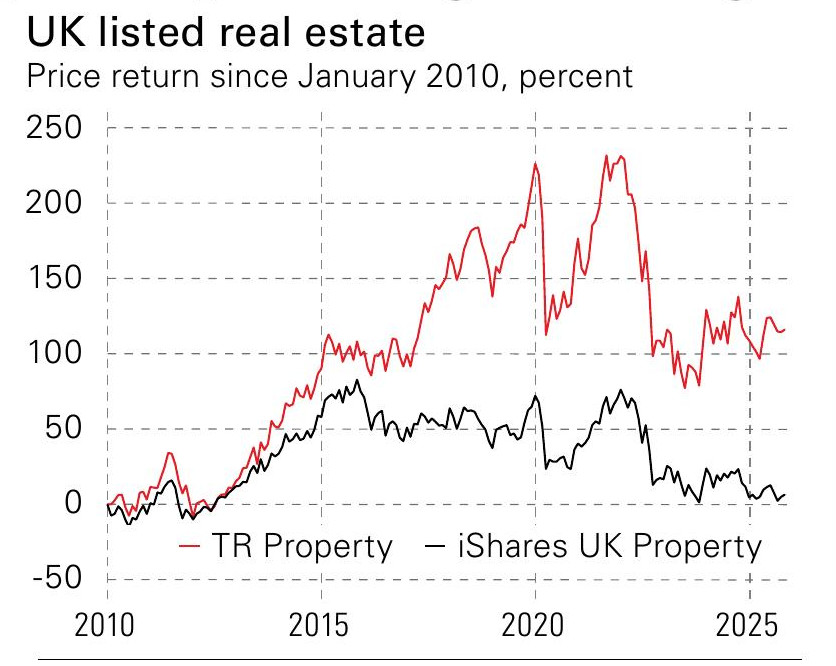

There are times when either you are missing the obvious, or the market is. Commercial property feels like one of those times. Most UK real estate investment trusts (REITs) trade at wide discounts to net asset value (NAV), with shares still lower than they were a decade ago, despite a regular flow of solid operating updates from key players.

We can clearly worry about certain subsectors – eg, the oversupply of lower-grade offices, made fit only for redevelopment by new energy-efficiency standards or changing work patterns. Yet UK commercial real estate is very diverse: we tend to notice and talk about offices out of all proportion to their share, as Marcus Phayre-Mudge of TR Property Investment Trust (LSE: TRY) pointed out at the Association of Investment Companies Showcase last week. Pure office REITs are only around 5% of the total.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Why the uncertainty surrounding UK REITs?

There are a few top-down possibilities. First, investors were shocked by the rapid rise in interest rates in 2022. That makes them still cautious about where rates will be as REITs refinance maturing debt and the impact of that on earnings. Note how the sector tends to gyrate as five-year swap rates – a rough benchmark of how new debt will be priced – go up and down.

Second, the rise in longer-term bond yields will be affecting valuations. A fixed yield from a 10-year bond is not the same as income from a physical asset that varies with inflation and rental demand, but higher yields still influence where institutions put their money. This affects the underlying assets more directly than the listed REITs, but the uncertainty is not helpful.

Third, there are many self-reinforcing factors. A sector trading at persistent discounts cannot easily raise equity to fund deals. This means they cannot seize opportunities to snap up cheap assets as other investors exit the sector. They cannot grow and remain sub-scale, or fall behind the rising size and liquidity requirements that buyers such as wealth managers require. Thus the sector consolidates (okay), or is bought out by private equity (bad for public markets).

Real estate is of course very cyclical. Maybe it is now primed for a strong rebound, as Phayre-Mudge argues. In the meantime, TR Property (which invests across Europe and sees plenty of value in other countries as well), a passive fund such as iShares UK Property ETF (LSE: IUKP), or a diversified basket of REITs will all earn some income – TRY yields 5%, IUKP yields 4.3% – while waiting for sentiment to change.

(Image credit: Future)

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.