UK house prices surge to highest point since January to end months of stagnation after rate cut

| Updated:

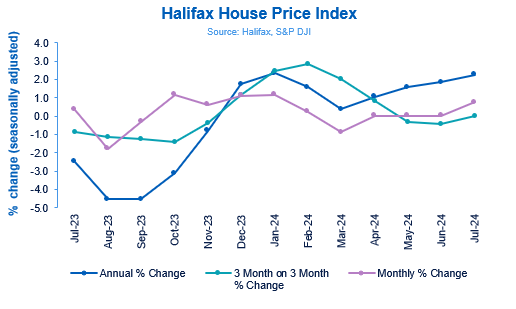

Renewed momentum in the property market has seen UK house prices rise at the highest rate since January, ending a three-month spell of stagnation.

House prices increased by 0.8 per cent in July, with the average property now costing £291,268, up from £289,042 in June, according to the Halifax house price index. This surge sets the annual growth rate at 2.3 per cent.

This comes after the Bank of England cut interest rates last week, ending months of an elevated position. Many prospective property buyers and sellers had been holding off for interest rates to come down, as it would have an impact on mortgages and borrowing.

The Monetary Policy Committee cut them by just 25 basis points, and the decision was split by five votes to four. Andrew Bailey, its governor said: “What matters for our policy decisions is the accumulation of evidence about the medium term outlook for inflation,” indicating the Bank would remain cautious..

London remains the priciest area in the UK, with average property prices now at £536,052, – a 1.2 per cent rise from last year. The average house price in the city has risen by more than 239 per cent since the year 2000, versus a national average growth rate of 207 per cent.

Northern Ireland saw the strongest house price growth in the UK, with prices soaring by 5.8 per cent annually in July, up from 4.1 per cent in June—the highest rise since February 2023.

The average property price in Northern Ireland now stands at £195,681.

House prices in the North West surged by 4.1 per cent compared to last year, bringing the average property price to £232,489. In Wales, prices climbed by 3.4 per cent to reach £221,102—the highest since October 2022.

Scotland also saw an increase, with the average property now costing £205,264, up 2.1 per cent from the previous year.

Eastern England was the only region to see a decline, with property prices averaging £330,282, down 0.4 per cent annually.

Amanda Bryden, head of mortgages at Halifax, said: “In July, UK house prices increased by 0.8 per cent on a monthly basis, following three relatively flat months.

“The average house price in the UK is £291,268, up over £2,200 compared to the previous month. Annual growth rose to 2.3 per cent, the highest rate since the start of this year.

“Last week’s Bank of England base rate cut, which follows recent reductions in mortgage rates, is encouraging for those looking to remortgage, purchase a first home or move along the housing ladder.

“However, affordability constraints and the lack of available properties continue to pose challenges for prospective homeowners.

“Against the backdrop of lower mortgage rates and potential further base rate reductions, we anticipate house prices to continue a modest upward trend throughout the remainder of this year.”

Rental market ‘still a mess’

Following the announcement by Halifax analysts said the picture for the UK property market was improving.

Daniel Austin, CEO and co-founder at ASK Partners, said: “Research suggests that the property market is not traditionally affected by general elections, but it is positive to see that the recent election has not had a negative impact.

“We are continuing to see a month-on-month rise in house prices, which is hopefully the sign of an upward trend developing for the rest of the year.

“The market certainly appears to be showing signs of resilience. Everyone is waiting in anticipation of what the new government will do to drive construction of new homes and unlock the planning system, and it is likely that initiatives announced in the coming months will give the market a further boost.

“In the property investment world, rent values have seen sustained growth, positioning real estate as reasonably valued in comparison to gilts and presenting growth potential. In the realm of commercial real estate, we have seen values hit the bottom and confidence return.

“The market has picked up with opportunistic acquisitions of prime properties in prime locations.

“As a debt provider, we hope to support well-capitalised borrowers who understand their product and are looking at the best sites in prime locations with potential to add to their asset value.

“Following this strategy, we aim to bolster developers’ initiatives with the flexible underwriting approach that is necessary for navigating a changing market.

“This will enable us to continue to offer opportunities for the growing number of private individuals opting to invest in property debt.”

However Sam Mitchell, CEO of Purplebricks, warned that the picture was still bleak for renters and those looking to take their first steps onto the housing ladder.

They said: “The growing confidence we’ve seen take hold of the housing market in recent weeks has been supercharged by the Bank of England’s interest rate cut.

“With lenders already slashing mortgage rates in response to last week’s decision, buyers are beginning to move ahead with purchasing decisions they have been putting off for months.

“However, the rental market is still a complete mess and there is a significant way to go before the outlook can be said to be as positive for prospective homeowners.

“The focus for the coming months must be lowering the barriers to home-ownership for first-time-buyers, which will only be achieved by Labour pushing forward with its plans to ‘get Britain building’.”