(Bloomberg) — Japanese equities powered higher, leading a global rebound as they retraced some of the losses sustained in Monday’s rout that erased billions across markets from New York to London. Treasuries fell.

Most Read from Bloomberg

Japan’s two key share gauges both jumped more than 9% at the close, after tumbling more than 12% the day before, while a regional gauge halted a three-day decline. European and US equity futures also advanced. The initial positive signs suggest traders are catching their breath following a dramatic day in which almost every risk asset were sold.

“The market reaction was a bit extreme yesterday and hence we see this sharp rebound today,” said Rupal Agarwal, Asia quantitative strategist at Sanford C. Bernstein. “I would expect markets to remain volatile and hence would stick to looking for late cycle defensive exposure through quality/dividend yielding names.”

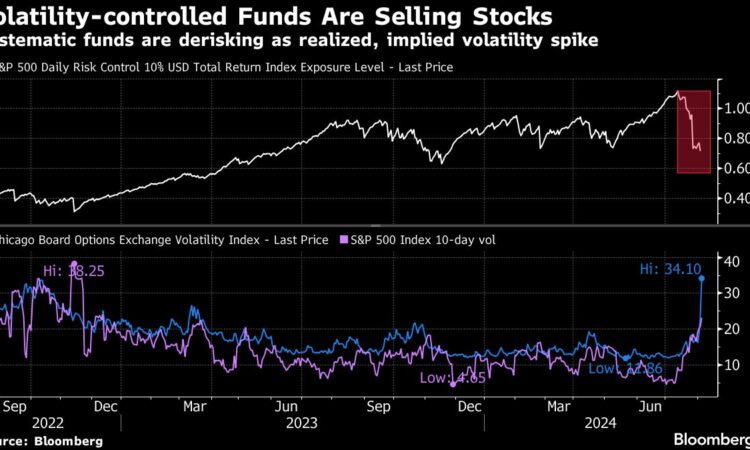

Speculation about a looming US recession, an unwinding of artificial intelligence euphoria, and a surging yen causing an unwind of carry trades had led to a three-day selling spree across global equities. While markets have rebounded, Wall Street’s “fear gauge” — the VIX — remains elevated, suggesting that risk assets will face hurdles with continued uncertainty over the economic outlook. The VIX at one point Monday posted a record increase in data going back to 1990.

Treasury yields rose across the curve in Asia, with the benchmark 10-year yield climbing five basis points to 3.84%. The yield had fallen as low as 3.67% Monday before being pushed back up by a stronger-than-expected US ISM services report.

“The hotter-than-expected ISM services report slowed the bleeding on Wall Street,” said Matt Simpson, a senior market strategist at City Index Inc. “So we’re not seeing a risk on rally as such, but a healthy correction after an unhealthy selloff, triggered by investors stampeding for a tiny exit.”

The S&P 500 Index sank 3% Monday, its biggest one-day drop since September 2022 while the Cboe Volatility Index, or VIX, jumped to 38.57, 1.1 times the level of the VXN, a similar measure for the Nasdaq 100. Futures on the S&P 500 Index and the Nasdaq 100 rose in Asian trading hours.

Fed rate cut

Federal Reserve Bank of San Francisco President Mary Daly said the labor market is softening and indicated the US central bank should begin cutting interest rates in coming quarters, but stopped short of concluding the labor market has begun seriously weakening.

The swaps market is pricing in a near 50-basis-point Fed rate cut in September, while data compiled by Bloomberg show expectations for lower policy rates in the coming months have intensified in Korea, Thailand and Malaysia.

Back in Asia, the yen fell as much as 1.5% Tuesday, before paring some of its losses. The currency has still gained about 11% this quarter on expectations of further rates hikes by the Bank of Japan. The Nikkei 225 futures circuit breaker was triggered before the market opened as Monday’s savage selloff was deemed overdone. A surge in Kospi 200 and Kosdaq 150 futures activated another “sidecar” in South Korea on Tuesday morning, briefly halting buy orders for program trading.

Japan’s market rout may have been worsened by forced margin selling. Retail investors’ margin buying position rose to a 18-year high in late July, even as the Nikkei 225 slipped from its historic peak. Investors who have bought stocks using credit are often forced to close their positions when stock prices fall more than expected, unless they have enough extra cash for collateral.

The selloff pushed Japan’s key share indexes into a bear market Monday. Officials from Japan’s Ministry of Finance, the Bank of Japan and the Financial Services Agency will hold a three-way meeting later in the day to discuss international markets, according to a notice from the BOJ.

Japan’s auction of 10-year sovereign notes on Tuesday met the weakest investor demand since 2003 by one measure, as expectations of more rate hikes deterred investors. Traders sold the benchmark bond in the secondary market, unwinding a haven trade during the selloff earlier.

Chip giant Taiwan Semiconductor Manufacturing Co. rebounded after being touted as a “top pick” by Morgan Stanley following a record plunge in its shares on Monday. The global equities meltdown saw Taiwan’s main stock gauge mark its worst selloff in 57 years.

In other news, Australia’s central bank Tuesday held its cash rate at 4.35% for a sixth straight meeting. The Australian dollar was little changed after the decision, while the yield on policy sensitive three-year bonds was steady.

Oil rose from a seven-month low as the halting of production from Libya’s biggest field refocused attention on the Middle East. Bitcoin inched back to briefly top $56,000 after a bout of risk aversion in global markets inflicted steep losses on most major cryptocurrencies.

Key events this week:

-

Australia rate decision, Tuesday

-

Eurozone retail sales, Tuesday

-

China trade, forex reserves, Wednesday

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 1.5% as of 2:42 p.m. Tokyo time

-

Japan’s Topix rose 8.7%

-

Australia’s S&P/ASX 200 rose 0.7%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite fell 0.3%

-

Euro Stoxx 50 futures rose 1.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.0949

-

The Japanese yen fell 1.2% to 145.86 per dollar

-

The offshore yuan was little changed at 7.1449 per dollar

Cryptocurrencies

-

Bitcoin rose 2.5% to $55,740.65

-

Ether rose 3.1% to $2,512.9

Bonds

-

The yield on 10-year Treasuries advanced five basis points to 3.84%

-

Japan’s 10-year yield advanced 14 basis points to 0.890%

-

Australia’s 10-year yield declined six basis points to 4.00%

Commodities

-

West Texas Intermediate crude rose 1.5% to $74.04 a barrel

-

Spot gold fell 0.2% to $2,406.74 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rita Nazareth, Winnie Hsu, Jason Scott, Sangmi Cha and Matthew Burgess.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.