Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

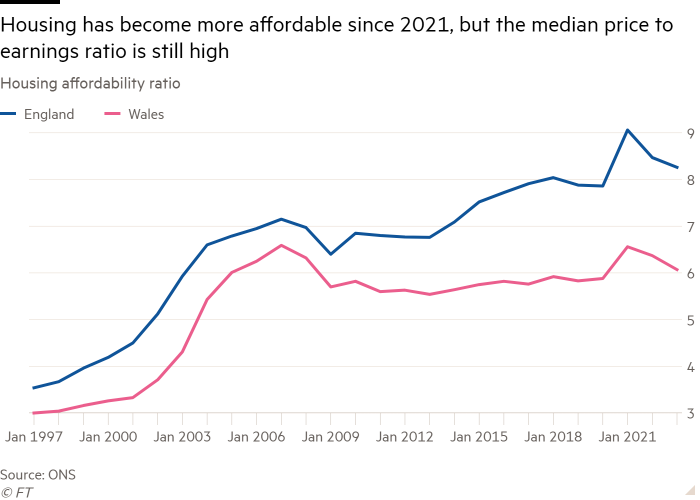

England’s housing has become more affordable since a spike in prices during the Covid-19 pandemic, but experts warned home ownership is set to remain out of reach for many because the cost of property is still high.

The housing affordability ratio for England — the relationship between median house prices and median salaries — was 8.26 in 2023, down from 8.47 in 2022 and well below the pandemic peak of 9.06 in 2021, according to data released by the Office for National Statistics on Monday. The ratio in Wales was 6.07 last year, down from 6.37 in 2022.

But while the numbers paint a somewhat rosier picture, housing experts and economists cautioned any affordability improvements may only be temporary.

“Even though the ratio has declined, that does not mean that the cost of housing has declined,” said Anthony Breach, associate director at the Centre for Cities think-tank.

“Income growth has been faster than house price growth for the last year, but that is not set to remain.”

Since 2022, UK wage growth has been at record highs, with average earnings excluding bonuses increasing at an annualised rate of 3.5 per cent between October last year and January.

Meanwhile, a recent rise in UK home sales and a fall in mortgage rates have created a slightly more hospitable market for buyers.

But economists said the increase in affordability recorded by the ONS was transient, as structural issues in the UK’s housing supply would continue to lock many out of the market.

“It is more affordable today, yet fewer people can afford it. Prices are down but deposits are up,” said Paul Cheshire, professor emeritus of economic geography at the London School of Economics.

“The housing market has continued with its perennial issue of inelastic supply. There are far too few houses being built, and the number has been falling as local authorities have cut back.”

Data from the Resolution Foundation think-tank showed a lack of new construction and the lagging modernisation of older homes has left the UK with the worst-value housing of any advanced economy.

Despite the improvement in the most recent ONS data, UK housing is still on average less affordable than before the pandemic.

In 2020, the housing affordability ratio for England was 7.86 and had increased in three of the preceding five years.

The ONS figures also showed affordability had deteriorated in every local authority area since data was first collected in 1997, with an especially large differential between median prices and median earnings in the South East of England. The central London borough of Kensington and Chelsea was ranked as the least affordable.

Breach at Centre for Cities said: “The planning system, by disconnecting local supply from local demand, has resulted in housing being more unaffordable over time.”