Getting on the property ladder is more affordable now than it was in 2022, according to the latest figures from Nationwide Building Society.

Average property prices remain just below the all-time high recorded in summer 2022, according to Nationwide.

But average earnings have increased by more than 15 per cent since then, according to Nationwide’s analysis of Office of National Statistics data, meaning buying a home costs less in proportion to people’s wages.

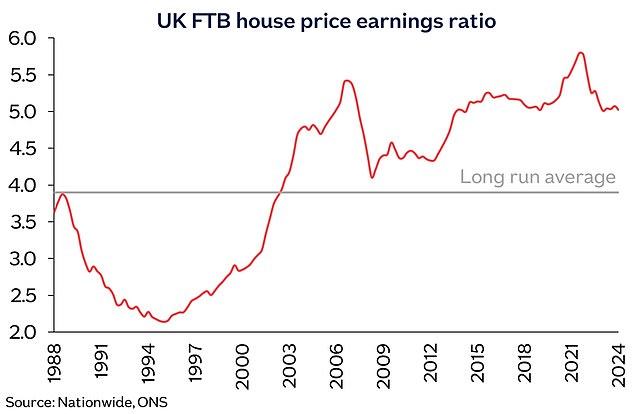

The typical first-time buyer now buys a home worth five times their gross annual salary, down from a high of 5.8 times annual income between April and June 2022.

However, property remains much less affordable than it was in decades past.

The long-running average ratio for house prices to earnings is 3.9 times.

Modest improvement: Affordability has improved compared to 2022, though first-time buyers are still paying a higher multiple of their income than they did in the past

The main obstacle for most first-time buyers is getting together a deposit. While some are able to get help from family, many are left with the challenge of saving up, which can take years.

This has been made more difficult for some by the record increase in rents in recent years as well as inflation.

And while wages have outpaced house prices over the past two and half years, the mortgage landscape has also changed, meaning monthly repayments have risen.

If borrowers want lower monthly payments they will need to save a larger deposit, which will take longer, or buy a cheaper home.

In April 2022 the average two-year fixed rate mortgage was 2.86 per cent, according to Moneyfacts, whereas today it is 5.51 per cent.

On a £200,000 mortgage being repaid over 25 years, that’s the difference between paying £934 and £1,229 a month.

Higher: A typical first-time buyer with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – above the long-run average of 30%

Andrew Harvey, senior economist at Nationwide, said: ‘There has been a modest improvement in housing affordability over the last year, due to earnings growth marginally outpacing house price growth and a slight reduction in average borrowing costs.

‘Nonetheless, housing affordability remains stretched by historic standards.

‘A prospective buyer earning the average income and buying a typical first-time buyer property with a 20 per cent deposit would have a monthly mortgage payment equivalent to 36 per cent of their take-home pay – well above the long-run average of 30 per cent.

‘It’s not surprising that a significant proportion of first-time buyers have to draw on help from friends and family to raise a deposit.

‘In 2023-24, around 40 per cent of first-time buyers had some assistance raising a deposit, either in the form of a gift or loan from family or friends, or through an inheritance.’

Where are homes the least affordable?

House price to earnings ratios remain broadly similar to a year ago across the UK, with London continuing to have the highest house price to earnings ratio at 8.0 and Scotland the lowest at 3.0.

Since summer 2016, the average London property has only increased by 9 per cent from £475,000 to £519,000 as of November 2024.

Flats and maisonettes in the capital have only risen 3 per cent on average during that time.

Kensington and Chelsea is the least affordable local authority in the country, with the average home being 13.6 times more than the average income.

Chichester in West Sussex is the least affordable area in the Outer South East region, with house prices 8.5 times average earnings.

Meanwhile, in the Outer Metropolitan region, Three Rivers in Hertfordshire, which includes the popular commuter town of Rickmansworth, is the least affordable local authority.

In the South West, Bath and North East Somerset is the least affordable area.

It is a similar story in Cambridge, where average first-time buyer prices are much higher than parts of East Anglia.

York is another sought-after city, but with a house price to earnings ratio of 6.3, it is the least affordable location within Yorkshire and the Humber.

Wychavon in Worcestershire, is the least affordable part of the West Midlands, and includes Evesham, Droitwich Spa and parts of the Cotswolds.

Meanwhile, in the East Midlands, Derbyshire Dales is one of the highest-priced areas, with much of it sitting within the Peak District National Park, including towns such as Matlock, Ashbourne and Bakewell.

Westmorland and Furness, which takes in significant swathes of the Lake District National Park, is the least affordable area in the North.

In Wales and Scotland, the capital cities are the least affordable places, with Cardiff and Edinburgh having first-time buyer house price to earnings ratios of 5.6 and 5.4 respectively.

The most affordable local areas

Aberdeen is the most affordable authority in the UK, with average first-time buyer prices just 2.5 times average earnings in the area.

Burnley and Hartlepool are the most affordable areas in the North West and North regions respectively, both with house price to earnings ratios of 2.8.

North East Lincolnshire, which includes seaside towns Grimsby and Cleethorpes, is the most affordable local authority in Yorkshire and The Humber.

Further down the east coast, Great Yarmouth in Norfolk has the lowest ratio in East Anglia and is also the lowest-priced area in the region.

Continuing south, Tendring in Essex, which includes Clacton-on-Sea and Harwich, is the most affordable area in the Outer South East.

Swindon is the most affordable town in the South West, with a house price to earnings ratio of 5.3.

Meanwhile in the Outer Metropolitan region, Surrey Heath, which includes Camberley and Bagshot, is the most affordable area, due to relatively high earnings.

Enfield is the most affordable London borough, though its house price earnings ratio of 6.2, is still higher than the majority of local authorities across the country.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.