FMC’s stock crashed recently after the company slashed its dividend and released underwhelming earnings numbers.

When a stock plummets to multiyear lows, it’s typically not a good sign for the business and its investors. It can signal that there’s something deeply wrong with the business, its fundamentals, future, or all of the above.

If it’s just a 52-week low, that may not be all that bad. But the longer back you have to go to find the last time the stock traded at its current levels, the worse the situation usually is. In some cases, however, the market can overreact and punish a stock excessively. In those circumstances, it could make for an attractive contrarian investment.

One stock that’s been down big of late is FMC (FMC +1.87%). This year, it has lost more than 70% of its value. The sell-off has been so extreme that the stock is now trading at levels it hasn’t been at since 2008 — a whopping 17 years.

Is the stock really in a horrible position, or is this the case of an overreaction in the markets, meaning this could this be a good time to buy the stock for the long haul? Let’s take a closer look.

Image source: Getty Images.

The company’s financials haven’t been looking good

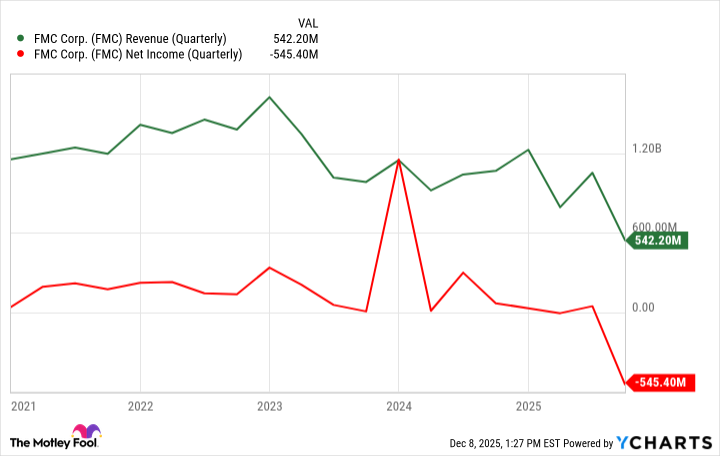

FMC is a chemical manufacturing company that sells insecticides, herbicides, and other products that help farmers protect their crops. But the company has been struggling to grow its sales of late, and its bottom line has also been a big problem: FMC has incurred a net loss of $532 million over the trailing 12 months.

FMC Revenue (Quarterly) data by YCharts

The net loss in its most recent quarter looks worse than it really is, however. The company incurred restructuring charges and reported write-downs, which had significant impacts on its bottom line. The company is in the middle of restructuring its operations and is divesting its business in India, where it’s facing tough market conditions due to high inventory levels.

For investors, this creates some added complexity in trying to determine just how strong the business will be amid all this noise and these financial adjustments. But even organically, the company says that for the third quarter, which ended on Sept. 30, its top line was down by 11%. While the divestment is playing a part in its weaker financials, the company is still facing some significant challenges beyond just India.

FMC recently slashed its dividend

It’s one thing if a company has some bad results due to restructuring, but it’s quite another when it makes a massive cut to its dividend, which is what FMC recently did. The company will now pay investors a quarterly dividend of $0.08, down from the previous $0.58. That equates to a massive 86% cut, which doesn’t inspire much confidence in the business moving forward.

The company says the move was “part of a broader response to the challenges the company is facing, and to further prioritize debt reduction.” As of the end of September, FMC’s total debt was $4.5 billion. That’s far higher than its cash and trade receivables, which total a combined $2.8 billion.

News of the underwhelming earnings report and dividend cut rattled the stock, which was trading at around $30 prior to the release of the numbers. Now, it’s at less than half of that value. While FMC’s current yield is still above average at 2.5% (the S&P 500 average payout is 1.2%), a big cut to the payout can crush any appeal in the stock from income-seeking investors, who often value reliability, consistency, and a strong track record when looking for quality dividend stocks.

Today’s Change

(1.87%) $0.25

Current Price

$13.62

Key Data Points

Market Cap

$2B

Day’s Range

$13.15 – $13.63

52wk Range

$12.17 – $57.91

Volume

5.8M

Avg Vol

4.6M

Gross Margin

37.10%

Dividend Yield

17.35%

Is FMC a good contrarian stock to buy today?

FMC’s stock is down big this year, and there is no reason to be terribly optimistic about a turnaround coming anytime soon. In its own forecast, the company references “cautious customer purchasing behavior,” which suggests the business is bracing for continued challenges ahead.

This isn’t much of a growth stock, and I wouldn’t feel comfortable relying on the dividend, given the uncertainty ahead for the business. If FMC can’t generate strong-enough results to get its debt under control, I wouldn’t rule out the possibility of another cut to the dividend in the future.

With so many safer dividend stocks to choose from in the market, FMC isn’t one I’d consider. Although it may look cheap, the stock simply isn’t worth the risk.