities has expressed skepticism about the recent surge in Public Sector Undertaking (PSU) stocks. It recommends that investors capitalize on the profits and liquidate the majority of their holdings.

In its report dated March 9, the firm highlighted that the rally in PSU stocks occurred despite no substantial improvements in their fundamentals or significant reforms. This suggests that the remarkable surge was mainly fueled by optimistic market sentiment. (Read the full story here.)

Sensex Today Live : 1 pm Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 1 am, Sensex was down 346.21 points, or 0.47%, at 73,773.18, and Nifty was down 81.25 points, or 0.36%, at 22,412.30.

Sensex Today Live : Supreme Court directs SBI to furnish details of Electoral Bonds Scheme by March 15; shares fall 2%

Sensex Today Live : The Supreme Court has denied the State Bank of India’s (SBI) request for an extension to disclose the identities of individuals and corporations that purchased its electoral bonds to finance political parties. The court ordered that this information be provided to the Election Commission by Tuesday, March 12, and that the commission should publish it on its website by the evening of March 15.

In a significant ruling last month, the Supreme Court had abolished the electoral bond process, deeming it ‘unconstitutional’. The electoral bonds scheme, initiated by the Modi government, facilitated ‘anonymous’ political contributions. SBI, as the authorized financial institution under the scheme, was instructed by the Supreme Court of India to submit the details of the electoral bonds bought from April 12, 2019, onwards to the Election Commission by March 6. The commission was then directed to make this information available on its official website by March 13.

Sensex Today Live : IndusInd Bank launches all-in-one payment wearables

Sensex Today Live : IndusInd Bank today informed the exchanges that it has launched its contactless payments wearables, ‘Indus PayWear,’ an all-in-one tokenizable wearable service for both debit and credit cards on Mastercard. The exchange filing said that the offering will be extended to other card networks shortly.

Indus PayWear allows users to tokenize their IndusInd Bank credit or debit card onto a chip-enabled wearable device.

This will facilitate swift and secure tap-and-pay transactions at any contactless Point-of-Sale (PoS) terminal across the globe, eliminating the need for a physical card or even a payment app for purchases.

The three wearables, i.e. ring, watch clasp, and stickers, cater to diverse preferences of customers, with an affordable price ranging from Rs. 499 to Rs.2,999.

While transactions below ₹5,000 are seamlessly done as a tap-and-pay using the wearable, transactions exceeding ₹5,000 will necessitate the added security of the PIN of the linked card to be entered on the PoS machine.

Sensex Today Live : Power Grid Corporation signs MoU with Rajasthan Rajya Vidyut Prasaran Nigam with an aim to take up projects worth ₹10,000 crore

Sensex Today Live : Grid Corporation of India today informed the exchanges that it has executed a Memorandum of Understanding with Rajasthan Rajya Vidyut Prasaran Nigam Limited (RRVPNL) on 10th March, 2024 to incorporate a Joint Venture (JV) Company for development of Intra State Transmission System in the state of Rajasthan with an equity Participation of 74% by POWERGRID and 26% by RRVPNL.

The company added that the JV company will undertake projects worth upto ₹10,000 crore in a phased manner.

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : Along with the broader market, most heavyweight sectoral indices were also in the red, with Metal emerging as the biggest loser.

Sensex Today Live : Broader market indices heat map

Sensex Today Live : The broader market was under pressure, with the BSE MidCap index down 0.18%, and the BSE SmallCap index down 1.59%.

Sensex Today Live : Gainers and Losers on Nifty

Sensex Today Live : Bajaj Finserv, Nestle India, Apollo Hospital Enterprises, Cipla, and Sun Pharma, were the top gainers on the Nifty 50, while Tata Consumer Products, Tata Steel, Power Grid Corp., Bajaj Auto, and Tata Motors, were the top losers.

Sensex Today Live : Gainers and Losers on Sensex

Sensex Today Live : Tata Steel, Power Grid Corp., IndusInd Bank, Tata Motors, and NTPC, were the biggest drags on the Sensex, while Bajaj Finserv, Nestle India, HCL Tech, Sun Pharma, and Bharti Airtel, were the biggest gainers.

Sensex Today Live : 12 pm Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 12 am, Sensex was down 345.29 points, or 0.47%, at 73,774.10, and Nifty was down 102.50 points, or 0.46%, at 22,391.05.

Sensex Today Live : ICICI Securities revises Ambuja Cement’s TP to ₹831, retains ‘BUY’ rating

Sensex Today Live : Under Adani Group, Ambuja Cement has narrowed the margin gap considerably versus peers, mainly led by cost control.

We believe, it has ‘just scratched the surface’ given its ongoing plan of significant green power addition and a resolve to boost efficiency in other areas by leveraging group synergies.

While plans to add ~32mtpa capacity is in the works, the upcoming fund infusion of INR 150bn (promoter warrant conversion due in Apr’24) has potential to expedite (by organic and/or inorganic route) ACEM reaching the 140mtpa capacity target well ahead of its initial guidance of FY28 (76mtpa currently).

Given the odds, ACEM comes across as a rare opportunity which makes a favourable investment argument irrespective of the sector’s outlook.

Retain BUY; TP revised to INR 831 (vs. INR 668).

Sensex Today Live : ICICI Securities says price cut and ministry/regulator comments are lile storm in a tea cup for gas distribution companies

Sensex Today Live : A Petroleum and Natural Gas Regulatory Board (PNGRB) member and the Oil Ministry, recently flagged execution delays and profit margins of city gas distribution companies (CGD).

We believe the comments, in conjunction with the price cuts taken in the CNG segment – INR 2.5/kg by MGL and IGL, effective 6 th Mar’24 and 7th Mar’24, respectively, have combined to steeply impact CGD stocks negatively.

That said, we do find comfort in PNGRB clarifying that they do not intend to regulate margins for CGDs, coupled with the fact that gross margins for both IGL/MGL remain above historical levels and FY25 estimates despite the price cut.

With valuations at comfortable levels and no material threat to margins, we maintain BUY on MGL, ADD on IGL and SELL on GUJGA at these levels.

Sensex Today Live : ICICI Securities says equity valuations are getting more uncomfortable as prices react positively to growth upgrades

Sensex Today Live : Nifty 50 index expanded 31% from Mar’23’s lows, as against a trailing earnings expansion of ~18% during the same time, thereby resulting in valuations expanding from a reasonable 17.5x to an elevated 20x on a forward earnings basis.

Broader market price rise was even higher compared to their earnings expansion with mid/small/micro-caps returning 62%/73%/100%, since Mar’23’s lows.

Driven by the ‘investment rate’, real GDP growth for Q3FY24 was much higher (8.4% YoY) than consensus estimates, thereby resulting in consensus upward revision to FY24 GDP.

This could potentially lead to upward earnings revisions – such expectations have begun egging stock prices on, which are already stretched in terms of valuations, thereby thinning the ‘margin of safety’.

Upward growth revisions is likely to continue to emanate from cyclical and capital intensive space, as it has been for the past one year, thereby resulting in their outperformance.

Sensex Today Live : Dilip Buildcon receives Letter of Award (LOA) for a project worth ₹548 crore to improve the alignment of Thoppur Ghat Section in Dharmapuri-Salem section of NH-44

Sensex Today Live : Dilip Buildcon informed the exchanges that it has received the Letter of Award (LOA) for the tender floated by the National Highways Authority of India on Hybrid Annuity basis in the state of Tamil Nadu for the project, ““Improving the Alignment of Thoppur Ghat Section from Km 158+500 to 165+100 in Dharmapuri – Salem Section of NH-44 under NH(O) 2023-24 on Hybrid Annuity Mode in the State of Tamil Nadu.”

The company informed in its exchange filing that the project for the 6.6 km stretch, and worth ₹548 crore, would be completed within 36 months.

Sensex Today Live : 11 am Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 11 am, Sensex was down 211.54 points, or 0.29%, at 73,907.85, and Nifty was down 54.65 points, or 0.24%, at 22,438.90.

Sensex Today Live : February retail inflation seen at 5.08%: Mint poll

Sensex Today Live : Forecasts suggest that India’s retail inflation rate for February will be around 5.08%, showing little variation from the 5.10% observed in the prior month, according to a median estimate from a survey of 20 economists conducted by Mint. Despite a sequential increase in food prices, the impact is anticipated to be balanced out by a favourable base effect.

The predictions from the economists surveyed by Mint varied between 4.90% and 5.50%, with a mere three predicting a rise in inflation from the previous month. The official data is scheduled for release on March 12. (Read the full story here.)

Sensex Today Live : Why are RBI and Sebi spooked about JM Financial Products?

Sensex Today Live : In October 2023, Piramal Enterprises Ltd raised around ₹533 crore via non-convertible debentures (NCDs). JM Financial Products Ltd, a subsidiary of JM Financial Ltd, contributed to nearly 26% of this amount.

A majority of the investors were involved through the ICICI Bank branch situated at the Free Press Journal building at Nariman Point in Mumbai.

On the NCD’s listing day (7 November), JM Financial Products repurchased all the securities from all 1,016 investors. These securities were later sold to two corporate entities and a brokerage firm, causing JM Financial Services Ltd to incur a loss of ₹90 lakh.

The Securities and Exchange Board of India uncovered this intricate transaction during an investigation, leaving the regulators puzzled. A Sebi order, dated 7 March, concluded, “For a profit-driven company, it is commercially illogical to engage in transactions that consistently result in losses.” (Read the full story here.)

Sensex Today Live : Adani Green Energy operationalizes 1,000 MW (1 GW) of the 30,000 MW Khavda renewable energy park; shares in focus

Sensex Today Live : Adani Green Energy Limited has operationalized a cumulative capacity of 1,000 MW solar energy at the world’s largest RE park at Khavda, Gujarat.

With this, AGEL has achieved operational capacity of 9,478 MW and continues strongly towards its stated goal of operationalizing 45,000 MW by 2030.

AGEL has delivered 1,000 MW in less than 12 months of commencing work at Khavda. This involved installing approximately 2.4 million solar modules.

The accelerated progress underscores AGEL’s commitment to India’s goal of achieving 500 GW non-fossil fuel capacity by 2030.

Sensex Today Live : Torrent power shares surge over 9% to all-time high after bagging 306 MW solar power project

Sensex Today Live : Torrent Power shares surged 9.2% to reach a new record high of ₹1,249.95 per share during Monday’s intraday trading. This increase came after the company was awarded a Letter of Award from Maharashtra State Electricity Distribution Co. Ltd. (MSEDCL) on March 07, 2024.

The Letter of Award, valued at ₹1,540 crore, is for the establishment of a 306 MW grid-connected solar power project. This project will be spread across 48 different locations in the Nasik District of Maharashtra, as stated in the company’s exchange filing.

With this award, the total renewable capacity that Torrent Power has under construction has risen to 1.7 GW. Once these 1.7 GW projects are completed, Torrent Power’s renewable capacity will expand to 3 GW within the next 18–24 months.

Sensex Today Live : 10 am Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 10 am, Sensex was down 119.33 points, or 0.16%, at 74,000.06 and Nifty was down 35.40 points, or 0.16%, at 22,458.15.

Sensex Today Live : Tata Chemicals down 9% after news that Tata Sons me rejig balance sheet to avoid mandatory IPO

Sensex Today Live : Investors who were speculating on a further increase in Tata Chemicals Ltd’s stock price have found themselves in a predicament. This is due to emerging reports that Tata Sons Pvt. Ltd, the main holding company of the Tata Group, might restructure its balance sheet to evade a compulsory listing by September of the following year.

The potential public share listing of the holding company has created such a stir that the share price of Tata Chemicals, which holds a 3% stake in Tata Sons, soared by 40% over six trading sessions up to March 7.

This surge occurred despite a drop in the realisations of soda ash produced by Tata Chemicals. It was predicated on the assumption of a valuation re-rating if the market assigned a holding company discount to Tata Sons that was less than the usual 50-60%. (Read the full story here.)

Sensex Today Live : Don’t chase stock market trends for short-term gains: Nilesh Shah

Sensex Today Live : In the coming 12-18 months, large-cap stocks are expected to offer better risk-adjusted returns compared to their mid- and small-cap counterparts, says Nilesh Shah, Managing Director of Kotak Mahindra AMC. He believes that banks with robust deposit franchises, along with sectors such as automobiles, real estate, and cement, are well-positioned to outperform. In an interview with LiveMint, Shah also drew attention to the apprehensions investors have regarding regulatory actions in the Non-Banking Financial Companies (NBFC) sector. He emphasized the likelihood of investors gravitating towards financial institutions with superior governance, including banks. (Read the edited excerpts here.)

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : With the markets starting on a weak note, Nifty Bank, Media, Metal, and Financial Services were in the red.

Sensex Today Live : Broader market indices heat map

Sensex Today Live : The broader market was mixed, with the BSE MidCap index up 0.37%, and the BSE SmallCap index down 0.33%.

Sensex Today Live : Gainers and Losers on Nifty

Sensex Today Live : SBI Life, UltraTech Cement, Hero MotoCorp, HDFC Life, and Cipla, were the top gainers on the Nifty 50, while Tata Consumer Products, Tata Steel, Power Grid Corp., Tata Motors, and Infosys, were the top losers.

Sensex Today Live : Gainers and Losers on Sensex

Sensex Today Live : Bharti Airtel, Bajaj Finance, UltraTech Cement, Bajaj Finserv, and ITC, were the top gainers on the Sensex, while Power Grid Corp., Tata Steel, Tata Motors, Tech Mahindra, and Infosys, were the biggest losers.

Sensex Today Live : Opening Bell

Sensex Today Live : Indian benchmark indices opened in the red on Monday, affected by weak signals flowing from global peers.

At opening bell, Sensex was down 94.61 points, or 0.13%, at 74,024.78 and Nifty was down 21.70 points, or 0.1%, at 22,471.85.

Sensex Today Live: Benchmark indices touch record highs at pre-open

Sensex Today Live: Indian benchmark indices were jumped at pre-open on Monday, despite weak signals from global markets.

Sensex was up 56.54 points, or 0.08%, at 74,175.93 and Nifty was up 23.95 points, or 0.11%, at 22,517.50 during pre-open.

Sensex had touched 74,434.42 and Nifty had climbed to 22,582.08, in pre-open trades earlier.

Sensex Today Live : Adani’s airport outlay plans at ₹60k crore in 10 years

Sensex Today Live : Karan Adani, the Managing Director of Adani Ports and Special Economic Zone Ltd, has announced that the Adani Group is set to channel approximately ₹60,000 crore into the expansion of its seven existing airports over the coming 5-10 years.

The investment plan includes allocating about half of this amount towards enhancing terminal and runway capacity within the next five years. The remaining funds will be directed towards the city-side development of these airports over the next decade.

Furthermore, this substantial investment is in addition to the ₹18,000 crore that the group has earmarked for the development of the Navi Mumbai airport. (Read the full story here.)

Sensex Today Live : What to expect from Indian stock market in trade on March 11

Sensex Today Live : Despite mixed global indicators, the Indian stock market indices are anticipated to start on a positive note on Monday. The Gift Nifty trends suggest a gap-up opening for the Indian benchmark index, trading around the 22,650 level, which is approximately 100 points premium from the Nifty futures’ close on Thursday.

On Thursday, the Indian stock market indices concluded with a slight upward trend, with the Nifty 50 reaching a new peak above the 22,500 mark during the day and consolidating ahead of the extended weekend. The domestic equity market remained closed on Friday due to a public holiday.

The Sensex increased by 33.40 points, closing at 74,119.39, while the Nifty 50 ended 19.50 points, or 0.09%, higher at 22,493.55. The Nifty 50 formed a small negative candle on the daily chart with a minor lower shadow.

According to Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities, this pattern technically signifies a breather type formation following the sharp upside breakout on Wednesday. The bullish rising three method pattern remains intact, suggesting potential further upside in the near term. (Read the full story here.)

Sensex Today Live : Eight key things that changed for market over weekend – Gift Nifty, Japan’s GDP to China inflation

Sensex Today Live : The domestic stock market indices are likely to start on a positive note on Monday, as indicated by the Gift Nifty trends amidst fluctuating global market indicators.

On Thursday, the Indian stock market indices closed with a slight upward trend, with the Nifty 50 reaching a new peak above the 22,500 mark during the day. The domestic stock market remained closed on Friday due to a public holiday. The Sensex saw an increase of 33.40 points, or 0.05%, closing at 74,119.39, while the Nifty 50 ended 19.50 points, or 0.09%, up at 22,493.55.

As the focus shifts to key economic data such as inflation figures from India and the US, announcements related to the upcoming 2024 General Elections, foreign capital inflows, and other international indicators, market players will be keeping an eye out for several potential stock market catalysts. (Read the full story here.)

Sensex Today Live : Asian markets sputter; Gift Nifty signals gap-up open

Sensex Today Live : Although Asian markets were under some pressure ahead of the release of inflation data in the US this week, Gift Nifty futures was trading strongly before markets open in India.

At 7:50 am, the Gift Nifty was trading at 22,640.50, nearly 150 points ahead of Nifty 50’s Thursday’s close of 22,493.55, after the benchmark index touched a fresh all-time high of 22,525.65 during the trading session.

Consequently, opening after a three-day break, the markets look well poised to give another strong performance on Monday.

Elsewhere, Asian share markets sputtered on Monday while the dollar looked vulnerable ahead of a reading on U.S. inflation that could hasten, or delay, the start of global rate cuts.

Hopes for lower borrowing costs have been a fillip for equities with MSCI’s broadest index of Asia-Pacific shares outside Japan easing 0.1%, after hitting an eight-month peak on Friday.

Japan’s Nikkei retreated 2.3%, having scored a succession of all-time highs last week. Chinese blue chips added 0.2%, but without much conviction.

S&P 500 futures and Nasdaq futures were a fraction lower, having both run into profit taking on Friday as artificial intelligence diva Nvidia shed 5.6%. [.N]

EUROSTOXX 50 futures fell 0.4%, and FTSE futures dipped 0.2%.

Treasury bonds continued their rally after the benign jobs report with 10-year yields touching a one-month low of 4.038% and last trading at 4.060%.

Oil prices have had a tougher time as worries about China’s demand offset supply cuts by producer group OPEC .

Brent dipped 54 cents to $81.54 a barrel, while U.S. crude lost 57 cents to $77.44 per barrel.