China falls deeper into deflation territory, hitting markets; IMF warns of risk of cold war II – as it happened | Business

Introduction: China’s consumer price drop adds to deflation fears

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

While most of the advanced world is struggling with inflation, China has the opposite problem.

The world’s second-largest economy has dropped further into deflation territory, with consumer prices falling last month, new data released last weekend shows.

China’s consumer price index (CPI) dropped 0.5% on a monthly basis in November, showing that prices of a basket of goods and services fell compared with October.

CPI was also 0.5% lower on an annual basis, China’s National Bureau of Statistics (NBS) reported, which is the steepest drop since November 2020.

The drops have disappointed investors, as they indicate rising deflationary pressures as domestic demand remains subdued.

Kyle Rodda, senior financial market analyst at capital.com, says:

Chinese stocks have sunk as investors digest the weekend’s disappointing price data. Deflation is deepening, and while debate rages about why, the trend is undeniable: consumer prices are falling, and producer prices have been negative for more than a year. The data simultaneously indicates anaemic demand and the eroding profitability of Chinese companies.

The latest pledges of deeper fiscal support from last week’s Politburo meeting have amounted to little and may be considered insufficient to spark the economy out of this rut.

China has already dropped into deflation back in August, before prices rose again in September – but that recovery proved temporary, with prices also having dropped in October.

Zhang Zhiwei, chief economist at Pinpoint Asset Management, said deflationary pressures have increased because of weak domestic demand, adding:

“This highlights the importance of more supportive fiscal policy.”

In another sign of deflation, China’s manufacturers are cutting prices too. China’s producer price index fell 3% year-on-year, compared with October’s 2.6% drop, which is the 14th decline in a row.

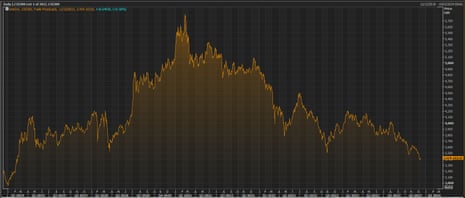

The data, released last weekend, has knocked stocks today. China’s CSI 300 index, which tracks stocks on the Shanghai and Shenzen exchanges, fell as much as 1.4% today.

But the economic picture may be brightening in the UK, after a troubled year.

Manufacturing body MakeUK has reported a pick-up in business confidence.

And encouragingly, manufacturers reported that export orders surpassed domestic orders for the first time in four years. That suggests that companies are taking advantage of either faster growing or new markets.

Fhaheen Khan, senior economist at Make UK, said:

“After the economic and political shocks of the last few years there is some semblance of stability returning for manufacturers.

While growth is not exactly supercharged, the positive announcements in the Autumn statement can at least allow companies to plan with more certainty without having to constantly fight fires.”

Key events

Afternoon summary

Time to recap

China’s fall into deflation territory has accelerated, after consumer prices fell 0.5% per cent in November, the sharpest decline in three years.

The drop in prices highlighted weakness in China’s economy, and pushed China’s CSI 300 share index down to a near five-year low today. Hong Kong’s Hang Seng also dropped, down around 1%.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, points out that signs of fragility are now starting to be felt in the service sector.

Streeter adds:

With global growth expected to slow further in 2024, there will be little support coming from overseas, while the property market’s woes keep consumer confidence subdued. The clamour for a big bazooka of stimulus is growing to restore vigour to the economy.

Authorities also have their eye on debt laden local authorities which pose another risk to financial stability. Hopes are being focused on the Central Economic Work Conference later this month for more medicine to try and put the economy on the road to better health.’’

A senior International Monetary Fund official has warned that the world economy is on the brink of a second cold war that could “annihilate” progress made since the collapse of the Soviet Union.

Gita Gopinath, the IMF’s first deputy managing director, said the accelerating fragmentation of the world economy into regional power blocs – centred around the US and China – risked wiping out trillions of dollars in global output.

She said:

“If we descend into cold war two, knowing the costs, we may not see mutually assured economic destruction. But we could see an annihilation of the gains from open trade.”

In the UK housing sector, average asking prices fell by almost £7,000 last month, as sellers tried to compete to find a buyer.

Tenants in Britain last month were hit by the highest increase in rents for any November in at least a decade, estate agent Hamptons reported.

On Wall Street, shares in department store chain Macy’s have jumped almost 19% after reportedly becoming the target of a $5.8bn takeover offer.

Energy firm Occidental Petroleum has agreed to buy CrownRock, a major privately held energy producer that operates in the Permian Basin, for $12bn.

In the City…Hipgnosis Songs Fund, which owns the streaming rights to artists ranging from Beyoncé to Neil Young, has sold a chunk of its song rights at a steep discount to raise cash.

Analysts have predicted that mining company Anglo American could become a takeover target after warning of weaker than expected production last week.

And travellers have been warned that festive getaway traffic will probably peak earlier than normal this year as Christmas Day falls on a Monday.

Here’s our news story on Gita Gopinath’s warning that the fragmentation of the global economy could knock GDP by 7%.

IMF warns of risks of Cold War II

Newsflash: The global economy is on the brink of a second cold war, a senior International Monetary Fund official is warning.

Gita Gopinath, the IMF’s first deputy managing director, is concerned that the accelerating fragmentation of the world economy into regional power blocs risked destroying trillions of dollars in global output.

That would wipe out progress made since the collapse of the Soviet Union.

Speaking to the 20th World Congress of the International Economic Association today, Gopinath points out that national security concerns are shaping economic policy worldwide.

She says:

Pandemic, war, and growing tensions between the two largest economies of the world—the US and China— have undoubtedly changed the playbook for global economic relations.

The US calls for “friend-shoring,” the EU for “de-risking,” and China for “self-reliance.”

Gopinath warns that there are signs of growing fault lines, with the growth in trade between blocs that are not politically aligned slowing more than the average.

She explains that if the global economy fragments into two blocs based on UN voting on the 2022 Ukraine Resolution, wiping out trade between the two blocs, global losses are estimated to be about 2.5% of GDP – but could be as high as 7% of GDP if economies struggled to adjust.

Gopinath adds that policymakers today can take lessons from the first cold war, reming us:

Throughout that period, the US and Soviet Union made several agreements to avoid nuclear catastrophe. Both superpowers subscribed to the doctrine of mutually assured destruction, knowing that an attack by one would ultimately lead to total annihilation.

If we descend into Cold War II, knowing the costs, we may not see mutually assured economic destruction. But we could see an annihilation of the gains from open trade.

Just in: The US stock market has just ht iits highest level of the year.

The S&P 500 index has briefly crossed the intraday high hit in July, and is currently 0.1% higher at 4,607.55, up 3 points.

🇺🇸 S&P 500 BRIEFLY CROSSES JULY INTRADAY TRADING HIGH TO HIT HIGHEST LEVEL OF THE YEAR, LAST UP 0.1% AT 4,606.02 POINTS

— *Walter Bloomberg (@DeItaone) December 11, 2023

Microsoft and labour unions form AI alliance

Microsoft is teaming up with US unions to create “an open dialogue” on how artificial intelligence will impact workers, amid concerns that AI could eliminate millions of jobs.

The American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) and Microsoft say the new partnership will discuss how AI must anticipate the needs of workers and include their voices in its development and implementation.

They say the partnership is the first between a tech company and a union to focus on AI, and will look at three issues:

-

sharing in-depth information with labor leaders and workers on AI technology trends;

-

incorporating worker perspectives and expertise in the development of AI technology; and

-

helping shape public policy that supports the technology skills and needs of frontline workers.

AFL-CIO President Liz Shuler says:

“The labor movement looks forward to partnering with Microsoft to expand workers’ role in the creation of worker-centered design, workforce training and trustworthy AI practices.

Microsoft’s neutrality framework and embrace of workers’ expertise signals that this new era of AI can also catalyze a new era of productive labor-management partnerships.”

Macy’s shares surge 15% after buyout bid report

In New York, another bout of takeove excitement has driven shares in department store chain Macy’s up by 15% at the start of trading.

They’ve jumped to around $20, after it emerged that an investor group consisting of Arkhouse Management and Brigade Capital has made a $5.8 billion offer for Macy’s. worth $21 per share.

My colleague Jasper Jolly reports

Macy’s department stores are among the most high-profile in the US because of its sponsorship of a parade on Thanksgiving Day that has run since 1924, with giant floats and balloons featuring popular cartoon characters. The Macy’s top outlet in New York’s Herald Square is one of the world’s biggest department stores.

The company also owns Bloomingdale’s, a more expensive department store brand, and the beauty chain Bluemercury. Despite its cultural prominence and its broad geographical reach, with 700 stores when counting those from other brands, Macy’s has struggled to adapt to online retail.

The chain in 2020 announced the closure of 125 stores, along with cutting 2,000 jobs at its headquarters in Cincinnati and offices in San Francisco.

More here:

Anglo American share price picks up amid takeover chatter

Alex Lawson

Mining company Anglo American has seen a tentative recovery in its share price on Monday after takeover chatter buoyed the London-listed business.

Shares rose 1.5% to £18.29, valuing the business at £24.5bn, after a pummelling last week which exposed the company to a potential bid. Anglo’s stock is down nearly 45% this year, and the shares suffered their biggest one day fall since the financial crisis on Friday, down 19%, when the miner slashed its production outlook.

Anglo, which is among the 20 biggest companies on the FTSE 100, said difficulties at its mines in Peru and Chile had led to the cut in its forecasts for copper production. Brokers at Jefferies, Barclays and RBC have cut their target price for the stock in response.

Analysts noted that that £30bn had been lost from the value of the company, which is also listed in Johannesburg, since South African Duncan Wanblad, a company insider, had taken over as chief executive from longstanding boss Mark Cutifani in April 2022.

Jefferies analysts have said that Anglo may become “involved in the broader trend of industry consolidation” and suggested Glencore could be a potential suitor.

Glencore took over Xstrata, the company which made an abortive attempt to merge with Anglo in 2009. Xstrata was later subsumed into Glencore.

Anglo notched up profits of $4.5bn in 2022 but issues with iron ore and copper production have hit performance and it is in the process of a cost cutting exercise, which has seen it cut $500m of cuts including job losses.

The company also owns diamond miner De Beers, which has experienced a downturn in the diamond and platinum sectors amid weak demand and too much stock in the market.

Occidental Petroleum to buy Permian producer CrownRock for $12bn

More consolidation in the energy sector has just been announced, with US producer Occidental Petroleum winning an auction to buy CrownRock, an energy producer in the west Texas area of the Permian basin.

Occidental is acquiring CrownRock in a mixture of cash and stock in a transaction valued at approximately $12.0 billion, including taking on CrownRock’s debt.

Occidental says the deal will add 170,000 barrels of oil equivalent per day to its output, and also give it around 1,700 undeveloped locations where fossil fuels can be produced.

To fund the transaction, Occidental will issue $9.1bn of new debt and $1.7bn of shares.

But it is also lifting its dividend by $0.04 to $0.22 per share.

Some Occidental Petroleum news to start off the week:

(1) $OXY has agreed to purchase CrownRock (a Permian Basin oil producer) for $12 billion.

(2) To pay for it, Oxy will issue $9.1 billion in debt and about $1.7 billion in common stock.

(3) Oxy’s quarterly dividend will…

— Kevin Carpenter (@kejca) December 11, 2023

The pound has risen this morning, at the start of a busy week for central bankers.

Sterling has climbed by almost half a cent against the US dollar to $1.259, having fallen by a cent and a half last week.

It’s also up half a eurocent against the single currency, at €1.169.

The Bank of England (BoE), the US Federal Reserve and the European Central Bank are all expected to leave interest rates on hold this week.

But the BoE could take a hawkish tone, with three of its nine policymakers expected to vote for a rate hike to 5.5%.

Matthew Ryan, head of market strategy at global financial services firm Ebury, says:

“The MPC is expected to leave interest rates unchanged on Thursday, although we think that it will try to push back against market pricing of a full cut in the first half of 2024. The voting split among committee members will also once again be key.

“This vote was split 6-3 in favour of no change in November and could remain unchanged this time around as the bank reinforces its stance of higher rates for longer.

“We think both data and central bank communications are likely to be supportive of the pound, underlining the story of demand resilience and high wage growth that should keep UK rates elevated for longer than elsewhere.”

Back in the markets, the aluminium price has dropped to its lowest level in over three months.

China’s drop into deflation could hint at lower demand for raw materials such as aluminium, used in a wide range of products including consumer goods, window frames and aeroplane parts.

Aluminium dropped to $2,125 per metric ton this morning, the weakest since August 21, Reuters reports.

Sky: Shein holds talks with LSE to dangle prospect of London listing

Sky News are reporting that the chairman of fast-fashion giant Shein has held talks with the London Stock Exchange about the possibility of staging a blockbuster public listing in the City.

Donald Tang’s meeting with LSE executives comes despite Shein having filed papers in the US paving the way for a flotation in New York.

Sky News’s Mark Kleinman writes:

City sources said the discussions were focused on the possibility of a listing in the UK, with one saying that the Singapore-based behemoth was continuing to explore various options for raising capital through a public share sale.

A US listing remains the likeliest outcome for Shein, according to bankers and people close to the company, while a dual listing in both financial centres is said to be unlikely.

EXCLUSIVE: The chairman of Shein, the Asian fast-fashion behemoth which last month filed documents to pave the way for a blockbuster New York listing, met executives from the London Stock Exchange last week to discuss the option of a UK flotation. https://t.co/9hJSl6g1oY

— Mark Kleinman (@MarkKleinmanSky) December 11, 2023

UK productivity is being supported by a relatively small selection of highly productive companies, while many firms are running at below average productivity.

That’s the conclusion from new data released by the Office for National Statistics today, which shows that 70.6% of UK employees work in firms with labour productivity below the mean.

But there is also a long tail of workers in firms with very high labour productivity, the ONS says.

Its research shows that, at the top end, 1.5 million people are employed in firms with productivity of over £150,000 approximate gross value added (aGVA) per worker.

China’s currency has fallen to a three-week low after the latest CPI data showed deflation in the country worsened in November.

Reuters has the details:

The yuan weakened to a three-week low in both the onshore and offshore markets on Monday, with the former last at 7.1791 per dollar.

Alvin Tan, head of Asia FX strategy at RBC Capital Markets, explains

“The lack of a strong revival in the economy suggests that weak inflation will persist, and more policy support is indeed required.”