(Bloomberg) — UK house prices rose for a fifth month in February, confirming a rebound from a slump last year as consumers become more confident that borrowing costs are likely to drop.

Halifax said the average value of a home rose 0.4% from January to £291,699 ($371,710). It left values 1.7% higher than a year earlier.

The figures indicate the housing market recovery is taking root after a stagnant 2023. Prospective buyers are being encouraged by easing mortgage costs and a rosier economic outlook.

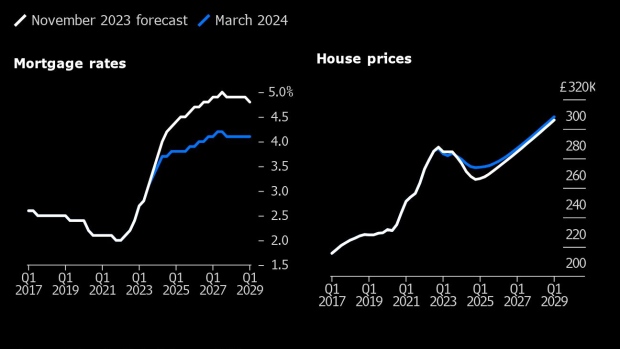

It comes a day after the UK fiscal watchdog upgraded its housing market outlook on the back of anticipated interest rate cuts from the Bank of England. The Office for Budget Responsibility expects average house prices to fall modestly this year, and at a shallower pace than anticipated four months ago.

Prices nationwide are now down 0.6%, or by £1,800, from their peak in mid-2022, Halifax said. London house prices rose 1.5% from a year ago, the first annual growth in a year.

The figures confirm increases also recorded by rival mortgage lender Nationwide Building Society and lending figures from the BOE.

The increase reported by Halifax was nonetheless the weakest reading since September, underlining the headwinds continuing to face the housing market.

“These figures continue to suggest a relatively stable start to 2024 and align with other promising signs of increased housing activity, such as mortgage approvals,” said Kim Kinnaird, director at Halifax Mortgages. “Even with growing wages and inflation falling back, raising a deposit and affording a sizeable mortgage remains challenging, especially for those looking to join the property ladder, so it remains a possibility that there could be a slowdown in the housing market this year.”

While mortgage rates have fallen from 15-year highs last summer, they are still well above levels before the BOE began its hiking cycle and have edged up in recent weeks as investors scaled back how far they expect the BOE to cut rates. According to Moneyfacts, the average 2-year fixed residential home loan is around 5.76%, up from 5.55% toward the end of January.

In his Budget on Wednesday, UK Chancellor Jeremy Hunt announced a series of measures meant to increase housing supply. He reduced the capital gains tax on residential sales in a bid to encourage existing home owners to sell. He also scrapped the furnished holiday lettings regime that gave tax breaks to people renting second homes out on a short-term basis.

“This recovery remains fragile, and the government had a prime opportunity during yesterday’s Spring Budget to stabilise this upward trajectory. Regrettably, this was an opportunity missed,” Sam Mitchell, CEO of Purplebricks

©2024 Bloomberg L.P.