With tentative signs that we may be at the bottom of the property cycle, it’s worth exploring whether now could be an attractive entry point.

The UK commercial property market, much like the broader economy, is characterised by cyclical patterns of growth and decline. Over the past four decades, it has gone through seven distinct downturns, including the current one. As we navigate these complexities, investors will need to move their focus away from past recovery patterns and take a more discerning and proactive approach.

UK property cycles in historical perspective

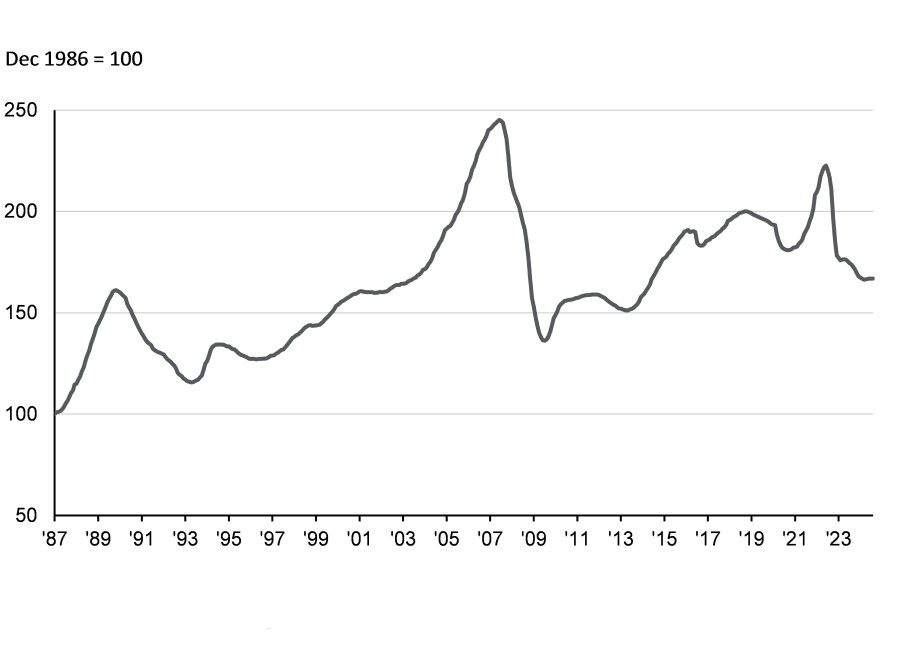

The UK commercial property market has always been closely linked to the broader economic environment, undergoing multiple periods of expansion and contraction, as the chart below illustrates.

UK all property capital value index

Source: MSCI UK Monthly Property Index, J.P. Morgan Asset Management, data as of 30 Sep 2024, Dec 1986 = 100.

While all seven downturns over the past 40 years have left their mark, three stand out for their magnitude:

The 1990s recession: From 1989 to 1993, property values dropped by 28%, marking a severe downturn triggered by high interest rates and an economic slowdown.

The global financial crisis (GFC): Between 2007 and 2009, the market faced its most dramatic decline, with property values plunging by 44% during a global economic meltdown.

The Covid-19 pandemic: The pandemic saw a 10% drop in property values between October 2018 and September 2020, as the pandemic disrupted economic activities and altered property use patterns.

Today, the market is navigating another significant downturn. UK commercial property values have declined by 25%, making this the third most severe drawdown since 1986 and the worst since the GFC. However, there are tentative signs that we may be approaching the cycle’s trough. Property values look to have bottomed out in March, with minimal fluctuations over the past five months.

Is now the time to enter the market?

With tentative signs that we may be at the bottom of the cycle, it’s worth exploring whether now could be an attractive entry point. Historically, significant downturns have been followed by strong recovery phases, providing attractive returns for those who invest at or near the trough.

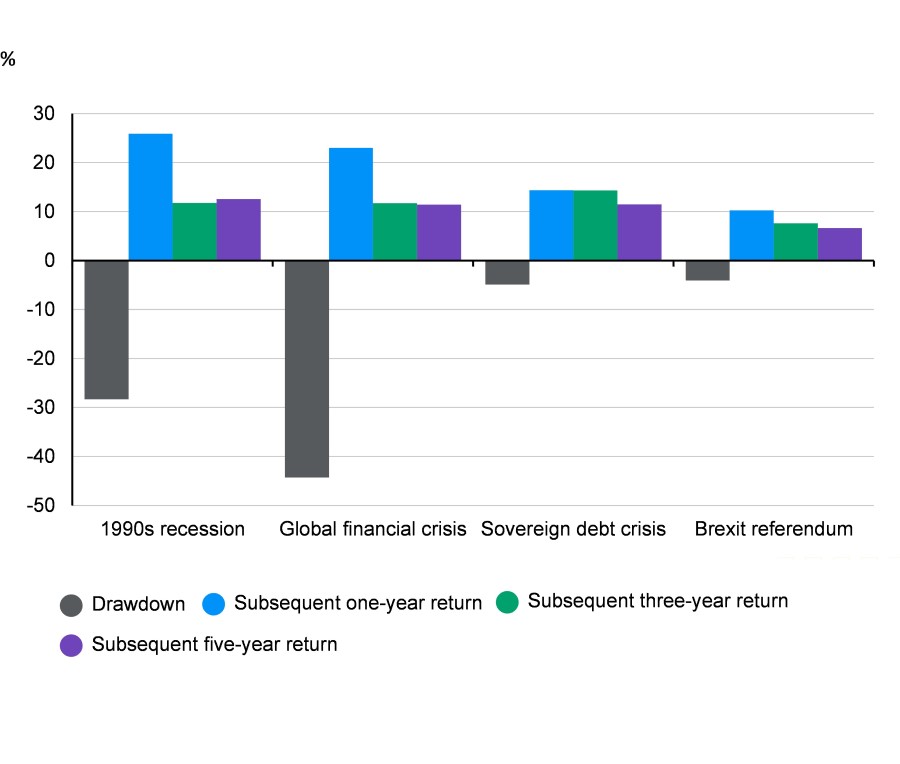

UK all property value declines and subsequent total returns

Source: MSCI UK Monthly Property Index, J.P. Morgan Asset Management, data as of 30 Sep 2024.

For example, after a 28% decline during the 1990s recession, the market began to recover in 1993. The subsequent one-year total return was 26%. Over the next three years, annualised returns averaged 11.8%, and over five years, they reached 12.5% – well above the long-term average of 8%.

Similarly, following the 44% drop caused by the GFC, one-year total return reached 23%, while the three-year and five-year annualised returns were nearly 12% and 11%, respectively – again, outperforming the long-term average.

In fact, looking back at the five previous downturns and recoveries, five-year annualised returns have, on average, been over three percentage points higher than the historical long-term average (exempting the Covid pandemic because it was less than five years ago). This indicates a substantial premium for those entering the market post-downturn.

What’s more, this pattern isn’t solely about precise timing; after both the 1990s recession and the GFC, returns remained elevated for several years following the initial drawdown.

Why might this time be different?

While past cycles have shown that investing near the trough of a capital value cycle often results in above-average total returns, several factors indicate that this time could be different.

First, we are unlikely to see the same aggressive interest rate cuts that historically spurred property value growth.

In the past, there were two distinct periods of strong appreciation: from 1993 to 2007 and from 2009 to 2018. During these periods, five-year gilt yields dropped by more than 4.5 percentage points between 1994 and 2006 and by around 5.5 percentage points from 2007 to 2018. In contrast, current forecasts suggest that interest rates will decline much more gradually, which may limit the magnitude of any recovery.

Second, the market is witnessing greater divergence across and within sectors due to ongoing structural changes. Until around 2014, the values of major property types typically moved in the same direction, largely influenced by macroeconomic factors.

Since then, however, shifts such as the rise of e-commerce and the increase in remote work have led to significant variation in performance across and within sectors. For instance, industrial properties, driven by the surge in online retail, have seen their values increase by more than 70% in the past 10 years. Meanwhile, traditional retail properties have struggled, with values falling by more than 20% over the same period.

Moreover, there is a growing bifurcation between best-in-class assets and the rest. Premium assets in prime locations with modern facilities are outperforming older, less desirable properties. This trend is becoming more pronounced as tenants and investors prioritise quality, sustainability and flexibility. The widening performance gap between top-tier assets and secondary properties makes sector and asset selection, along with active management, crucial for achieving strong returns.

In this environment, investors will need to adopt a more nuanced approach, focusing on identifying high-quality assets and sectors with robust fundamentals. This marks a shift from the broad-based recoveries seen in past cycles, where a rising tide lifted all boats.

Now, navigating the market successfully will require careful asset selection, active management, and an understanding of which properties and sectors are best positioned to thrive in the evolving landscape. Investors who can identify and invest in top-performing segments and actively manage their portfolios will likely be better positioned to capitalise on emerging opportunities.

Aaron Hussein is a market strategist at JP Morgan Asset Management. The views expressed above should not be taken as investment advice.