The Indian stock market witnessed a rise during the special Diwali session on Tuesday, October 21, continuing its recent upswing due to optimism about earnings and possible easing of trade tensions between the U.S. and China.

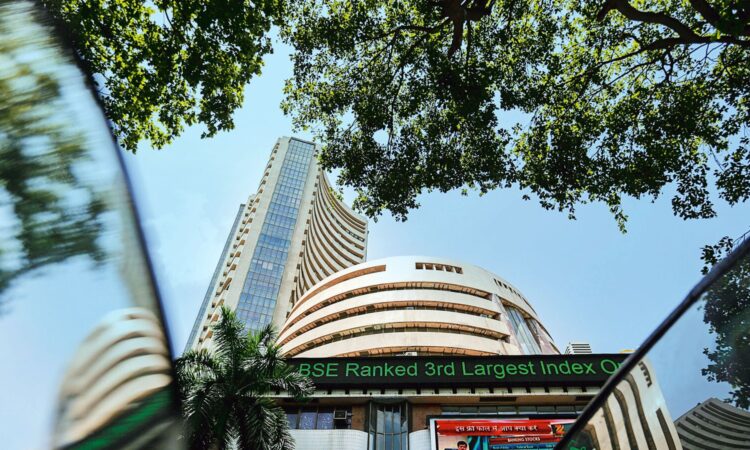

Dalal Street started Samvat 2082 on an upbeat note as Sensex and Nifty 50 clocked their 5-day winning streak.

The Nifty 50 climbed 0.1% to reach 25,868.6, while the Sensex increased by 0.07% to settle at 84,426.34, marking their highest closing levels since September 2024.

On Wednesday, October 22, 2025, the stock market will be closed on account of Diwali Balipratipada. In total, there are three stock market holidays in October 2025: October 2 for Mahatma Gandhi Jayanti/Dussehra, October 21 for Diwali Laxmi Pujan, and October 22 for Diwali Balipratipada.

Stock market holidays in 2025

The stock market holiday schedule for 2025 indicates there are 18 trading holidays, with four occurring on weekdays. Following the October holidays, both the BSE and NSE will be closed for a day each in November and December.

The upcoming stock market holiday in November is set for November 5, which is on account of Prakash Gurpurb Sri Guru Nanak Dev. In December, there is a single stock market holiday for Christmas, which falls on a Thursday.

Stock market outlook for Samvat 2082

The Indian stock market ended Samvay 2081 with modest gains. Stock market benchmark Nifty 50 rose by 6 per cent amid geopolitical tensions, concerns over US tariffs, weak earnings and foreign capital outflow.

“The important takeaway from Samvat 2081 is India’s huge underperformance. Even though there are many reasons, including Trump tariffs, for this underperformance, the single major factor is the sharp decline in India’s earnings growth to 5 per cent in FY25 from an average of 24 per cent during the three years before that,” VK Vijayakumar, Chief Investment Strategist, Geojit Investments, said.

The new Samvat is expected to augur well as earnings are expected to revive following income tax relief, GST reforms, a healthy monsoon and easing geopolitical uncertainties.

“The fiscal and monetary reforms implemented this year have started showing results. Particularly, the sales of automobiles and white goods have shot up early this festive season and, if this trend sustains, earnings growth will be good at around 8 to 10 per cent in FY26, accelerating to around 15 per cent in FY27,” Vijayakumar noted.

“If this expectation materialises, the market will rally in Samvat 2082, compensating for the underperformance of Samvat 2081. In the short run, the market may get a leg up from a possible India-US trade deal, but the long-term trend will be dictated by earnings growth,” Vijayakumar said.

Read all market-related news here

Disclaimer: This story is for educational purposes only. The views and recommendations expressed are those of individual analysts or broking firms, not Mint. We advise investors to consult with certified experts before making any investment decisions, as market conditions can change rapidly and circumstances may vary.