Stocks are hitting one new high after another.

The Morningstar US Market Index is up more than 21% so far this year, having rebounded from an August swoon. The index is up about 65% since bottoming out in September 2022.

“We’ve been surprised to the upside by how resilient equity markets have been, even in the face of a lot of volatility over the last few weeks,” says Kristy Akullian, head of iShares investment strategy, Americas, at BlackRock. She points to uncertainty surrounding fiscal stimulus in China, rising geopolitical tensions, and a neck-and-neck presidential election in the United States. That’s not to mention stretched valuations, recent weakness in the technology sector, and fears of a consumer spending slowdown. “In theory, all those things would be flashing warning signals,” Akullian says. But the market has taken it all in stride.

What’s behind the powerful rally, and what could derail it? Strategists say a surprisingly strong economy has given investors confidence and helped send stocks higher, but they also warn that trouble during earnings season could disrupt the bull run.

Why Stocks Are Soaring

“The most important thing about why every market has stayed so strong, even in the face of so many uncertainties, is that economic data has surprised to the upside,” Akullian explains. “The conversation about a recession, at least in the near term, is really off the table.”

Inflation has fallen dramatically over the past year, and recent labor market data has been healthy, easing investor worries about a significant slowdown in hiring. Consumers are still spending, wages are growing, and corporate profits have remained resilient. That’s a big change from earlier this year, when jobs and inflation data appeared to point to the possibility of a recession. Add Federal Reserve interest rate cuts to the mix, and you have a recipe for the powerful gains seen over the past two months.

“As far as the market can see, we’re going to have the Fed [as a] tailwind,” says Yung-Yu Ma, chief investment officer at BMO Wealth Management. “That provides a lot of encouragement and emboldening of positions.” On the other hand, interest rate cuts stemming from concerns about a recession would have a very different impact on investors.

With a soft landing coming into view, Ma says he expects upcoming interest rate cuts to boost the economy again as companies waiting for rates to fall accelerate spending.

The Rally Broadens

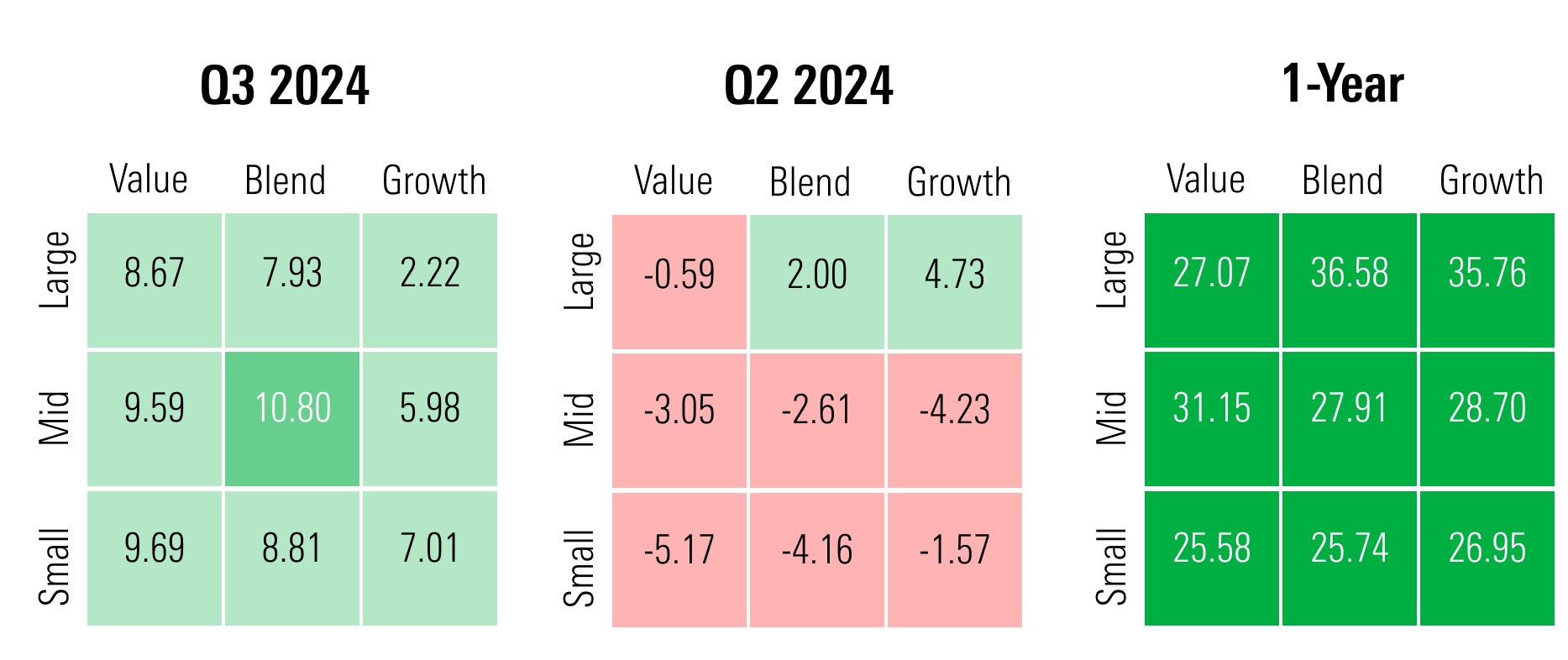

Growing confidence about the path of the economy and interest rates helped spark the recent rotation away from tech stocks into value and smaller capitalization stocks. After two years of eyewatering gains, large-cap growth stocks returned just 2.2% in the third quarter, while large-cap value stocks gained 8.8%.

Bryant VanCronkhite, senior portfolio manager at Allspring Global Investments, says this is a positive development, though it may be painful for some investors to see the artificial intelligence trade falter. “You want a better distribution of return across a wider group of companies,” he says. That’s an indication of a healthier market and a more durable rally.

Morningstar chief US strategist Dave Sekera also sees support for stocks continuing: “When evaluating market dynamics, we think the tailwinds from declining interest rates, moderating inflation, easing monetary policy, and the recent barrage of stimulus measures announced by the Chinese government will overwhelm the headwind from the slowing rate of economic growth.”

Keep an Eye on Earnings

Earnings season is now underway, kicking off with the big banks reporting their third-quarter results. Corporate profits have remained robust overall despite headwinds from inflation, high interest rates, and geopolitical uncertainty, but strategists warn that any major hiccups could spook markets.

“If we get a couple of weeks into earnings season and have some high-profile misses, I think that could derail things,” says James Ragan, director of wealth management research at DA Davidson. “That would be the biggest near-term risk,” he says, though his base-case expectation is for decent results overall.

Analysts broadly believe companies in the US Market Index grew their earnings by a collective 4.3% in the third quarter, according to FactSet estimates. That’s lower than the second quarter’s 10.3% growth and expectations of 11.7% growth for the fourth quarter. Some of that difference is because the third quarter of 2023 saw very strong results, so the third quarter of 2024′s growth looks smaller in comparison—a phenomenon analysts call a “base effect.” Falling oil prices are also expected to weigh on profits in the energy sector, which is dragging down estimates for the rest of the market.

Akullian says she’ll pay more attention to how companies expect to perform later this year and into 2025. “What I would be worried about is if we get a whole bunch of forward guidance that is gloomier than the market expects, particularly if that comes from the tech sector,” she says. If companies signal that the current expectations of earnings growth for the next quarter or two are “overly optimistic,” she says, “that could cause a pullback as markets start to recalibrate expectations for Q4 and beyond.”

When Will AI Spending Pay Off?

Investor enthusiasm surrounding AI has sent tech stocks soaring over the past two years. Companies are investing heavily in this technology, but investors worry about when exactly all that spending will begin paying off. “Eventually, these early winners have to justify the expenses” through new revenue streams or expanded margins, says VanCronkhite. “Without that, you have to question whether we’re ready for all these glorious things that are supposed to happen with AI.”

Akullian thinks that if investors hear earnings guidance that adds to these concerns, the market could falter, thanks to the heavy weighting of tech stocks within the major indexes and the fact that expectations surrounding AI are baked into valuations for many major companies beyond the tech giants. Still, many analysts remain bullish on AI. For example, following Advanced Micro Devices’ AMD “Advancing AI” event, Morningstar equity strategist Brian Colello wrote: “AMD’s line of sight into data center buildouts suggests that no AI chip bubble is imminent. Further, we’ve received many questions about what the size of the AI chip market might look like at maturity (whenever that might be), and although we’re confident the industry won’t grow 25% per year forever, it might not decelerate into a flattish market in the next five or 10 years either.”

Ma says that tech giants with deep pockets aren’t likely to back away from AI any time soon, and he adds that anecdotal evidence of the technology’s success is beginning to trickle in. “We think that’s going to continue for a while, irrespective of the [question] of ‘Are we seeing the payback?’” he says.

The Bottom Line for Investors

Nothing is ever certain when it comes to stocks. A soft landing is coming into view, but it’s also possible that the economy will weaken. “This is a nonstandard cycle relative to history,” says VanCronkhite. “Our ability to predict the future at a macro level is far murkier than it would have been in prior cycles.”

Strategists recommend a balanced approach to navigate the host of unknown factors, which includes the economy’s path, the outcome of the presidential election, and geopolitical developments. “What’s important going forward is being diversified,” says Akullian, who adds that she still sees plenty of opportunity in the stock market.

While the mega-cap tech trade may have worked in the past, investors should expect the composition of returns to look different in the months ahead. Ragan adds that tech’s recent strength means it could be a good opportunity for investors to rebalance into underperforming areas that may benefit as the rally continues to broaden. But he advises to “stick with high quality. Stick with companies with a little bit more visibility for continued earnings growth.”