Uber has underperformed the stock market since its 2019 IPO, but that could soon change.

Often, when you look up the past stock performance of the world’s most recognized companies, think names like The Home Depot, Microsoft, or Amazon, you’ll find sparkling track records of market-beating investment returns. Some have even turned modest sums into fortunes.

Uber Technologies (UBER +5.95%) could fit nicely into that above group as a very well-known brand. Almost nobody calls a rideshare these days; they call an Uber. However, the stock hasn’t delivered as you might expect. Uber has underperformed the S&P 500 index since its IPO in the middle of 2019, and quite badly, I should add.

But why? And should investors expect brighter days ahead?

A dive into Uber’s business provides a glimpse of where the stock could be trading in three years. Here is what you need to know.

Image source: Getty Images.

A market leader in a rapidly growing market

Uber has the business numbers to back up its name recognition. It dominates about three-quarters of the ridesharing market in the United States, a practical duopoly with arch-rival Lyft. Uber operates globally, too. It services approximately 15,000 cities worldwide, in more than 70 countries.

The global ridesharing market continues to grow, an enormous tailwind for Uber as the market leader. Precedence Research estimates it will grow at a compound annual growth rate of more than 18% over the next decade, reaching $788 billion by 2035.

Uber also continues to find new ways to make money. It has expanded its services to include courier services, food and grocery delivery, and car rentals, and monetized its customers and their data by introducing digital advertising and a subscription program for high-frequency users.

Combine all of that, and you get fantastic growth. Revenue is growing by 20% year over year, an impressive pace for a business with nearly $50 billion in annual revenue. Uber has grown large enough that profit margins are soaring as revenue growth outpaces expenses. Uber has converted 17.4% of its revenue into free cash flow over the past four quarters and is trending up.

Why hasn’t the market fully bought into Uber’s success?

Since the stock is up 25% over the past year, it would be unfair to say that Wall Street has completely abandoned Uber stock. Still, the stock currently trades at a price-to-earnings (P/E) ratio of just over 19 times 2026 earnings estimates. That’s quite a low valuation for a business with such healthy and profitable growth.

Today’s Change

(5.95%) $4.80

Current Price

$85.54

Key Data Points

Market Cap

$178B

Day’s Range

$81.09 – $85.65

52wk Range

$60.63 – $101.99

Volume

5.2K

Avg Vol

18M

Gross Margin

32.74%

Investors appear to be most concerned with Uber’s future. More specifically, the rise of self-driving vehicles and autonomous ridesharing services, like Alphabet‘s Waymo and Tesla‘s Robotaxi.

It’s fair for the market to have some concerns. Compensating human drivers is Uber’s primary business expense. If a competitor could eliminate that, they could potentially undercut Uber’s prices. Waymo is steadily expanding its service to new cities. Meanwhile, Robotaxi has started slowly, but Tesla’s vertical integration could help it make up ground if it can really get going.

But Uber isn’t sitting still, waiting for competition. The company has partnered with Nvidia to develop self-driving technology and plans to collaborate with automotive companies to build an autonomous fleet of 100,000 vehicles, starting in 2027.

Time will tell whether Waymo or Robotaxi can grow large enough to take a bite out of Uber’s growth over the next several years. It’s also unclear whether Uber will deliver on its own autonomous plans. What is clear is that the uncertainty has weighed on the stock.

If you buy Uber stock, you probably believe the company will succeed.

So, where could the stock be trading in three years?

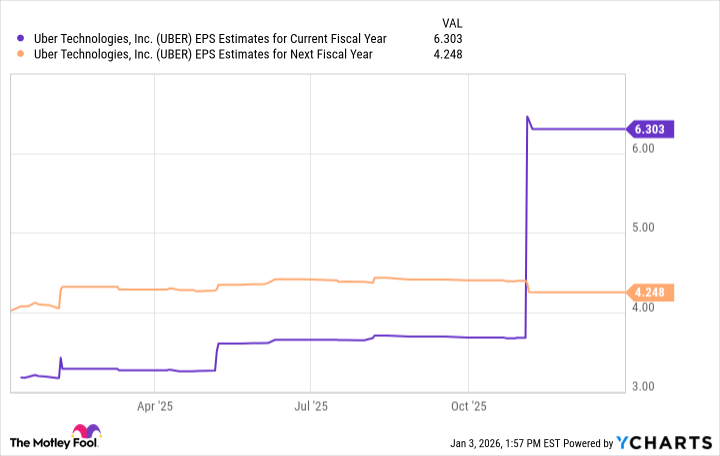

I’ll use 2026 earnings estimates as a starting point. You wouldn’t normally use forward estimates, but a $4.9 billion non-cash gain in the third quarter inflated Uber’s 2025 earnings. That should normalize this year, which is why earnings estimates drop so much from 2025 to 2026.

UBER EPS Estimates for Current Fiscal Year data by YCharts

From there, I’ll assume that Uber’s earnings grow at a compound annual growth rate of 20%. That’s just slightly higher than Precedence Research’s estimated ridesharing market growth rate, and implies that neither Uber’s market share nor profit margins increase much from their current level. It’s important to err on the conservative side in these exercises.

So, applying that to Uber’s estimated 2026 earnings of $4.25 per share, the company would earn:

- $5.10 per share in 2027

- $6.12 per share in 2028

- $7.34 per share in 2029

Investors can use the PEG ratio to value stocks based on their earnings growth. Typically, a stock is considered a great value at a PEG ratio of 1.0, when the P/E ratio is 1:1 with earnings growth. For top-notch companies or popular stocks, the PEG ratio can exceed 2.0.

In Uber’s case, that would mean the stock trades at a price as high as 40 times earnings — a share price of $294, representing more than a 250% gain over three years.

Uber won’t generate substantial returns like this if it doesn’t deliver on its autonomous plans and win the market’s confidence. However, at the very least, it highlights the stock’s potential upside if things do go well.