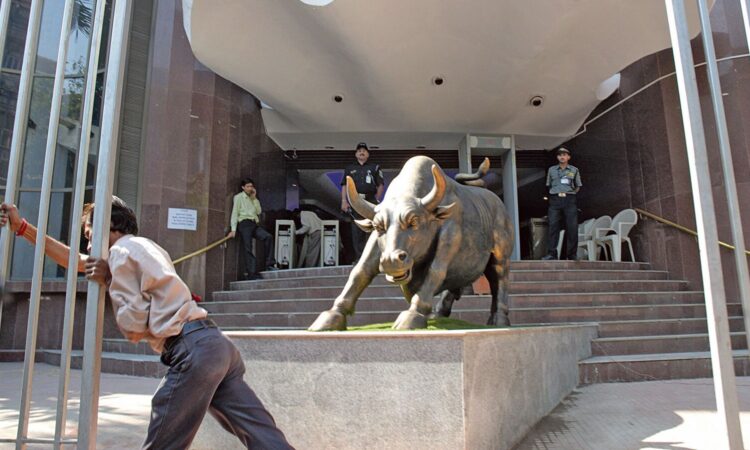

Stock market today: Nifty 50, Sensex end higher for 4th consecutive session; smallcaps falter

Stock market today: Extending gains into the fourth consecutive session, frontline indices the Sensex and the Nifty 50 ended at their fresh closing highs on Monday, March 4.

Despite touching new closing highs, market benchmarks saw modest gains due to mixed global cues and the absence of significant triggers.

The market lacks fresh triggers at this juncture which is keeping it in a range. Experts point out that most positives, including robust economic growth and political stability after the General Elections 2024, are already discounted.

According to Taher Badshah, Chief Investment Officer at Invesco Mutual Fund, it is going to be a period of low triggers in the market—not much in terms of actionable events to look forward to, except for policy rates at a global level, the monsoon development, and the election results from a domestic standpoint.

Investors now focus on central bank events and macro data this week that will influence the mood of the market.

“Federal Reserve Chair Jerome Powell testifies before lawmakers on Wednesday and Thursday, though analysts assume he will stay in wait-and-see mode on policy given recent upside surprises on inflation that have helped temper market rate cut bets,” reported Reuters.

Nifty 50 today opened at 22,403.50 against the previous close of 22,378.40 and touched its fresh all-time high of 22,440.90 during the session. The index finally closed at 22,405.60, up 27 points, or 0.12 per cent with 25 stocks in the green and an equal number in the red.

The Sensex opened at 73,903.09 against the previous close of 73,806.15 and settled at 73,872.29, up 66 points, or 0.09 per cent. Sensex remained 122 points away from its all-time high of 73,994.7 which it hit in the previous session on March 2.

BSE Midcap also ended with a mild gain of 0.16 per cent but smallcaps suffered losses on Monday. The BSE Smallcap index closed with a significant loss of 0.78 per cent.

Top Nifty 50 gainers today

Shares of NTPC (up 3.69 per cent), HDFC Life Insurance Company (up 2.82 per cent) and Power Grid Corporation (up 2.70 per cent) closed as the top gainers in the Nifty 50 index.

Top Nifty 50 losers today

Shares of Eicher Motors (down 2.68 per cent), JSW Steel (down 2.24 per cent) and SBI Life Insurance Company (down 2.06 per cent) closed as the top losers in the Nifty 50 pack.

Sectoral indices today

With a gain of 1.87 per cent, the Nifty Oil & Gas index closed as the top gainer among the sectoral indices. Nifty Bank rose 0.34 per cent. Nifty Private Bank (up 0.40 per cent), Financial Services (up 0.38 per cent) and PSU Bank (up 0.26 per cent) indices also clocked gains.

On the flip side, Nifty Media fell 1.85 per cent, followed by Nifty IT (down 0.77 per cent), Auto (down 0.49 per cent) and FMCG (down 0.45 per cent).

Expert’s views on markets

“The market traded in a rangebound manner due to weak global cues, while investors turned stock-specific due to the prevailing caution on broader indices. Further, the tepid consumption data influenced investors to refrain from FMCG and discretionary stocks,” said Vinod Nair, Head of Research at Geojit Financial Services.

“The global sentiment is likely to be cautious ahead of Fed chair testimony and ECB (European Central Bank) policy later this week. Since inflation is above the target range, the Fed is expected to keep its hawkish stance on interest rates and will be watchful of unemployment and nonfarm payroll data for more cues,” said Nair.

Technical views on Nifty 50

Jatin Gedia, a technical research analyst at Sharekhan by BNP Paribas observed that on the daily charts, the Nifty has been inching higher, holding on to the gains. This consolidation should be considered as a healthy sign and in case the Nifty dips in the process of retesting the breakout (22,300 – 22,250) it should be considered as a buying opportunity.

“The key hourly moving averages placed in the range 22,290- 22,230 should act as a crucial support zone and potential entry zone in case of a dip. The initial target on the upside is placed at 22,570 – 22,600 where the hourly upper Bollinger band is placed,” said Gedia.

Read all market-related news here

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decisions.

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech: Click to download!