The Stock Market Is Rebounding, but Is It Really Safe to Invest Right Now? Here’s What History Says.

The stock market has given many investors quite the scare over the past few weeks, as the S&P 500 (SNPINDEX: ^GSPC) plummeted by more than 8% between mid-July and early August. The Nasdaq (NASDAQINDEX: ^IXIC) fared even worse, dropping by roughly 12% in that time and officially entering a correction.

That dip seems to have been short-lived, however, as major market indexes have rebounded as quickly as they fell. As of this writing, the S&P 500 is up by nearly 8% just in the last two weeks, while the Nasdaq has soared by roughly 10% in that time.

While many investors may be feeling relief that this downturn didn’t turn into something worse, others are nervous that this is only a temporary rally before prices fall again. That’s a fair concern, especially considering how unpredictable the market has been lately.

Sometimes, it can be helpful to see how the market has performed during previous periods of uncertainty. While past performance doesn’t guarantee future returns, here’s what history says about times like these.

To get an idea of what the market is capable of, let’s look at two scenarios — one in which stock prices continue to rebound, and another where prices fall substantially from their peak.

Scenario one: Stock prices continue surging

One of the most recent and prominent market rebounds happened in 2020, in the early stages of the COVID-19 pandemic. The S&P 500 plummeted by nearly 34% in less than a month, prompting many investors to fear that we were headed toward a deep and long-lasting recession. However, the market almost immediately recovered before going on to enter a new bull market.

If you’d stopped investing when stock prices began to fall, you’d likely have missed out on the earliest stages of the market’s recovery. Even if you’d invested at seemingly the worst time (in February 2020, just before the market crashed), the S&P 500 has still earned total returns of nearly 66% since then.

On the other hand, say that you sold your investments as soon as prices began falling, and you didn’t invest again until January 2021 when the market was surging. That may have seemed like a safer option, but the S&P 500 has only earned total returns of around 49% since then.

Timing the market effectively is next to impossible, so it’s best to simply stay invested no matter what happens. If prices surge from here, you’ll be along for the full ride.

Scenario two: Stock prices fall again

While the market could continue its upward momentum, it could also fall yet again — potentially even crashing into bear market territory. Nobody knows for certain what will happen. However, a more significant downturn is always possible.

That said, if a bear market is on the horizon, it shouldn’t affect your long-term investing strategy. Even if you invest just before a major downturn begins, by holding your investments long enough, you’re all but guaranteed to see positive returns eventually.

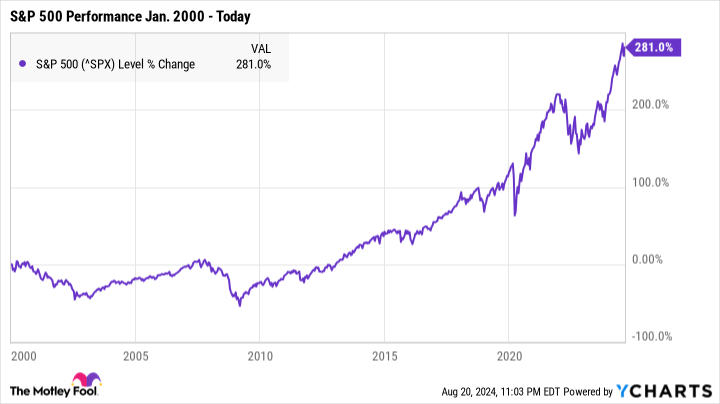

For example, say you had invested in an S&P 500 index fund in January 2000 — just before the dot-com bubble burst, resulting in one of the longest bear markets in history. The index didn’t reach a new high until 2007, only a few months before the market sank again during the Great Recession.

However, if you’d stuck it out and held your investments until today, you’d have earned total returns of 281% — nearly quadrupling your money. Those first several years would have been rough, but patience pays off when it comes to the market.

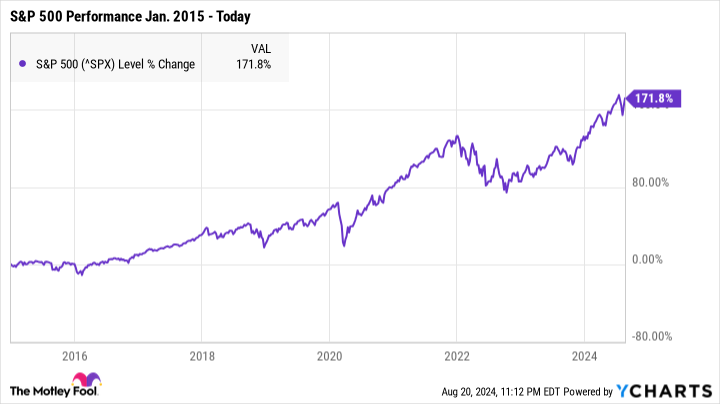

Also, like the previous example, waiting to invest until the market was thriving may have seemed like a safer option. But if you had held off on buying until, say, January 2015 (after the S&P 500 had reached a new all-time high and was officially in a new bull market), you’d only have earned returns of around 172% by today.

The market will always be unpredictable in the short term, and trying to buy or sell at just the right moment can be costly. While it’s often easier said than done, simply staying invested (regardless of how the market performs) can protect your portfolio and maximize your long-term earnings.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $19,837!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,475!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $371,550!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 22, 2024

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Stock Market Is Rebounding, but Is It Really Safe to Invest Right Now? Here’s What History Says. was originally published by The Motley Fool