House sales increased for the fifth month in a row in May, according to HM Revenue and Customs (HMRC) figures.

Across the UK, an estimated 91,290 sales took place in May, which is 17% higher than in May 2023 and 2% higher than in April 2024.

HMRC’s report said: “Provisional figures for May 2024 showed a fifth consecutive month-on-month increase in seasonally-adjusted transactions.”

Over April and May this year, 180,450 transactions took place, compared with 160,530 a year earlier.

Tom Bill, head of UK residential research at estate agent Knight Frank, said the figures indicate “a slow return to normality for the UK housing market as expectations around a rate cut are pushed into the autumn and a General Election adds to the mood of uncertainty”.

Property website Zoopla said this week that it expects house price inflation to remain muted and likely to rise more slowly than household incomes over the next one to two years.

Zoopla estimates that the typical house price is currently sitting at nearly £20,000 above the level that would generally be affordable to households, although it said this mismatch is expected to disappear by the end of the year amid income growth and a trend towards longer mortgage terms.

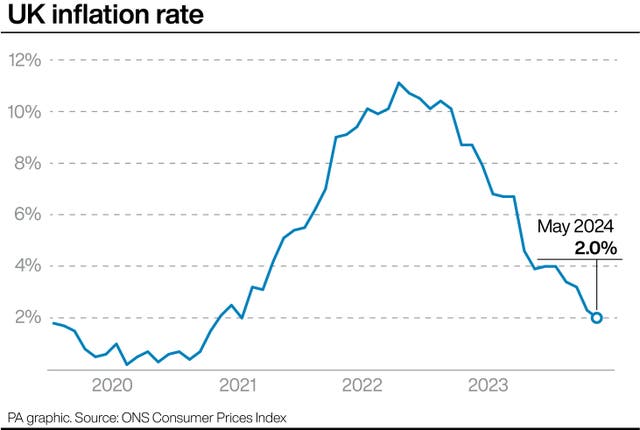

Consumer Prices Index (CPI) inflation slowed to 2% in May, from 2.3% in April, according to the most recent Office for National Statistics (ONS) figures.

CPI inflation was last recorded at the 2% target in July 2021, before rocketing up and at one stage reaching a 41-year high of 11.1% in October 2022.

Crispin Harris, director at Jackson-Stops, said looking at its estate agent branch figures: “New instructions in the months of April and May were up 34% year-on-year, with overall sales likewise seeing an uplift of 19%, suggesting the scales of supply and demand are allowing for a more active 2024 regardless of the politics that lay ahead.”

Emma Cox, MD of real estate at Shawbrook bank, said: “Residential property transactions have continued on their upward trajectory in May, according to the latest figures from HMRC.

“After five consecutive months of growth, confidence within the market appears to be returning, helped by the increasingly favourable macroeconomic outlook.

“Prospective buyers and investors are adapting to higher fixed-rate mortgage rates and continuing to transact.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “Several lenders have reduced fixed-rate mortgages for borrowers taking out new deals on the back of cheaper funding rates, which is encouraging and hopefully a sign of better things to come.

“But until the Bank of England starts cutting interest rates, these reductions are unlikely to become more sustained.”

Amy Reynolds, head of sales at London-based estate agent Antony Roberts, said: “While property prices have fallen in some areas, it is still very difficult for first-time buyers.

“With higher borrowing costs, home ownership is out of reach for many.”