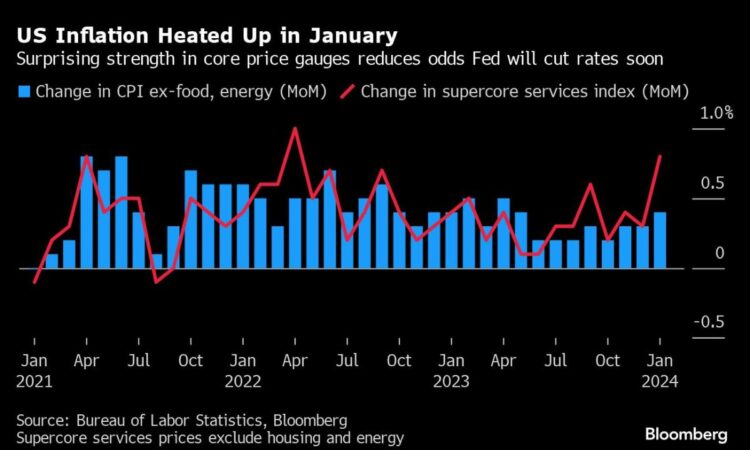

(Bloomberg) — US equity futures signaled a rebound from Tuesday’s Wall Street slump triggered by hotter-than-expected US inflation data that fueled bets the Federal Reserve may not cut interest rates as soon as expected.

Most Read from Bloomberg

Contracts on the S&P 500 climbed 0.5% after the worst inflation-day drop for the index since September 2022. Benchmark Treasury yields retraced some of the previous day’s surge, but held near the 4.3% mark, as traders trimmed bets for an early Fed rate cut.

Coming soon: Sign up for Hong Kong Edition to get an insider’s guide to the money and people shaking up the Asian finance hub.

The American CPI data came as a disappointment for investors pushing US stocks to a record, and European peers to just short of one, on mounting hopes for imminent rate cuts. Fed swaps shifted full pricing of a rate cut to July from June after the data and global bonds erased the last remnants of a rally that started in December.

The setback did little to deter investors riding bets on an eventual Fed pivot to easier policy. BlackRock Inc. portfolio manager Russ Koesterich sees the setback as temporary, with potential for further upside to US stocks of 6-8% this year and possibly four rate cuts still in the offing.

“Despite yesterday’s action in the stock market it’s probably going to to be a decent year for US equities,” Koesterich said in an interview with Bloomberg TV. “There’s reason to stay long equities. I don’t think the narrative changes. We still think that the Fed will begin cutting late this spring or in the summer. We still think three, maybe four, cuts are likely.”

There was better news Wednesday for UK traders looking forward to policy easing by the Bank of England. Inflation in Britain came in lower than forecast in January, with underlying price pressures not rising as much as markets and the BOE feared. The pound reversed earlier gains after the data, while UK bonds rallied. The inflation data triggered a repricing in BOE rate bets, with traders resuming wagers on three quarter-point reductions this year.

Oil steadied after a mixed US inventory report, while OPEC and the IEA offered contrasting outlooks for the global crude market. Gold was locked in a narrow range after plunging below $2,000 an ounce for the first time in two months while Bitcoin traded near the $50,000 mark.

Listen to the Big Take podcast on iHeart , Apple Podcasts , Spotify and the Bloomberg Terminal. Read the transcript here.

Corporate Highlights

-

Lyft Inc. gained in premarket trading on Wednesday, even after the ride-sharing company corrected its outlook for earnings margin in 2024, a typo that initially helped send the stock up as much as 67% in after-market trading on Tuesday.

-

ASML Holding NV said the semiconductor market has reached its nadir and there are now are signs of a rebound.

-

Vizio slid in US premarket trading, ceding some of the previous day’s 25% surge triggered by a Wall Street Journal report that Walmart is in talks to buy the TV maker for more than $2 billion.

-

Heineken NV shares slumped after the world’s second-biggest brewer warned that persistent inflation and economic worries will weigh on beer demand in 2024.

-

ABN Amro Bank NV rallied after it unveiled a fresh share buyback with the Dutch state participating, as part of its planned sell down in the lender.

-

Robinhood shares jumped in premarket trading after the online brokerage firm reported fourth-quarter net revenue that beat estimates.

-

Airbnb Inc. shares declined after the home-rental company reported its fourth-quarter results.

Key Events this Week:

-

BOE Governor Andrew Bailey testifies to House of Lords economic affairs panel, Wednesday

-

Chicago Fed President Austan Goolsbee speaks, Wednesday

-

Fed Vice Chair for Supervision Michael Barr speaks, Wednesday

-

Japan GDP, industrial production, Thursday

-

US Empire manufacturing, initial jobless claims, industrial production, retail sales, business inventories, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

Fed Governor Christopher Waller speaks, Thursday

-

ECB chief economist Philip Lane speaks, Thursday

-

US housing starts, PPI, University of Michigan consumer sentiment, Friday

-

San Francisco Fed President Mary Daly speaks, Friday

-

Fed Vice Chair for Supervision Michael Barr speaks, Friday

-

ECB executive board member Isabel Schnabel speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.5% as of 8 a.m. New York time

-

Nasdaq 100 futures rose 0.6%

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The Stoxx Europe 600 rose 0.5%

-

The MSCI World index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0708

-

The British pound fell 0.3% to $1.2558

-

The Japanese yen rose 0.1% to 150.60 per dollar

Cryptocurrencies

-

Bitcoin rose 4% to $51,563.08

-

Ether rose 4% to $2,739.28

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.30%

-

Germany’s 10-year yield declined two basis points to 2.37%

-

Britain’s 10-year yield declined seven basis points to 4.08%

Commodities

-

West Texas Intermediate crude rose 0.1% to $77.98 a barrel

-

Spot gold fell 0.1% to $1,990.29 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu and Garfield Reynolds.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.