An initial rebound in Wall Street’s benchmark S&P 500 (SP500) and tech-heavy Nasdaq Composite (COMP:IND) averages on Thursday lost steam, as investors continued to rotate out of technology stocks.

Eyes are also on Netflix (NFLX), with the U.S. streaming giant scheduled to report Q2 results after the closing bell.

A global sell-off in semiconductors on Wednesday sent the Nasdaq (COMP:IND) slumping to its worst intraday session since September 2022. The index bounced back at the start of regular trading, but then quickly gave up those gains. It was last down 0.56% to 17,896.57 points in afternoon trade. The S&P (SP500) followed a similar pattern, last lower by 0.47% to 5,561.80 points.

The blue-chip Dow (DJI) also fluctuated, reversing course to slip 0.68% to 40,918.21 points.

Solid quarterly numbers and outlook from Taiwan Semiconductor Manufacturing (TSM) – the world’s largest contract chipmaker – came as a bit of a relief earlier in the day following Wednesday’s rout in semis, but the theme of rotation out of technology seen since last week eventually outweighed the positive sentiment ignited by the report. All members of the “Magnificent 7” club retreated, except Tesla (TSLA).

Of the 11 S&P sectors, eight were in the red, with Health Care, Financials and Technology topping the losers.

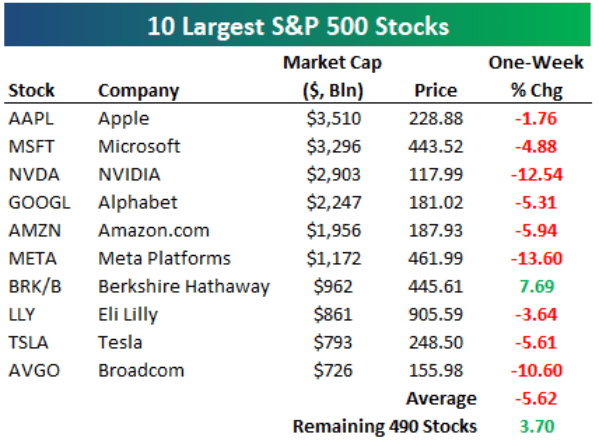

“Coming into today, the 10 largest stocks in the S&P 500 were down an average of 5.6% over the last week compared to an average gain of 3.7% for the remaining 490 stocks in the index,” Bespoke Investment Group noted on X (formerly Twitter). See below for the chart it shared:

Monetary policy and economic data grabbed attention as well on Thursday. Across the Atlantic, the European Central Bank (ECB) kept its key policy rates steady, after implementing a cut in June. The ECB noted that “domestic price pressures” were still high and that headline inflation was likely to remain above its target well into next year.

“The Governing Council is not pre-committing to a particular rate path,” the ECB added. The euro (EUR:USD) fell 0.3% to $1.09.

At home, traders continue to confidently price in a 25 basis point rate cut by the Federal Reserve at its September meeting. Further signs of weakening in the labor market supported that scenario, after the number of Americans filing for initial jobless claims in the past week came in unexpectedly higher than anticipated.

“With the qualification that the weekly numbers tend to be inherently noisy: The just-announced U.S. weekly jobless claims were notably higher than expected: 243,000 versus the consensus forecast of 229,000. The question, and it is important, is whether this is noise or an indication of a weakening of the labor market in a manner that results in growth losing momentum much quicker than most currently expect,” Mohamed El-Erian, chief economic advisor at Allianz, said on X.

Looking at the fixed-income markets, U.S. Treasury yields were slightly higher on Thursday. The longer-end 30-year yield (US30Y) was up 3 basis points to 4.40%, while the 10-year yield (US10Y) was up 2 basis points each to 4.18%. The shorter-end, more rate-sensitive 2-year yield (US2Y) was up 1 basis point to 4.46%.

See live data on how Treasury yields are doing across the curve on the Seeking Alpha bond page.

Turning to active stocks, there were some earnings-related moves. D.R. Horton (DHI) was the top percentage gainer on the S&P 500 (SP500), after the home builder announced a $4B stock buyback and pointed to “favorable” housing demand trends despite elevated inflation and mortgage rates.

Conversely, Domino’s Pizza (DPZ) slumped and was the top S&P percentage loser. The world’s largest pizza company said it was temporarily suspending its target of opening more than 1,100 global net stores.