LandlordBuyer Reveals the Best UK Cities for Landlords in 2026 – and London Doesn’t Make the List

LandlordBuyer Reveals the Best UK Cities for Landlords in 2026 – and London Doesn’t Make the List

BUCKINGHAMSHIRE, United Kingdom, May 27, 2025 (GLOBE NEWSWIRE) — The UK’s buy-to-let (BTL) property market is undergoing significant transformation. Amid rising interest rates and regulatory changes, some landlords are choosing to exit the sector. However, for astute investors, 2026 could represent a year of strategic opportunity-particularly in regional cities that are primed for rental growth.

According to a combination of industry data and expert insights, landlords who adapt swiftly to the evolving market landscape may still secure substantial returns-if they know where to focus.

Key Buy-to-Let Forecasts for 2026:

- BTL lending is projected to reach £42 billion in 2026, marking an 11% rise on 2025 figures.

- Average UK house prices are anticipated to grow by 4%, bolstered by increasing market confidence and easing inflation.

- Rental prices are expected to rise by 3.5% in 2026, contributing to a cumulative 17.6% increase by 2029.

- BTL purchase lending fell by 7% in 2025, largely due to landlord departures and stricter lending regulations.

Best Regional Yield Performers:

- Blaenau Gwent: 11.4% yield

- Redcar & Cleveland: 9.5% yield

- Derby and Newcastle: 6-8% yields

Birmingham: The Emerging Capital of Buy-to-Let?

One of the most promising cities for landlords in 2026 is Birmingham. The city benefits from major infrastructure and urban regeneration projects, high tenant demand from young professionals and students, and forecasted rental price growth of 3.5%.

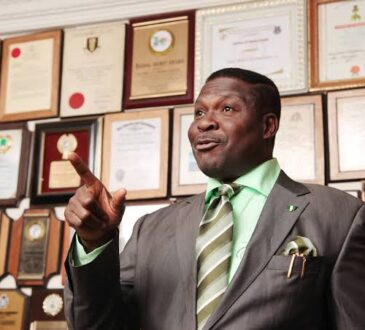

Expert Commentary from Jason Harris-Cohen

Jason Harris-Cohen, Managing Director of LandlordBuyer, believes 2026 will be a pivotal year for UK landlords.

“Birmingham’s rental market is poised for continued growth through 2025 and 2026, underpinned by strong demand, limited supply, and ongoing urban development. For landlords and investors, the city presents an opportunity to achieve both attractive rental yields and capital appreciation. As Birmingham continues to evolve, it solidifies its status as a leading destination for property investment in the UK.”

Regulatory Tightening: Raising the Bar for Market Participation

2026 will see the phased implementation of several key reforms:

- Abolition of Section 21 ‘no-fault’ evictions

- Higher stamp duties on additional property purchases

- Enhanced energy performance standards

- More rigorous rental regulations and enforcement mechanisms

These changes may prompt less-prepared landlords to leave the sector, paving the way for more professionalised property portfolios.

Despite challenges, 2026 offers a golden window for those investors willing to:

- Target high-yield regional locations

- Upgrade portfolios to meet new compliance standards

- Adapt to shifting tenant demands

In the new era of UK property investment, adaptability will be essential-not only for success but for survival.

About LandlordBuyer

LandlordBuyer are a professional property buyers and landlords. We are flexible, fast-acting investors, and we’ll make an immediate offer for any type of rented property throughout England. LandlordBuyer are members of the National Landlord Association (NRLA), and the Property Ombudsman. We are committed to providing quality homes to our tenants, and providing a simple service for landlords who want to sell property with sitting tenants.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4f9eb9b9-af0b-4101-8b80-e925b1b068a2

CONTACT: Media Contact: David Donaldson

07427623617

https://www.landlordbuyers.com/

Suite 1, Europa House Packhorse Road

Gerrards Cross

Buckinghamshire

SL9 8BQ

GB