Beauty and cosmetics retailer Ulta Beauty (NASDAQ: ULTA)‘s price action has been anything but pretty over the past six months. Slowing growth and slipping profit margins have caused the stock to falter; shares have fallen from nearly $600 to under $400 in just the past six months.

Although the stock had reasons for slipping, the stock market often gets overzealous. There’s a solid argument that Ulta Beauty’s selling has gone too far, and shares are poised to rebound strongly. Here is why Ulta Beauty is a beautiful buy for investors right now.

Why has the stock fallen so much?

Beauty and cosmetics are cultural staples, not just in America, but worldwide. Ulta Beauty is the largest cosmetics retailer in the United States, with 1,395 stores and an e-commerce store. It sells tens of thousands of products from hundreds of brands. Ulta has also become a full-fledged brand; the company engages with customers through social media and loyalty programs.

Ulta had just 449 stores in 2011. Steadily opening new stores has fueled relatively uninterrupted sales growth for years outside the pandemic, which hurt virtually any business with physical stores. Consistent, profitable growth has made Ulta Beauty a market-beater; the stock has outperformed the S&P 500 roughly 3-to-1 since the company’s IPO in 2007.

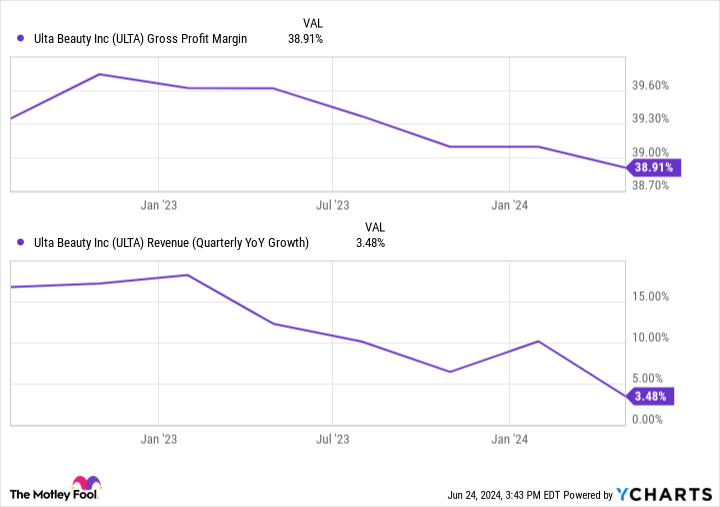

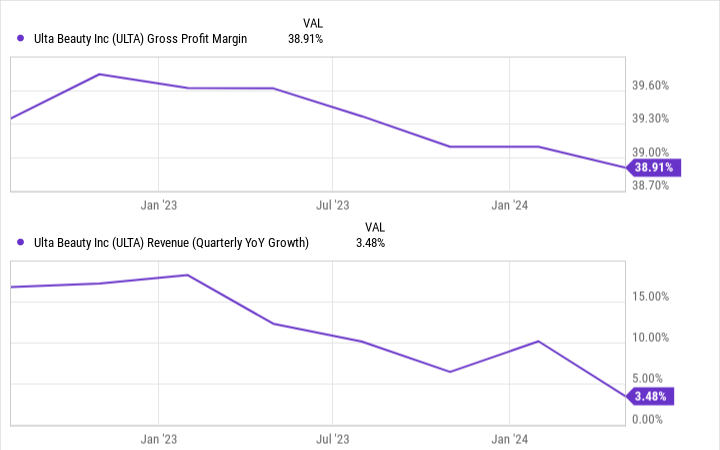

Consumers were flush with cash coming out of the pandemic, which boosted Ulta’s business. However, those tailwinds have faded. Sales growth has steadily slowed since peaking in 2021, while gross profit margins peaked in late 2022:

Management has pointed to increased theft and lower-margin sales as the culprits behind margin pressures. That makes sense; consumer savings rates have fallen below pre-pandemic levels. Naturally, a retailer will struggle if shoppers have less money and are trading down to cheaper brands. As much as people may try to maintain their beauty regimen, cosmetics are ultimately a discretionary budget item.

It’s not all bad

The good news is that Ulta Beauty’s formula for success has worked for many years, and there isn’t much reason to believe it won’t continue.

The company is still opening new stores and remodeling existing locations. Management forecasts 60 to 65 new store openings in 2024 and another 40 to 45 remodels. New stores will boost total locations by 4% to 5%, which essentially builds low-single-digit revenue growth into the business.

Remodels and an eventual consumer recovery should boost sales at existing stores. Analysts believe Ulta Beauty’s annual revenue growth will average between 5% and 6% over the long term.

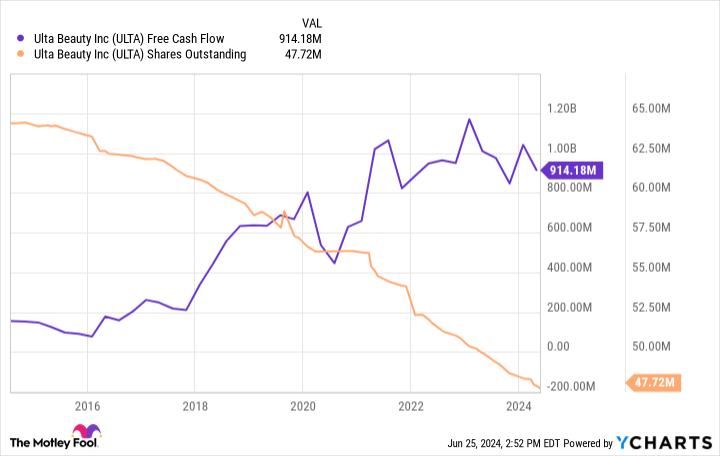

Ulta Beauty’s margin declines aren’t necessarily a reason to panic. Today’s gross margins of 38.9% are still notably higher than before the pandemic, when Ulta’s margins were roughly 36%. The company’s free cash flow is still within shouting distance of decade highs, which should continue to fuel future share repurchases. It has reduced its share count by 26% over the past decade, which helps drive earnings-per-share growth.

Ultimately, investors must determine whether Ulta Beauty can continue driving long-term growth. Nothing here seems to indicate that it can’t.

The selling has gone far enough

The market has aggressively sold off Ulta Beauty stock over the past few months, and shares have become cheap. The company averaged a price-to-earnings ratio of 32 over the past decade. Today, Ulta Beauty is trading at just 15 times its estimated 2024 earnings — less than half its long-term average valuation.

It would make sense if Ulta Beauty’s business were severely damaged, but that doesn’t seem to be the case, as discussed. Additionally, analysts are optimistic and expect the company to grow earnings by an average of over 12% annually over the long term.

There is a famous saying that the stock market can sometimes be irrational. That saying works in both directions, meaning stocks can become remarkably expensive or cheap, depending on Wall Street’s whims. Ulta Beauty has fallen out of style, and the market has used some legitimate short-term speed bumps to sell the stock into the ground unfairly.

The stock is a bargain at this price, making it a compelling buy for long-term investors willing to wait for these challenges to subside.

Should you invest $1,000 in Ulta Beauty right now?

Before you buy stock in Ulta Beauty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Ulta Beauty. The Motley Fool has a disclosure policy.

This Market-Beating Stock Is a Beautiful Buy Right Now was originally published by The Motley Fool