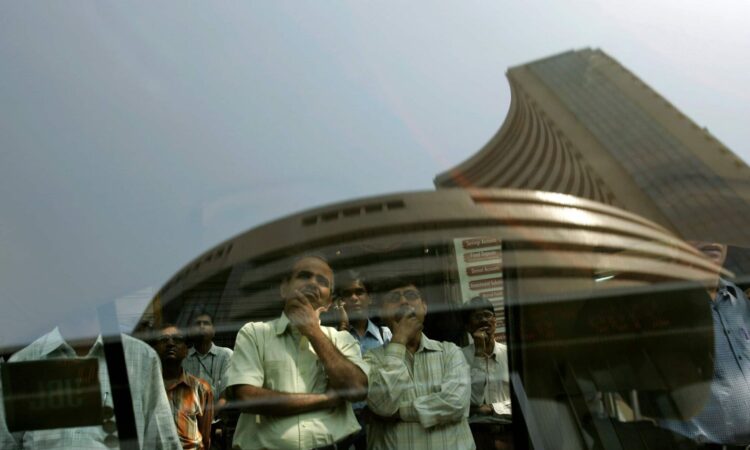

Sensex Today | Share Market Live Updates : Sensex down 200pts, Nifty at 22,430; Bank, Auto, FS, IT, Metal indices down

Sensex Today | Share Market Live Updates : Shares in Asia edged lower Monday as investors look ahead to US inflation data due Tuesday that is expected to show a further slowing in core prices.

Australian and Japanese shares both fell over 1% while Hong Kong futures inched higher. Contracts for US stocks slipped in Asian trading, extending the downbeat end to the week in the US, where both the S&P 500 and the Nasdaq 100 declined.

Support in Hong Kong equity futures follows positive signs for the Chinese economy over the weekend, when authorities reported the first rise in consumer prices since August. The 0.7% increase in February CPI exceeded consensus estimates and is welcome news for investors worried about deflation in the world’s second largest economy.

Economic growth in Japan expanded in the fourth-quarter, supporting expectations that the Bank of Japan will raise interest rates for the first time since 2007 as soon as this month. Declines for Japanese shares partly reflected the stronger yen, which typically acts as a headwind for the country’s equities.

Tuesday’s US consumer price index figures will dominate the economic data reports this week. The core prices gauge is seen rising 0.3% in February from a month earlier, and 3.7% on a year-over-year basis — which would be the smallest annual rise since April 2021.

Further moderation in US prices would support the disinflation narrative that broadly remains in tact, despite a pullback in the number of Federal Reserve rate cuts expected this year.

Last week’s US jobs data did little to change that outlook. The jobless rate touched a two-year high, even as the number of new jobs added exceeded estimates.

The pullback in US equities on Friday reflected a decline for most of the so-called Magnificent Seven stocks that have powered the US market to fresh highs this year.

In commodities, oil held a loss Monday ahead of reports from OPEC and the IEA this week that may provide clues on the demand outlook. Gold ended Friday almost 1% higher while Bitcoin traded around $69,000, holding its rally over the past few weeks.

Sensex Today Live : Dilip Buildcon receives Letter of Award (LOA) for a project worth ₹548 crore to improve the alignment of Thoppur Ghat Section in Dharmapuri-Salem section of NH-44

Sensex Today Live : Dilip Buildcon informed the exchanges that it has received the Letter of Award (LOA) for the tender floated by the National Highways Authority of India on Hybrid Annuity basis in the state of Tamil Nadu for the project, ““Improving the Alignment of Thoppur Ghat Section from Km 158+500 to 165+100 in Dharmapuri – Salem Section of NH-44 under NH(O) 2023-24 on Hybrid Annuity Mode in the State of Tamil Nadu.”

The company informed in its exchange filing that the project for the 6.6 km stretch, and worth ₹548 crore, would be completed within 36 months.

Sensex Today Live : 11 am Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 11 am, Sensex was down 211.54 points, or 0.29%, at 73,907.85, and Nifty was down 54.65 points, or 0.24%, at 22,438.90.

Sensex Today Live : February retail inflation seen at 5.08%: Mint poll

Sensex Today Live : Forecasts suggest that India’s retail inflation rate for February will be around 5.08%, showing little variation from the 5.10% observed in the prior month, according to a median estimate from a survey of 20 economists conducted by Mint. Despite a sequential increase in food prices, the impact is anticipated to be balanced out by a favourable base effect.

The predictions from the economists surveyed by Mint varied between 4.90% and 5.50%, with a mere three predicting a rise in inflation from the previous month. The official data is scheduled for release on March 12. (Read the full story here.)

Sensex Today Live : Why are RBI and Sebi spooked about JM Financial Products?

Sensex Today Live : In October 2023, Piramal Enterprises Ltd raised around ₹533 crore via non-convertible debentures (NCDs). JM Financial Products Ltd, a subsidiary of JM Financial Ltd, contributed to nearly 26% of this amount.

A majority of the investors were involved through the ICICI Bank branch situated at the Free Press Journal building at Nariman Point in Mumbai.

On the NCD’s listing day (7 November), JM Financial Products repurchased all the securities from all 1,016 investors. These securities were later sold to two corporate entities and a brokerage firm, causing JM Financial Services Ltd to incur a loss of ₹90 lakh.

The Securities and Exchange Board of India uncovered this intricate transaction during an investigation, leaving the regulators puzzled. A Sebi order, dated 7 March, concluded, “For a profit-driven company, it is commercially illogical to engage in transactions that consistently result in losses.” (Read the full story here.)

Sensex Today Live : Adani Green Energy operationalizes 1,000 MW (1 GW) of the 30,000 MW Khavda renewable energy park; shares in focus

Sensex Today Live : Adani Green Energy Limited has operationalized a cumulative capacity of 1,000 MW solar energy at the world’s largest RE park at Khavda, Gujarat.

With this, AGEL has achieved operational capacity of 9,478 MW and continues strongly towards its stated goal of operationalizing 45,000 MW by 2030.

AGEL has delivered 1,000 MW in less than 12 months of commencing work at Khavda. This involved installing approximately 2.4 million solar modules.

The accelerated progress underscores AGEL’s commitment to India’s goal of achieving 500 GW non-fossil fuel capacity by 2030.

Sensex Today Live : Torrent power shares surge over 9% to all-time high after bagging 306 MW solar power project

Sensex Today Live : Torrent Power shares surged 9.2% to reach a new record high of ₹1,249.95 per share during Monday’s intraday trading. This increase came after the company was awarded a Letter of Award from Maharashtra State Electricity Distribution Co. Ltd. (MSEDCL) on March 07, 2024.

The Letter of Award, valued at ₹1,540 crore, is for the establishment of a 306 MW grid-connected solar power project. This project will be spread across 48 different locations in the Nasik District of Maharashtra, as stated in the company’s exchange filing.

With this award, the total renewable capacity that Torrent Power has under construction has risen to 1.7 GW. Once these 1.7 GW projects are completed, Torrent Power’s renewable capacity will expand to 3 GW within the next 18–24 months.

Sensex Today Live : 10 am Market Update

Sensex Today Live : Indian benchmark indices were in the red on Monday, affected by weak signals from global peers.

At 10 am, Sensex was down 119.33 points, or 0.16%, at 74,000.06 and Nifty was down 35.40 points, or 0.16%, at 22,458.15.

Sensex Today Live : Tata Chemicals down 9% after news that Tata Sons me rejig balance sheet to avoid mandatory IPO

Sensex Today Live : Investors who were speculating on a further increase in Tata Chemicals Ltd’s stock price have found themselves in a predicament. This is due to emerging reports that Tata Sons Pvt. Ltd, the main holding company of the Tata Group, might restructure its balance sheet to evade a compulsory listing by September of the following year.

The potential public share listing of the holding company has created such a stir that the share price of Tata Chemicals, which holds a 3% stake in Tata Sons, soared by 40% over six trading sessions up to March 7.

This surge occurred despite a drop in the realisations of soda ash produced by Tata Chemicals. It was predicated on the assumption of a valuation re-rating if the market assigned a holding company discount to Tata Sons that was less than the usual 50-60%. (Read the full story here.)

Sensex Today Live : Don’t chase stock market trends for short-term gains: Nilesh Shah

Sensex Today Live : In the coming 12-18 months, large-cap stocks are expected to offer better risk-adjusted returns compared to their mid- and small-cap counterparts, says Nilesh Shah, Managing Director of Kotak Mahindra AMC. He believes that banks with robust deposit franchises, along with sectors such as automobiles, real estate, and cement, are well-positioned to outperform. In an interview with LiveMint, Shah also drew attention to the apprehensions investors have regarding regulatory actions in the Non-Banking Financial Companies (NBFC) sector. He emphasized the likelihood of investors gravitating towards financial institutions with superior governance, including banks. (Read the edited excerpts here.)

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : With the markets starting on a weak note, Nifty Bank, Media, Metal, and Financial Services were in the red.

View Full Image

Sensex Today Live : Broader market indices heat map

Sensex Today Live : The broader market was mixed, with the BSE MidCap index up 0.37%, and the BSE SmallCap index down 0.33%.

View Full Image

Sensex Today Live : Gainers and Losers on Nifty

Sensex Today Live : SBI Life, UltraTech Cement, Hero MotoCorp, HDFC Life, and Cipla, were the top gainers on the Nifty 50, while Tata Consumer Products, Tata Steel, Power Grid Corp., Tata Motors, and Infosys, were the top losers.

View Full Image

Sensex Today Live : Gainers and Losers on Sensex

Sensex Today Live : Bharti Airtel, Bajaj Finance, UltraTech Cement, Bajaj Finserv, and ITC, were the top gainers on the Sensex, while Power Grid Corp., Tata Steel, Tata Motors, Tech Mahindra, and Infosys, were the biggest losers.

View Full Image

Sensex Today Live : Opening Bell

Sensex Today Live : Indian benchmark indices opened in the red on Monday, affected by weak signals flowing from global peers.

At opening bell, Sensex was down 94.61 points, or 0.13%, at 74,024.78 and Nifty was down 21.70 points, or 0.1%, at 22,471.85.

Sensex Today Live: Benchmark indices touch record highs at pre-open

Sensex Today Live: Indian benchmark indices were jumped at pre-open on Monday, despite weak signals from global markets.

Sensex was up 56.54 points, or 0.08%, at 74,175.93 and Nifty was up 23.95 points, or 0.11%, at 22,517.50 during pre-open.

Sensex had touched 74,434.42 and Nifty had climbed to 22,582.08, in pre-open trades earlier.

Sensex Today Live : Adani’s airport outlay plans at ₹60k crore in 10 years

Sensex Today Live : Karan Adani, the Managing Director of Adani Ports and Special Economic Zone Ltd, has announced that the Adani Group is set to channel approximately ₹60,000 crore into the expansion of its seven existing airports over the coming 5-10 years.

The investment plan includes allocating about half of this amount towards enhancing terminal and runway capacity within the next five years. The remaining funds will be directed towards the city-side development of these airports over the next decade.

Furthermore, this substantial investment is in addition to the ₹18,000 crore that the group has earmarked for the development of the Navi Mumbai airport. (Read the full story here.)

Sensex Today Live : What to expect from Indian stock market in trade on March 11

Sensex Today Live : Despite mixed global indicators, the Indian stock market indices are anticipated to start on a positive note on Monday. The Gift Nifty trends suggest a gap-up opening for the Indian benchmark index, trading around the 22,650 level, which is approximately 100 points premium from the Nifty futures’ close on Thursday.

On Thursday, the Indian stock market indices concluded with a slight upward trend, with the Nifty 50 reaching a new peak above the 22,500 mark during the day and consolidating ahead of the extended weekend. The domestic equity market remained closed on Friday due to a public holiday.

The Sensex increased by 33.40 points, closing at 74,119.39, while the Nifty 50 ended 19.50 points, or 0.09%, higher at 22,493.55. The Nifty 50 formed a small negative candle on the daily chart with a minor lower shadow.

According to Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities, this pattern technically signifies a breather type formation following the sharp upside breakout on Wednesday. The bullish rising three method pattern remains intact, suggesting potential further upside in the near term. (Read the full story here.)

Sensex Today Live : Eight key things that changed for market over weekend – Gift Nifty, Japan’s GDP to China inflation

Sensex Today Live : The domestic stock market indices are likely to start on a positive note on Monday, as indicated by the Gift Nifty trends amidst fluctuating global market indicators.

On Thursday, the Indian stock market indices closed with a slight upward trend, with the Nifty 50 reaching a new peak above the 22,500 mark during the day. The domestic stock market remained closed on Friday due to a public holiday. The Sensex saw an increase of 33.40 points, or 0.05%, closing at 74,119.39, while the Nifty 50 ended 19.50 points, or 0.09%, up at 22,493.55.

As the focus shifts to key economic data such as inflation figures from India and the US, announcements related to the upcoming 2024 General Elections, foreign capital inflows, and other international indicators, market players will be keeping an eye out for several potential stock market catalysts. (Read the full story here.)

Sensex Today Live : Asian markets sputter; Gift Nifty signals gap-up open

Sensex Today Live : Although Asian markets were under some pressure ahead of the release of inflation data in the US this week, Gift Nifty futures was trading strongly before markets open in India.

At 7:50 am, the Gift Nifty was trading at 22,640.50, nearly 150 points ahead of Nifty 50’s Thursday’s close of 22,493.55, after the benchmark index touched a fresh all-time high of 22,525.65 during the trading session.

Consequently, opening after a three-day break, the markets look well poised to give another strong performance on Monday.

Elsewhere, Asian share markets sputtered on Monday while the dollar looked vulnerable ahead of a reading on U.S. inflation that could hasten, or delay, the start of global rate cuts.

Hopes for lower borrowing costs have been a fillip for equities with MSCI’s broadest index of Asia-Pacific shares outside Japan easing 0.1%, after hitting an eight-month peak on Friday.

Japan’s Nikkei retreated 2.3%, having scored a succession of all-time highs last week. Chinese blue chips added 0.2%, but without much conviction.

S&P 500 futures and Nasdaq futures were a fraction lower, having both run into profit taking on Friday as artificial intelligence diva Nvidia shed 5.6%. [.N]

EUROSTOXX 50 futures fell 0.4%, and FTSE futures dipped 0.2%.

Treasury bonds continued their rally after the benign jobs report with 10-year yields touching a one-month low of 4.038% and last trading at 4.060%.

Oil prices have had a tougher time as worries about China’s demand offset supply cuts by producer group OPEC .

Brent dipped 54 cents to $81.54 a barrel, while U.S. crude lost 57 cents to $77.44 per barrel.

Download the App to get 14 days of unlimited access to Mint Premium absolutely free!