The stock market has been scorching hot in 2023. The S&P 500 has gained nearly 25% on the year, while the tech-heavy Nasdaq has zoomed more than 40%. That means bargains are few and far between these days.

However, the market did mark down a few high-quality stocks this year. Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), Kinder Morgan (NYSE: KMI), and Stag Industrial (NYSE: STAG) have underperformed and now trade at bargain prices and higher dividend yields. Those attractive payouts will provide their investors with the gift of recurring income in 2024 and beyond.

Growth on sale

Shares of Brookfield Infrastructure are roughly flat this year. It has gotten significantly cheaper, considering its funds from operations (FFO) are on track to rise by more than 10% per share to around $3.00. With shares recently trading hands at about $36 apiece, Brookfield sells for roughly 12 times FFO. That’s a bargain compared to the broader market. The S&P 500 trades at over 21 times earnings while the Nasdaq fetches more than 28 times earnings.

Brookfield’s bargain price is a big reason why it offers a high-yielding dividend (currently 4.3% compared to the 1.5% dividend yield of the S&P 500). That already high-yielding payout should head even higher in 2024 and beyond. Brookfield aims to increase it by 5% to 9% per year. It has delivered 8% compound annual dividend growth since 2013.

The company has plenty of fuel to increase its dividend. Its organic drivers (inflation-linked rate increases, volume growth as the global economy expands, and expansion projects) should boost its FFO per share by 6% to 9% annually. With inflation still elevated and a record capital project backlog, Brookfield is in an excellent position to deliver high-end organic growth over the next few years. Meanwhile, the company has closed several acquisitions this year (a leading global container leasing company and three data center platforms), putting it in a strong position to deliver double-digit growth again in 2024.

A bottom-of-the-barrel valuation

Kinder Morgan’s stock price is down slightly this year, even though it’s having another solid year. The natural gas pipeline giant produces very stable cash flow, giving it the funds to pay a high-yielding dividend while investing in expanding its midstream operations.

Kinder Morgan’s dividend currently yields 6.4%, putting its yield in the top 5% of those in the S&P 500. The company has already revealed plans to raise its payment by another 1.8% next year, which will be its seventh consecutive year of dividend growth.

The company’s dirt cheap valuation is the main driver of its big-time dividend yield. Kinder Morgan currently expects to produce $5 billion, or $2.21 per share, of distributable cash flow next year (up 5% from 2023). With its stock recently trading at less than $18 per share, Kinder Morgan sells for around eight times its cash flow. That’s scraping the bottom of the valuation barrel.

Meanwhile, there’s upside to its 2024 growth plan. The company agreed to acquire STX Midstream in a $1.8 billion deal, which should close early next year. Even with that acquisition, the company has tremendous financial flexibility to make additional investments and opportunistically repurchase shares, which could further boost its cash flow per share.

Still relatively cheap despite the rally

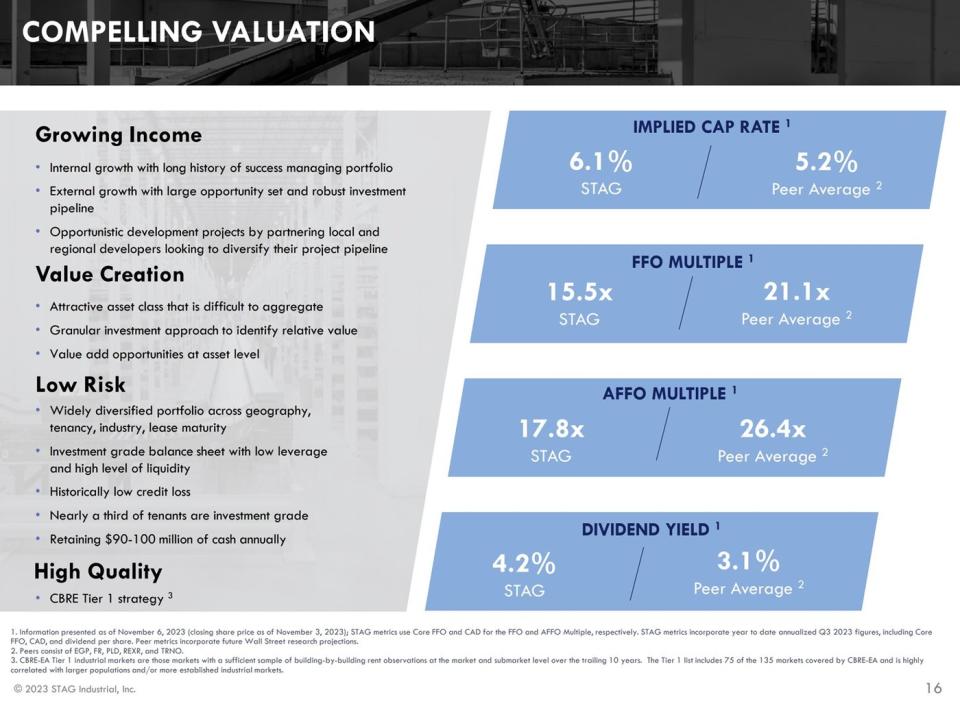

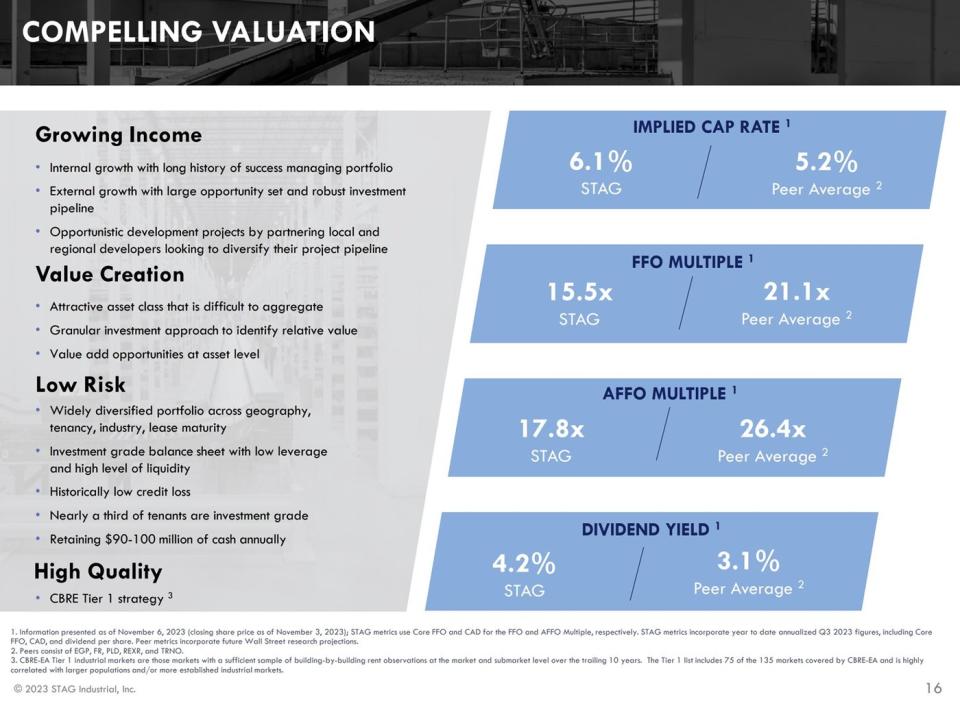

While Stag Industrial has rallied about 20% this year, it’s still a relative bargain. The industrial REIT trades at a much more compelling valuation compared to its peers:

As that slide shows, it’s a better value than its peers across every metric. That’s despite the company benefiting from the same catalysts that are driving growth across the industrial real estate sector. For example, the REIT recently unveiled that it signed two 63-month early renewal leases for warehouse and distribution space with a tenant. The rental rate on the renewal leases was a staggering 49.8% above the prior term’s expiring rental rate. Meanwhile, the rental rate will escalate by 3% annually for the lease term.

The company has a lot of long-term leases set to expire in the coming years, positioning it for outsized rental growth. On top of that, it has the financial flexibility to continue making accretive acquisitions. The company spent $204 million to acquire a dozen buildings in the third quarter at an average cap rate of 6.7%, which is even cheaper than its valuation. Those growth drivers will increase Stag Industrial’s income, enabling the REIT to continue growing its dividend (which it has done every year since it came public in 2011).

Give yourself the gift that keeps on giving this holiday season

Brookfield Infrastructure, Kinder Morgan, and Stag Industrial have underperformed the market this year. Because of that and their earnings growth, they trade at bargain prices and attractive dividend yields. That makes them great stocks to buy this holiday season. They could produce attractive total returns in 2024 as they grow their earnings and dividends.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Matthew DiLallo has positions in Brookfield Infrastructure, Brookfield Infrastructure Partners, Kinder Morgan, and Stag Industrial. The Motley Fool has positions in and recommends Kinder Morgan and Stag Industrial. The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

Holiday Sale: These 3 Dividend Stocks Are Bargain Buys This Holiday Season was originally published by The Motley Fool