We’re over six months into 2024, an excellent time to reassess your portfolio and consider what moves might be best for the year’s second half and beyond. The stock market has seemed to be in a frenzy recently, with the S&P 500 briefly c

rossing the 5,600 mark for the first time. The index was boosted by growth from countless tech stocks that have risen alongside the potential of artificial intelligence (AI) and the prospect that a reduction in interest rates could be just around the corner.

During the rally, two stocks stood out as exciting investment opportunities: Intel (NASDAQ: INTC) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Over the last month, Intel’s stock is up 13%, while Alphabet jumped 10%, both beating the S&P 500’s increase of 5%.

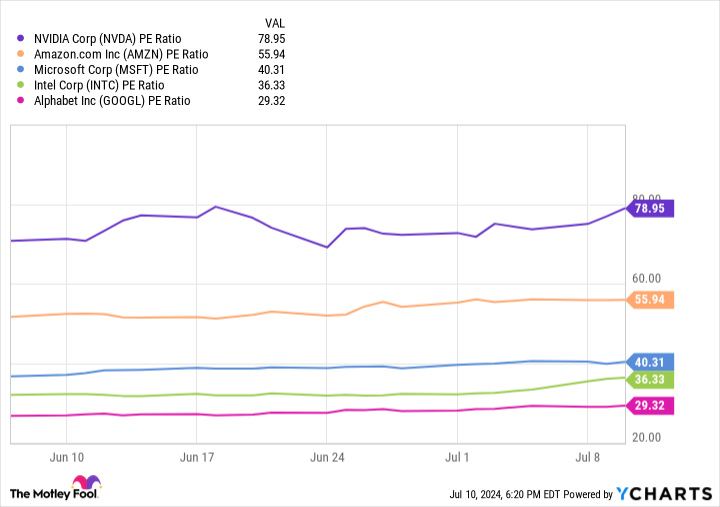

Yet, despite recent growth, Intel and Alphabet are potentially some of the biggest bargains in tech. Data in the chart shows these companies have lower price-to-earnings ratios (P/E) than some of the most prominent names in the industry.

P/E is a helpful valuation metric calculated by dividing a company’s stock by its earnings per share. The lower the P/E, the better the value.

Meanwhile, Intel and Alphabet have exciting prospects that could see them keep beating the market over the next decade. Intel has made a crucial shift in its business model that will see it prioritize expanding its role in the foundry market. Meanwhile, Alphabet is leveraging the popularity of its services to make headway in AI.

So want to get richer? Here are the two best stocks to buy in 2024 and hold forever.

1. Intel

A rally for Intel over the last month is a welcome change from the declines its stock has endured in recent years. Wall Street appears to be increasingly convinced of the company’s plan to turn things around with new chip releases and its manufacturing expansion.

Toward the end of June, news broke that Intel has plans to launch a new graphics processing unit (GPU), its Battlemage “Xe2” Arc GPU. The new chip is expected to be 50% more powerful than its predecessor, equipped with Taiwan Semiconductor Manufacturing‘s 4nm node platform. The upcoming GPU will launch in 2025 and be geared toward the gaming community.

Intel’s Battlemage GPU is just the latest in a line of new chip launches, many of which have been centered around AI. Earlier this year, the company unveiled Gaudi 2 and Gaudi 3 AI accelerators, which are meant to go head-to-head with similar offerings from Nvidia. Intel has priced these chips significantly lower than its competitors, hoping to gain market traction.

However, the biggest news from Intel’s camp has been its restructured focus on manufacturing. The company is building chip fabs throughout the U.S. and abroad as it works to steal market share from companies like TSMC and Samsung, just as chip demand is rising across tech.

Intel cut spending in different areas of its business to fund the costly venture that could significantly pay off in the coming years. Intel has said it expects the shift to manufacturing to save it between $8 billion to $10 billion by 2025 and see it “achieve non-GAAP (generally accepted accounting principles) gross margins of 60%.”

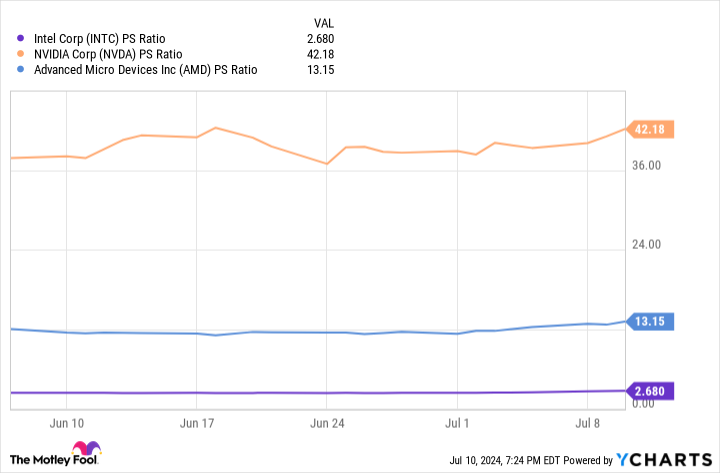

Moreover, Intel is one of the best-valued chip stocks. with a lower price-to-sales ratio (P/S) than Nvidia and Advanced Micro Devices. And while its rival’s P/S ratios have seen erratic changes over the last five years, Intel’s more steady movement suggests it could be the more reliable investment in 2024.

2. Alphabet

Alphabet has been a stock to watch this year after a glowing earnings release and heavy investment in AI. Initially, the company appeared behind in the sector with the third-largest market share in the AI-driven cloud industry (after Amazon and Microsoft). However, recent earnings show Alphabet is on track to catch up to its AI rivals. It has the brand power and financial resources to continue delivering significant gains.

In the first quarter, Alphabet’s revenue increased by 15% from a year ago. The company profited from a 14% rise in its Google Services segment, which includes income from ad sales. However, its most impressive growth came from Google Cloud, where revenue spiked 28% and operating income nearly quadrupled. The cloud platform beat Microsoft Azure’s revenue growth of 21% and Amazon Web Services’ 17% increase in the same quarter.

In-house brands like Google, Android, and YouTube made Alphabet a tech behemoth. These platforms draw billions of users, which the company leveraged to become a leader in digital advertising. However, the company now has the chance to employ a similar method to get its AI technology into consumers’ hands by integrating generative features across its product lineup.

Alphabet hit $69 billion in free cash flow this year, indicating it has the financial ability to keep investing in its business and retain its potent position in tech. In addition to a lower P/E than many of its peers, Alphabet’s stock is one you can buy now and hold indefinitely.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Want to Get Richer? 2 Best Stocks to Buy in 2024 and Hold Forever. was originally published by The Motley Fool