Property asking prices edge up AGAIN – but looming stamp duty hike and glut of homes makes life hard for sellers

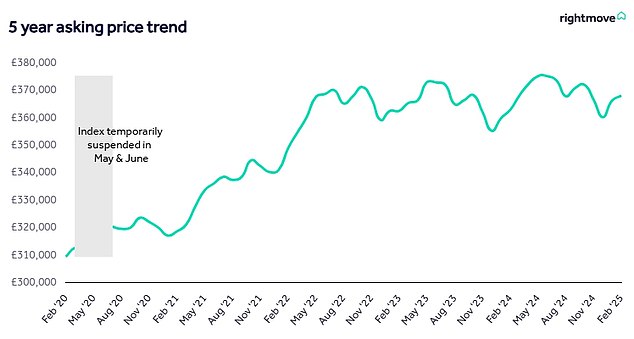

Property asking prices rose on average by £1,805 in the past month, according to the latest figures from Rightmove.

While this represented at 0.5 per cent monthly rise, the property website said this was more subdued than in previous years. The typical monthly rise in February is 0.8 per cent.

It means the average price of property coming to market for sale is currently £367,994.

Rightmove says the lower monthly rise appears to be both a proactive measure, recognising higher costs for some buyers with England’s looming stamp duty deadline looming and a reaction to the record number of sellers who came to market early in 2025.

The average number of available homes for sale per estate agency branch continues to run at a 10-year high, reducing sellers’ negotiating hand.

Meanwhile, rising stamp duty charges are set to impact some regions and types of movers more than others.

Many first-time buyers in lower-priced areas won’t be affected at all by the changes, as there is still good availability of homes that will be stamp-duty free.

By contrast, those most affected will be first-time buyers purchasing a home between £500,001 and £625,000 where an extra £11,250 in costs is at stake for this group if the deadline is missed and not given a short extension by the government.

The average price of property coming to market for sale rises by 0.5 per cent this month to £367,994, a muted price rise for this time of year, according to Rightmove

Colleen Babcock, property expert at Rightmove said: ‘New sellers are showing some pricing restraint after a fast start to the year, being mindful of both the high level of seller competition, and in England also of the looming stamp duty deadline and extra costs for some buyers.

‘Agents report that some of the steam is coming out of new sellers’ price expectations to fit the changing market conditions, which is a sensible reaction to attract buyer interest, and it will also help to support activity levels.

‘The upcoming stamp duty deadline in England remains a key talking point, and while some movers may not be affected at all, others will be more severely impacted.

‘For those in higher-priced areas of England like London, the additional stamp duty charges they face can be significant and difficult to afford when already stretched to the max.’

Rightmove is expecting a conveyancing log-jam as some movers scramble to complete their purchase in time for the stamp duty changes.

The average time to complete a property transaction is still around five months, meaning that the typical mover has been working against the clock for some time to complete before 1 April.

As the stamp duty deadline looms, Rightmove says there are more than 550,000 homes are currently going through the completion process, 25 per cent more than at this time last year.

Jeremy Leaf, north London estate agent and a former Rics residential chairman, said: ‘Asking prices are not values but reflect seller aspirations at the start of the process.

‘Although the start of the year saw the highest jump in prices and listings since 2020 and 2015 respectively, even with ongoing affordability concerns, this was always unlikely to continue at the same pace as we near the end of the stamp duty concession.’

What next for the housing market?

There is some positive momentum currently building across the mortgage market.

Mortgage rates have been on a downward spiral over the past few weeks and the Bank of England cut interest rates for the third time in six months at the start of the month.

Last week, multiple lenders slashed mortgage rates and even some 3.99 per cent fixed rate deals appeared on the market for the first time since November.

‘We’ve now had the first bank Rrte cut of the year, and current forecasts suggest there are still two or potentially three more cuts to come, which could see us closing out the year with a base rate of 4 per cent or lower,’ said Matt Smith, mortgage expert at Rightmove.

‘The response from the market to the decision has been positive, and mortgage rates have trickled downwards since the announcement.

‘We hope this is the beginning of a sustained period of rates slowly heading downwards, and while we’re unlikely to see major falls across the board, we’ve already seen the first sub-4 per cent rates of 2025.’

However, buyers are being warned not to assume that mortgage rates will continue to fall.

In truth they have been yo-yoing back and forth for some time now and it is likely most buyers will continue to face a rate of between 4 and 5 per cent this year.

Global and economic news, including worse than expected inflation figures could also temper any downward momentum and affect sentiment and outlook for the market.

Tomer Aboody, director of specialist mortgage lender MT Finance, said: ‘The confident start to 2025 continues, with more sellers coming to market and good levels of activity.

‘Increased choice ultimately results in lower property prices as the market shifts in the buyer’s favour.

‘With the stamp duty changes looming, a big push in the first quarter is likely with uncertainty potentially creeping in after that.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.