(Bloomberg) — UK house prices slipped for the first time in six months in March, lender Halifax said in data that confirmed a setback in the property market’s recovery.

Most Read from Bloomberg

Halifax said that the average house price dropped 1% to £288,430 ($364,160) last month. That followed a 0.3% gain in the month of February and small increases in each of the previous four months.

It chimes with an unexpected slide in prices in Nationwide Building Society’s measure earlier this week, which economists interpreted as an interruption in the overall trend toward little change or mild gains in the market this year until the Bank of England cuts interest rates. From a year ago, Halifax said prices have risen 0.3%.

“The direction of travel for the property market is currently sideways,” said Tom Bill, head of UK residential research at Knight Frank. “Once a rate cut appears firmly on the horizon and more mortgage rates start with a 3, we expect stronger demand to push UK prices 3% higher this year.”

Other indicators have pointed to continued growth for property prices, with demand improving from buyers and sellers also putting more places up for sale. The market is responding to a dip in mortgage costs and the expectation that interest rates will fall later this year. Mortgage approvals surged to the highest level in 17 months in February.

“That a monthly fall should occur following five consecutive months of growth is not entirely unexpected particularly in view of the reset the market has been going through since interest rates began to rise sharply in 2022,” Kim Kinnaird, director of Halifax Mortgages, said in a report Friday. “Despite this house prices have shown surprising resilience in the face of significantly higher borrowing costs.”

Earlier on Friday, the property website Rightmove said that last Thursday was its biggest day for new sellers coming onto the market this year.

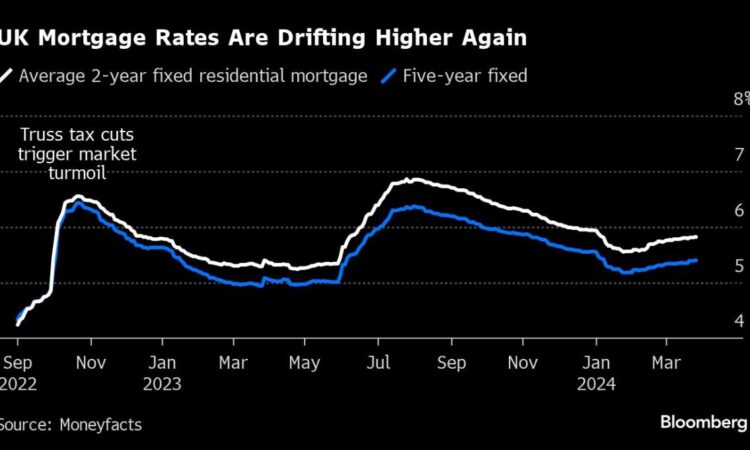

While mortgage rates have cooled from the 15-year high hit last summer, borrowing costs have crept up again in recent weeks.

The average two-year fixed mortgage rate has climbed to 5.81%, up from 5.55% in late January, according to Moneyfacts. However, it is still well below the highs of almost 6.9% seen last summer as the BOE edges toward cutting interest rates.

Prices were largely stagnant in London, up 0.4% compared to a year ago, while Northern Ireland was the strongest performing region with 4.3% growth. Halifax said there was a “north/south divide” in English house prices with the North West enjoying a 3.7% jump year-on-year.

Markets expect the central bank to begin loosening policy in August, with three cuts almost fully priced in by the end of the year.

“Affordability constraints continue to be a challenge for prospective buyers, while existing homeowners on cheaper fixed-term deals are yet to feel the full effect of higher interest rates,” Kinnaird said. “This means the housing market is still to fully adjust, with sellers likely to be pricing their properties accordingly.”

She also said that financial markets have become less optimistic about the scale and timing of BOE rate cuts, which has halted a drop in mortgage rates that benefited the property market in the past few months.

(Updates with comment from fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.