Stock market today: Global shares mostly decline as investors await earnings, US elections

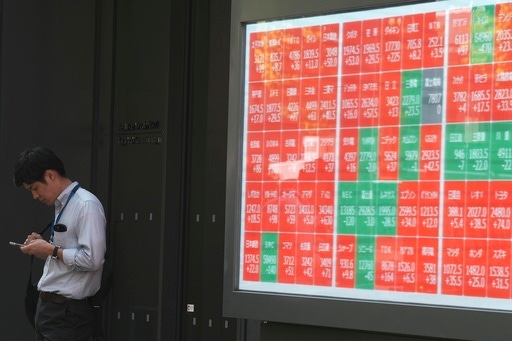

TOKYO (AP) — Global shares mostly declined Thursday as investors grappled with uncertainty ahead of the U.S. election next Tuesday.

France’s CAC 40 slipped 0.7% to 7,378.45 in early trading. Germany’s DAX fell 1.1% to 19,257.34. Britain’s FTSE 100 declined 0.6% to 8,114.02. U.S. shares were set to drift lower with Dow futures down 0.5% at 42,149.00, while S&P 500 futures slipped nearly 0.8% to 5,807.50.

Japan’s benchmark Nikkei 225 dipped 0.5% to finish at 39,081.25. Australia’s S&P/ASX 200 slipped 0.3% to 8,160.00. Hong Kong’s Hang Seng lost 0.1% to 20,359.95, while the Shanghai Composite added 0.4% to 3,279.82.

South Korea’s Kospi dropped 1.5% to 2,556.15 after North Korea test launched a new intercontinental ballistic missile designed to be able to hit the U.S. mainland in a move that was likely meant to grab America’s attention ahead of Election Day.

Markets also were watching the Bank of Japan, which kept its benchmark rate unchanged at 0.25%. Japan is also facing political uncertainty after its governing party, tainted by campaign financing scandals, lost its majority in the lower house of parliament in elections last weekend.

Upcoming earnings releases in Asia, as well as the rest of the world, also added to the wait-and-see mood.

A U.S. report Wednesday suggested employers outside the government accelerated their hiring in October, when economists were forecasting a slowdown. It could raise optimism for Friday’s more comprehensive jobs report coming from the U.S. government.

A slowing economy is no surprise after the Federal Reserve hiked interest rates sharply in hopes of braking the economy enough to get inflation under control. The question is whether the Fed can help keep the economy out of a recession, now that it’s begun cutting interest rates to keep the job market humming.

Traders are largely expecting the Fed to cut its federal funds rate by a quarter of a percentage point at its next meeting next week, according to data from CME Group.

In energy trading, benchmark U.S. crude rose 18 cents to $68.79 a barrel. Brent crude, the international standard, added 15 cents to $72.70 a barrel.

In currency trading, the U.S. dollar slipped to 152.14 Japanese yen from 153.31 yen. The euro cost $1.0855, down from $1.0858.

___

AP Business Writer Stan Choe contributed.

___

Yuri Kageyama is on X: https://x.com/yurikageyama

Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.