Investing

-

Echoing yesterday’s modest increase in the consumer price index, today’s report shows the producer price index also rising just 0.1% in May.

-

The IPO market seems to be perking up with a successful space stock IPO yesterday, and a fintech IPO — Chime — on deck today.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Live Updates

Live Coverage Has Ended

The Vanguard S&P 500 ETF closed at 555.00 Thursday, up 0.4%.

There wasn’t a lot of earnings news this morning, but last night, Oracle (NYSE: ORCL) beat earnings with $1.70 in adjusted profit per share, and better than expected sales of $15.9 billion as well.

CEO Safra Catz boasted that “FY25 was a very good year-but we believe FY26 will be even better as our revenue growth rates will be dramatically higher.” Oracle stock is up more than 14% this afternoon.

S&P 500 component stock Boeing (NYSE: BA) fell as much as 6% in early trading this morning after news reports out of Ahmedabad showed an Air India Boeing 787 crashing after takeoff. Details are still firming, but initial reports suggest an engine failure caused the crash, and claimed the lives of all 242 passengers and crew aboard.

S&P 500 component company GE Aerospace (NYSE: GE), which makes the 787’s engines, are down 2%.

Bank of America downgraded S&P 500 component company Conagra Brands (NYSE: CAG) to Underperform with a price target of $20 this morning. The consumer packaged foods company’s cost to produce proteins including chicken, beef, and pork is expected to increase and pose a “meaningful headwind” to earnings growth. BofA says as a result, Conagra stock deserves a lower multiple to earnings.

This article will be updated throughout the day, so check back often for more daily updates.

Investors received further encouragement that tariffs aren’t driving crazy rates of inflation this morning. The producer price index — like the consumer price index yesterday — rose a tame 0.1% in May. Economists had worried the rise would be 0.2%, so this is good news. On the other hand, continuing jobless claims last week came in at a disconcerting 1.96 million, indicating the jobs market isn’t looking great. This was the highest number of claims for continuing unemployment benefits seen since November 2021.

Investors seem nervous, and the Vanguard S&P 500 ETF (NYSEMKT: VOO) is down 0.3% in premarket trading.

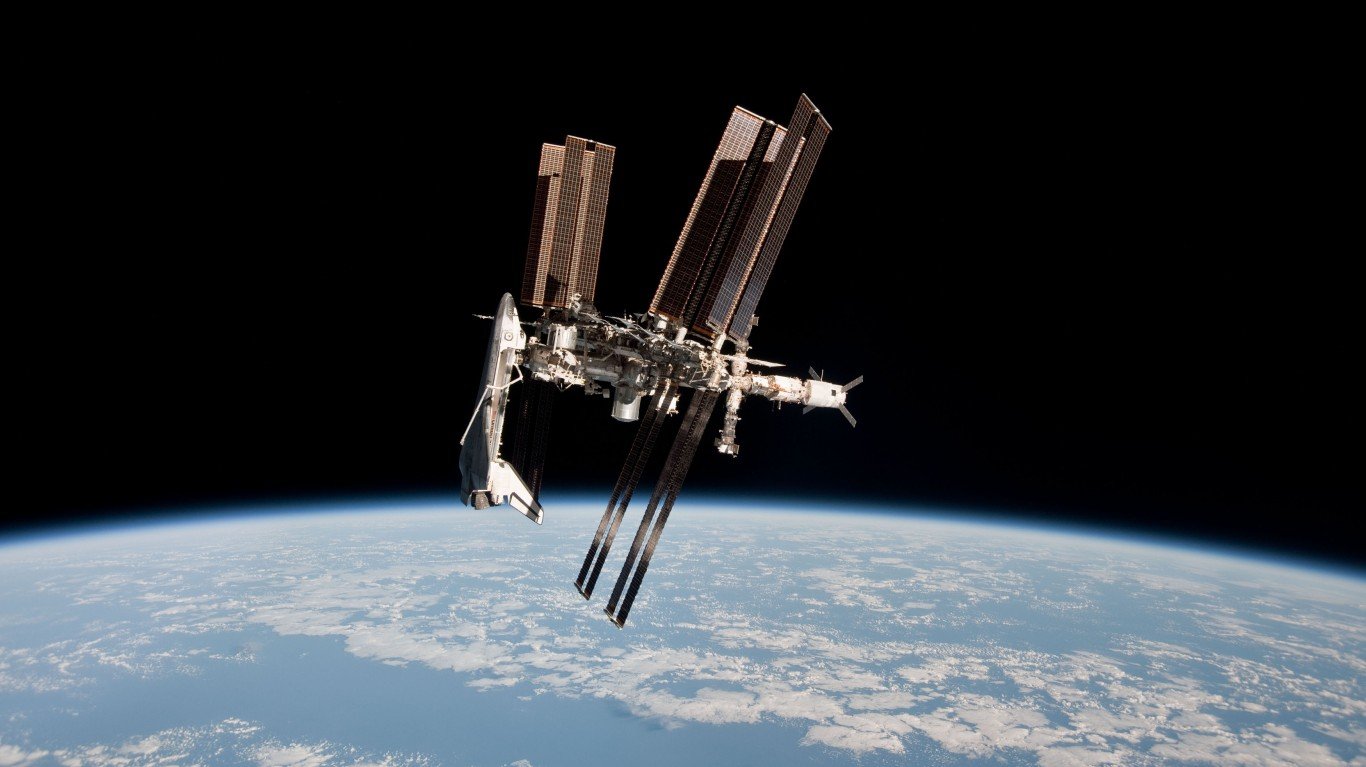

In happier news, yesterday’s IPO of space station construction company Voyager Technologies (NYSE: VOYG) — there’s a business you don’t see every day! — was a smashing success. Shares that were expected to price between $26 and $29 a share ended up IPO’ing at $31 — then surged as high as $73.95 in their first day of trading.

Voyager ended up closing at $56.48 yesterday, and are up about 5% in premarket trading this morning.

IPO update

IPOs remain in the news Thursday, with new fintech stock Chime pricing its IPO at $27 yesterday, again, higher than investors expected. The online banking services provider is being valued at $11.6 billion. Chime begins trading later today on the Nasdaq under ticker symbol CHYM.

Earnings

Two furniture companies reported earnings this morning. Hooker Furniture (Nasdaq: HOFT) missed earnings badly with a $0.29 per share loss reported on sales of $85.3 million. The Lovesac Company (Nasdaq: LOVE) beat earnings, but still reported a loss — $0.73 per share — and its sales of $138.4 million were worse than expected.

You worked hard to build a six-figure portfolio. But, you’re aware that building a comfortable retirement not just about saving—it’s about strategy. For example, if you’re not taking taxes into account, you’re missing out on a key input to optimize your wealth. Answer a few simple questions to find a financial advisor who can help you take steps to wield your assets in ways to compound over time. Click here to get started now. (Sponsor)

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.