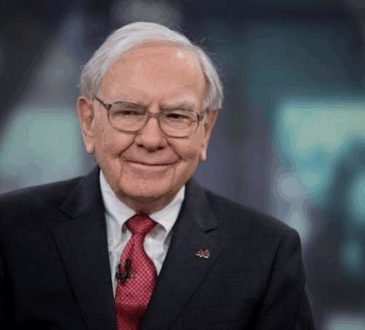

Warren Buffett Retires With a $187 Billion Warning to Investors. History Says the Stock Market Will Do This Next.

This weekend, Berkshire Hathaway (NYSE: BRKA) (NYSE: BRKB) released its full-year financial report, and it contained a final warning from...