(Bloomberg) — UK house prices defied predictions of a slump in 2023, with a shortage of properties on the market offsetting painfully high mortgage rates, one of the nation’s biggest lenders said.

Most Read from Bloomberg

Halifax said Friday the average house price rose to a nine-month high of £287,105 ($363,810) in December, the third consecutive monthly increase and 1.7% above the end of 2022. That was slightly stronger than the 1.8% annual drop Nationwide Building Society announced last week.

The figures from Britain’s two leading mortgage lenders underscored the resilience of the property market, which economists at the start of the year anticipated would drop by 10% or more. Instead, prices have essentially stagnated, and most forecasters see a price war among lenders that has been driving down mortgage rates in recent days helping to boost demand from buyers.

“The growth we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand,” said Kim Kinnaird, director at Halifax Mortgages. “That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months.”

-

Halifax reiterated its outlook for prices to fall 2% to 4% this year.

-

Nationwide predicts stagnation or a 2% drop.

-

Overall, prices are down 4.5% from their peak by Nationwide’s measure and by 2% according to Halifax.

Halifax said buyers and sellers will be “naturally cautious” given sluggish economic growth and that interest rates will remain elevated for as long as inflation is above the Bank of England’s target. Other forecasters have been more upbeat as wage growth begins to outstrip inflation and mortgage rates cool.

A separate survey of purchasing managers showed output in the construction industry fell at the slowest pace since August, a sign that a rout in the house building sector may be drawing to a close.

“Expectations of falling interest rates during the months ahead appear to have supported confidence levels among construction companies,” Tim Moore, economics director at S&P Global Market Intelligence, said in a statement Friday. “House building was the worst-performing area, but even in this segment there were signs that the downturn has started to ease.”

A major headwind facing the housing market is the scale of mortgage refinancing that has yet to take place. Around 1.5 million borrowers face an extra £1,800 annual bill on average this year as their fixed-rate deals expire, according to the Resolution Foundation.

“Given further recent falls in mortgage rates, house prices are on track to rise in the first quarter,” said Imogen Pattison, economist at Capital Economics. “The larger jump in the Halifax data suggests that the index, which is based on Lloyds Banking Group mortgage lending, continues to be more sensitive to changes in mortgage rates than Nationwide’s. So, the Nationwide house price index is likely to play catch up over the coming months.”

A number of lenders have rushed to slash mortgage rates in recent days. The price war comes after investors ramped up their bets on the Bank of England slashing interest rates this year. Currently markets are leaning toward the first cut coming in May followed by at least four more by the end of the year.

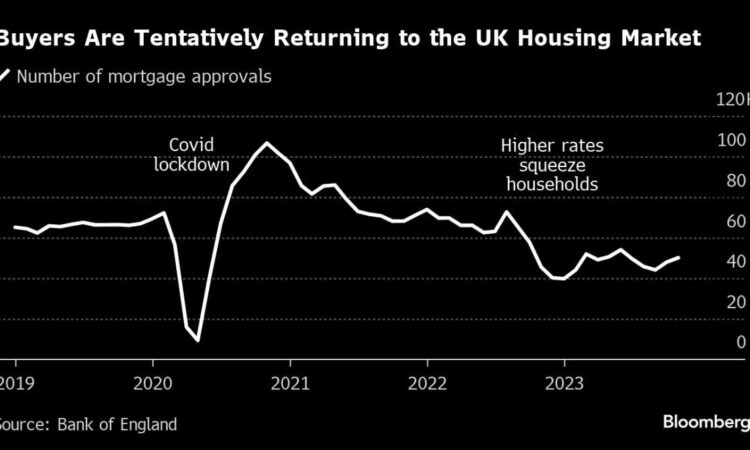

A cooling in mortgage rates from the 15-year high hit last summer is tempting more buyers back to the market, helping to prop up prices. According to Moneyfacts, the average two-year fixed mortgage rate has fallen to 5.87%, well below the almost 6.9% peak seen in July. BOE data on Thursday showed mortgage approvals jumping more than forecast in November.

“Shifts in the monetary policy outlook mean the key headwind to the housing market should be less significant than anticipated only a few months ago,” said Martin Beck, chief economic adviser to the EY ITEM, which runs a forecasting model using the UK Treasury’s parameters. The group “ now thinks 2024 will be a year of stability in house prices, rather than falls.”

London had the highest average house price across all the regions, at £528,798, although prices in the capital dropped by 2.3% in the year.

Northern Ireland was the strongest performing region in 2023 with prices jumping 4.1%. Scotland, the North West of England and Yorkshire also saw gains, while the South East suffered a decline. Prices in the region surrounding the capital slipped 4.5%, the biggest slump of the UK regions.

–With assistance from Andrew Atkinson.

(Updates with construction PMI data.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.