The number of UK residential property transactions fell again in December while non-residential transactions increased, the latest figures provided by HM Revenue & Customs (HMRC) has revealed.

The number of UK residential property transactions fell again in December while non-residential transactions increased, the latest figures provided by HM Revenue & Customs (HMRC) has revealed.

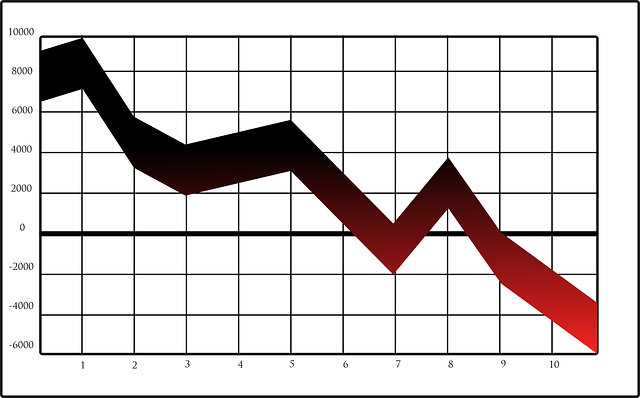

Transactions, which constitute a better barometer of market strength than property prices, have dropped by a fifth year-on-year, according to the data.

Residential transactions in the UK totalled 85,820 in December, which is 20% lower than the corresponding month last year, and 2% lower than November 2023. This, according to HMRC, is the fourth consecutive month-on-month fall in residential transactions.

In contrast to the slowing residential market, non-residential transactions rose by 8% in December compared to the previous month and by less than 1% relative to the figures 12 months prior.

Industry reactions:

Anthony Codling, former City analyst and now chief executive of Twindig, said: “Housing transactions fell by 19% during 2023 to just over 1.02 million, which is slightly ahead of the forecast we made at the start of 2023 of 960,000. So far the 2020s have been an unusual period for the UK housing market, stamp duty holidays and the 2022 mini-budget added volatility leading to booms and mini-busts. However, in the context of history, housing transaction volumes in 2023 were only 7.3% below their 15-year average.

“Given all that was thrown at the UK housing market last year one has to admire its resilience in the face of pressure. Looking forward the seas appear calmer and the breeze is behind us, and the mantra of ‘survive until 25’ may need to be updated and upgraded to ‘thrive in 25’.”

Nick Leeming, chairman of Jackson-Stops, commented: “Despite today’s figures showing a subdued final quarter of 2023, a seasonal slowdown is par for the course as celebration and reflection takes priority in December.

“If last year was characterised by greater supply and tentative buyer appetite, the cautious hope is that 2024 will shepherd in a period of greater steadiness and predictability. Buoyed by falling inflation and competitive mortgage rates, a strong response from buyers to renew their searches and push forward with completions should also encourage sellers to return their properties to the market at realistic guide prices.

“On the eve of the Bank of England’s next interest rate decision, the expectation that rates will hold firm is another important piece of the property prosperity puzzle. If the Bank of England opts to err on the side of stability, it will go some way to help the market level out and return to a stable footing both in terms of sales agreed and property prices.

“Across the Jackson-Stops network in December we saw a notable uptick in the number of prospective buyers for new listings in the commuter belt around Reigate, Newmarket and Colchester, as well as in popular rural and seaside areas such as Blandford Forum, Truro and Taunton. This month-on-month swing shows that regional revivals can quickly emerge despite a more subdued national market.

“Pre-election promises are likely to dominate news headlines and see the major parties go head-to-head on divisive issues such as housebuilding, home ownership, rental legislation and green homes. However, any changes in property market conditions are much more likely to be determined by the persistent imbalances between supply and demand, which has outlasted the current Government and will leave a major headache for the next one.”

Frances McDonald, director of research at Savills, said: “The latest transactions data highlights a relative slowdown in activity in December. Completed transactions ended the year at 1.02m, 15% below the 2017-19 average, on a seasonally adjusted basis, in part because of issues with conveyancing systems which caused some delays.

“However, general improvements in activity seen in the final few months of last year look to have carried forward into 2024.

“More than 40% of these transactions were to cash buyers, far higher than the average 35% before the pandemic, and reiterates that activity continues to be supported by cash and equity-rich buyers in particular.

“But as mortgage rates continue to ease, we expect the market to rebalance back to debt-dependent buyers. The latest data reveals that mortgage approvals hit their highest level in six months in December. While TwentyCi data for January 2024 also show signs of optimism. Agreed sales were 18% above 2023 levels for the month and within 2% of the 2017-19 average.

“At the same time, Nationwide’s January house price index showed an average monthly increase of 0.7% across the UK, leaving annual movements broadly flat at -0.2%.”

Andy Sommerville, director at Search Acumen, said: “The latest HMRC figures indicate that residential property transactions fell for the fourth consecutive month in December 2023, down 1% from November.

“We have seen a persistently challenging market in recent months as the property sector continues to cool under the pressure of high inflation and rising interest rates. Having said this, Christmas is always a slow month with fewer transactions historically, so underwhelming numbers are not necessarily an accurate reflection of market conditions. Looking at the year-on-year data, we can see some signs of the market stabilising after the initial shock of rapidly rising rates.

“In contrast, non-residential transactions, which saw a 3% increase this month, point to the sector weathering challenges better than housing. Investors seem more confident to transact despite economic headwinds and the higher cost of borrowing. With approximately €200 million worth of real estate debt set to mature in 2023/24 in UK, France and Germany alone, the cost of borrowing and debt servicing will be the defining theme of 2024’s commercial real estate market. Continued volatility is likely until inflation and rates normalise, but monetary policy is showing signs of working to reduce inflation levels, with confidence slowly returning to the market.

“Overall, these figures reflect an uncertain economic environment where households and businesses remain wary and with good reason. Sustained growth will require not just macroeconomic improvement, but better leveraging of technology and data to enable smarter, faster transactions. Innovation is not just a nice-to-have, but an essential component to the recovery of the market. Integrating solutions like AI could dramatically streamline processes and reduce costs, contributing to a stronger outlook for 2024.”

Ben Waugh, managing director at more2life, commented: “The drop in property transactions last month demonstrates a seasonal lull, as can be expected during December. As we enter 2024, lowering rates will likely bring a flurry of buyers back to the market and we can expect an uptick in activity to start the year off well. The ongoing rates reductions and increasingly stable interest rates are a further sign that 2024 will turn a corner on the disruption of last year.

“This stability may encourage some existing homeowners with fixed retirement incomes to consider how they can augment their pension pot or gift to younger generations. A conversation with a professional adviser will help these individuals understand the opportunities that are available to them. There is an increasingly broad range of later life lending products entering the market, so it pivotal that borrowers come to an informed decision based on expert advice, tailored to their personal circumstances and financial needs.”

Karen Noye, mortgage expert at Quilter, commented: “New data from HMRC shows that the end of 2023 witnessed a notable decrease in residential transactions, a trend attributed to the dampening effects of higher interest rates and a general sense of caution in the property market as a response to the cost of living crisis. Higher rates made the prospect of buying a home less attainable for many, leading to an 18% year-on-year decline in transactions by December 2023. The housing market has therefore been subdued, with activity slowing down considerably.

“This has had a knock on impact on the amount of tax the government are taking in from Stamp Duty. Other statistics out today show that residential property receipts in Q4 2023 were 4% lower than in the previous quarter, and 25% lower than Q4 2022. Reigniting the property market therefore might be something the government is keen to do to and recent rumours of the return of 99% mortgages could be its attempt to get more first time buyers into the market which helps boost transactions further up the chain too.

“However, as we step into 2024, there are burgeoning signs of optimism without the need for further measures. A critical factor contributing to this positive shift is the gradual reduction in mortgage rates. As these rates begin to lower, the financial burden on prospective homebuyers eases, making the dream of homeownership more accessible. This easing of mortgage rates is expected to inject newfound life into the housing market, fostering an environment where more individuals can afford to buy homes and these transaction figures start to rise again.

“Speculation around the BoE potentially lowering the base rate later this year has fuelled expectations of an even more favourable borrowing landscape. Such a move would likely lead to a further reduction in mortgage rates, thereby accelerating the housing market’s recovery by making financing more affordable for a broader segment of the population.”

Tomer Aboody, director at property lender MT Finance, added: “While interest rates are stabilising, leading to lower mortgage pricing, stamp duty is still the biggest outlay for any buyer and therefore, also the biggest obstacle,” he pointed out. “If there was to be some reduction in stamp duty, this would incentivise sellers to finally move and increase the supply of properties coming to market.”