Live Updates

Live

After a rough few weeks, shares of AMZN appear to have finally bottomed out and are just starting to pivot higher. It’s also oversold on RSI, MACD, Williams’ %R, and on Full Stochastics.

Helping, analysts at Morgan Stanley just reiterated their overweight rating on the stock.

The firm said, “AMZN is a top pick as AWS/Retail, both under-appreciated GenAI winners. AWS seems set to further accelerate as capex yield framework shows how it could grow 30%+ in ’26/’27. We also discuss why AMZN is an agentic winner with leverage and why partnerships would be positive/ manageable,” as quoted by CNBC.

Live

Shares of NVDA are up more than $3 a share this morning.

All on news it and Meta unveiled a multi-year AI infrastructure partnership. The deal features Meta’s first large-scale rollout of Nvidia’s Grace CPUs, future Vera CPU adoption, expanded Spectrum-X networking, GB300 systems for data centers, and Nvidia confidential computing enhancing AI privacy features in WhatsApp, as noted by Seeking Alpha.

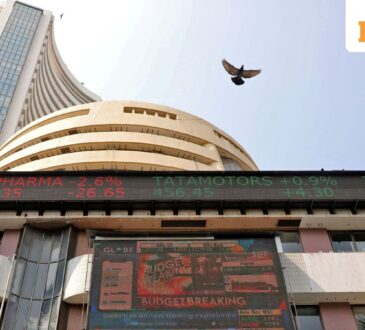

Markets are green this morning.

In fact, as we wait for the latest minutes from the Federal Reserve, the S&P 500 is up about 0.16%, or. By 10 points. The SPDR S&P 500 ETF (SPY) is up fractionally. The Dow is up 0.2%, or by 101 points. The Nasdaq is up 0.26%, or by 59 points. Gold is up by $88.50 to $4,970. Bitcoin is down about $210 at $67,263.14.

All Eyes on the Federal Reserve

Minutes from the Fed will provide more detail on why the central bank kept interest rates on hold, as well as what it might take for them to cut interest rates even more. The minutes, which will be released at around 2 pm EST, could also pose economic risks that could leave the central bank at odds over what to do moving forward.

“We still have some tension between employment and inflation, but it’s less than it was. I think that the upside risks to inflation and the downside risks to employment have probably both diminished a bit,” he said at the January meeting.

The other major catalyst will be the personal consumption expenditure price index reading that’s out on Friday. Also known as the Fed’s preferred inflation gauge, it will give us insight into the state of the economy.

$10,000 Gold?

Gold last traded at $4.954 and could test $7,000, even $10,000, according to analysts.

That’s on speculation the Fed could cut rates even more, mounting geopolitical tensions, and a wave of central bank buying. According to SAMCO Securities, gold could test $7,000, driven by further geopolitical uncertainties, sky-high deficits, central bank demand, and the real interest rate environment, as noted by Business Standard.

Others, according to SBG Securities, are calling for $10,000 gold based on monetary policy, geopolitical issues, and a weaker U.S. dollar, as noted by Investing.com. They added that a key driver of gold prices depends on the outlook for interest rate cuts. Markets are currently pricing in two cuts this year, but the firm seems to see room for more, noting that “three cuts could push gold to $7,000 by year’s end (SBG’s base case) and a more dovish Fed may send gold to $10,000.”

Ed Yardeni of Yardeni Research also says $10,000 is a possibility, arguing the metal is being driven by a broad “geopolitical risk-on trade,” as mentioned by Investing.com. “We are still targeting $6,000 by the end of this year and $10,000 by the end of 2029,” he added.

Oil is Gaining Momentum on Potential Conflict with Iran

Last checked, oil was up 2.7%, or by $1.71 to $64.04.

All after Vice President JD Vance said Iran did not address U.S. red lines in nuclear talks. He also said President Trump reserves the right to use military force, which could potentially jeopardize the Strait of Hormuz – a major shipping point for oil.

As noted by CNBC, “Iran’s Revolutionary Guard conducted war games in the Strait of Hormuz, a vital trade chokepoint for global oil flows. About one-third of all waterborne crude exports pass through the narrow waterway, according to data from energy consulting firm Kpler. The oil market is worried those oil flows would be disrupted if the U.S. and Iran go to war.”

If Iran fails to address the key issue, President Trump has already deployed a second aircraft carrier. “If we don’t have a deal, we’ll need it,” added Trump.

If You’ve Been Thinking About Retirement, Pay Attention (sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance, and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor. Here’s how:

- Answer a few simple questions

- Get Matched with Vetted Advisors

- Choose Your Fit

Why wait? Start building the retirement you’ve always dreamed of. Get started today! (sponsor)

© 2024 Getty Images / Getty Images News via Getty Images