Technology powerhouse International Business Machines (NYSE: IBM) used to be an industry giant. Big Blue’s market cap peaked at $239 billion in the summer of 1999, sparking speculation about perhaps forming the world’s first trillion-dollar company.

But the dot-com bubble popped, and IBM changed gears. The market cap reached $230 billion again in 2012, ending an era where other tech giants were copying IBM’s one-stop IT shop business model.

But that year also marked a sharp strategy shift under newly appointed CEO Ginni Rometty. IBM stiff-armed the hardware side of its operations, apart from the unique mainframe systems segment. When Rometty handed off the reins to current CEO Arvind Krishna in the spring of 2020, IBM was refocused on hybrid cloud computing, data security, and artificial intelligence (AI).

And its market cap had dropped to just $106 billion.

The company has enjoyed another renaissance since then, joining the AI boom just a bit later than many peers. Currently perched at a total market value of $167 billion, is the reformed Big Blue finally destined for trillion-dollar greatness before the end of this decade?

Let’s set some realistic targets for IBM

A starting point of $167 billion is pretty impressive. Only 45 of the S&P 500 (SNPINDEX: ^GSPC) index’s household names can boast a larger market cap than IBM’s today.

One-trillion is still a long way away, though. I’m talking about a sixfold jump, and share prices would rise even faster thanks to IBM’s unstoppable habit of buying back shares by the boatload.

So if IBM has a chance of reaching $1 trillion at all, it won’t be a quick and easy romp.

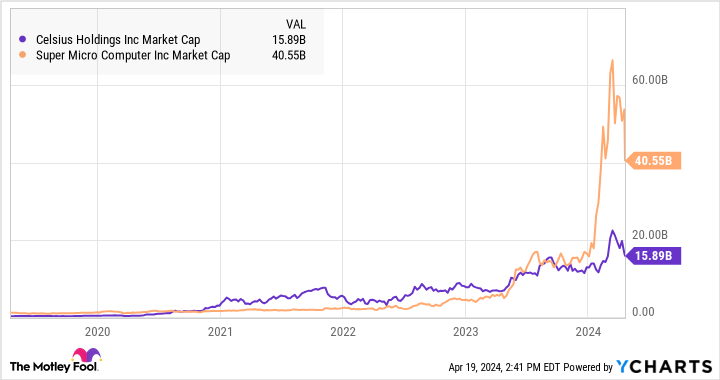

That’s a sixfold gain in five years and change. Most stocks wouldn’t even dream of it. And honestly, IBM faces some long odds here. Super Micro Computers (NASDAQ: SMCI) and Celsius Holdings (NASDAQ: CELH) have posted the strongest gains on the stock market over the last five years.

Supermicro soared on the wings of unique AI systems; Celsius was a literal penny stock five years ago, and its health-conscious energy drink had no distribution system or marketing to speak of. It’s a lot easier to multiply those modest starting values than it is to list IBM from a $167 billion platform.

And even then, Celsius barely reached the sixfold market cap multiplication target. Supermicro only made it halfway.

Why I don’t mind IBM missing the trillion-dollar mark

So the trillion-dollar goal looks nearly unreachable from IBM’s current starting point, given only five or six years of AI-driven growth. That’s alright. I still think IBM is one of the best AI buys in today’s market.

The company can pull its weight with much milder price gains. It doesn’t have to meet some arbitrary market-cap goal in five years. Remember, only one stock actually achieved a similar gain over the last five-year period, and that was from an optimal starting point. IBM isn’t reinventing energy drinks here or on the verge of signing a global distribution deal with PepsiCo (NASDAQ: PEP). That’s what it took to lift Celsius Holdings’ stock sixfold in half a decade.

But the company is nibbling on explosive growth opportunities in the massive market for business-grade AI services. Its Watson AI engine and the related Watsonx generative AI platform were built for enterprise customers, and the long-term contracts are starting to drop in.

Meanwhile, Big Blue’s stock trades at just 22 times earnings and 12 times free cash flows. That’s a bargain-basement deal next to AI-driven market darlings like Nvidia, Microsoft, and Supermicro. IBM’s stock could triple and still look affordable next to these recent Wall Street rockets.

So yes, IBM offers a tempting blend of low share prices and exciting growth opportunity in the AI market. You should look away from that hard-to-reach trillion-dollar goal and embrace IBM for what it is — an undervalued tech titan. You should pick up a few low-priced IBM shares while you can before the market really catches on to the company’s valuable position in the enterprise AI industry.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Anders Bylund has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends Celsius, Microsoft, and Nvidia. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Will IBM Be a Trillion-Dollar Stock by 2030? was originally published by The Motley Fool