(Bloomberg) — Britain’s prospective home buyers stepped up their search for property after the Bank of England’s first reduction in interest rates since the start of the pandemic, Rightmove Plc said.

Most Read from Bloomberg

The online property portal said the number of buyers contacting estate agents to view houses for sale jumped 19% from a year ago since the BOE decision on Aug. 1, an acceleration from the 11% increase across the month of July. The number of sellers coming to market also rose by 5% compared to a year ago.

The figures add to growing optimism that cooling mortgage rates will spark an upturn in the property market this autumn. While the recovery in the housing market has been patchy in 2024, a recent decline in borrowing costs for home buyers and the BOE’s policy pivot have increased confidence in a stronger second half of the year.

“The first bank rate cut since 2020 has sparked a welcome late summer boost in buyer activity,” Tim Bannister, director of property science at Rightmove, said in a report Monday. “While mortgage rates aren’t yet substantially lower since the rate cut, the fact that the long-hoped-for first cut has finally arrived, and mortgage rates are heading downwards, is positive for home-mover sentiment.”

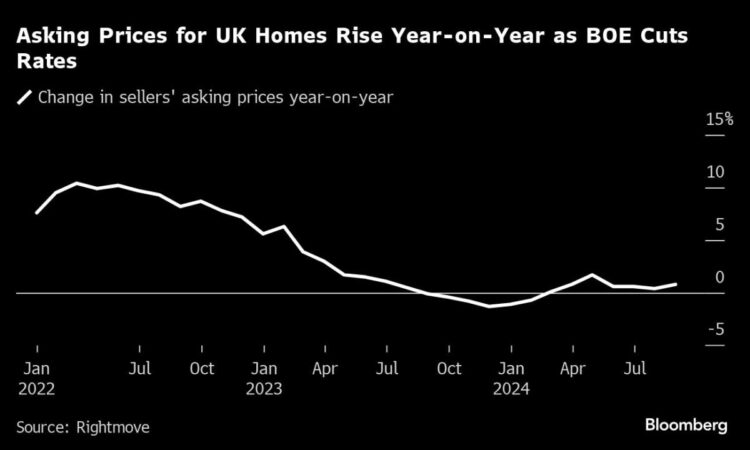

Rightmove upgraded its 2024 forecast for asking prices after the surge in activity in the property market since the central bank reduced rates from a 16-year high. It now expects a 1% gain in asking prices across 2024 as a whole, up from its previous forecast for a drop of 1%.

While sales were 16% higher than a year ago, Rightmove said sellers’ asking prices were down 1.5% month-on-month. It said the price fall was largely a reflection of a quieter August period traditionally seeing a dip in valuations.

Asking prices were up 0.8% on a year earlier when mortgage rates were near their peak, better than the 0.4% rise the previous month.

The average two-year fixed mortgage rate has fallen to 5.66%, down from around 6% earlier in the summer, according to Moneyfacts. However, borrowing costs may only come down gradually as traders expect the BOE to take a cautious approach to reducing bank rate.

Currently investors are only fully pricing in one more quarter-point cut by the UK central bank by the end of the year.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.