More and more homes in Cleveland have owners who live out of town, out of state or even in another country. Many of the houses are owned by companies.

The story of one company, SBAR Holdings LLC, offers a glimpse into the often invisible networks of businesses that buy and sell properties here. It’s an issue that has vexed Cleveland officials, especially when it comes to chasing down far away investors and landlords. Though investors still own a relatively small share of rental houses in cities nationwide, there’s evidence that they are purchasing more.

Real estate investor Andreas Johansson operated SBAR Holdings, which bought 160 houses in the Cleveland area. During the time SBAR Holdings was snapping up homes in Cleveland, investor purchasing was taking off. By 2020, one study found, businesses made up almost half of the homebuyers on the majority-Black East Side.

The majority of properties SBAR Holdings purchased – more than 100 – were sold to a Swedish network of investors through Solid Capital Group, a Stockholm business that acted as a marketer. Eventually, some of the investors sued Solid Capital Group in Sweden, saying they were misled about the conditions of the rental properties and lost money.

Johansson, who was not part of the lawsuit, said investors should have better understood the risks of buying real estate abroad.

It can be tough to get a clear picture of how many properties a company owns. Businesses can use different names to buy properties, making connections hard to uncover. In Cuyahoga County, most investors owned a single rental property or only a handful, according to a Case Western Reserve University study.

Signal Cleveland examined lawsuits, business and property records, and more to better understand this one large-scale network of property sellers, investor-owners, and property managers. Unearthing the connections reveals more about how the real estate investments work and the impact they have on Cleveland neighborhoods.

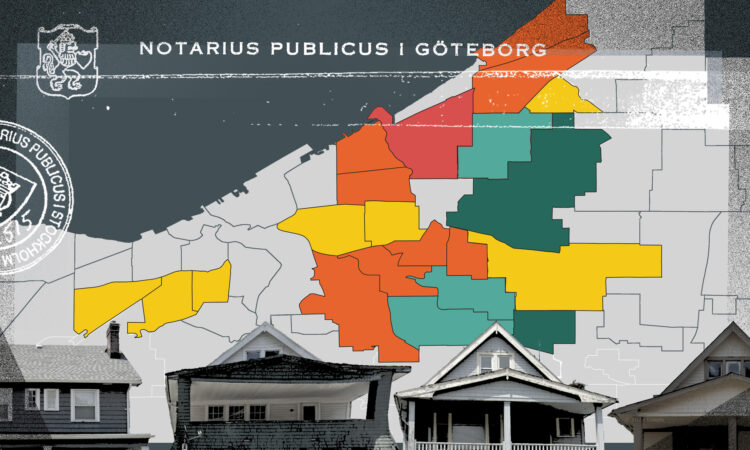

Properties sold in majority Black neighborhoods

SBAR Holdings bought about 160 properties in the Cleveland area, mostly between 2016 and 2019. The company purchased homes in Cleveland, though it also bought some in East Cleveland, Cleveland Heights and Shaker Heights.

All but three of the properties SBAR Holdings purchased were in majority Black neighborhoods on Cleveland’s East Side. Thirty-five were in the Glenville neighborhood. The homes were mainly in historically “redlined” areas where home sale prices remain very low.

SBAR Holdings bought homes in Cleveland from other real estate investors, older residents, real estate trusts, and one community development corporation that serves the Union-Miles neighborhood.

Explore properties sold to Swedish investors

Touch or click on a property on the map below for more information. Scroll, pinch or use the map navigation to zoom in and out.

SBAR Holdings flipped properties quickly

In most cases, SBAR Holdings purchased properties at low prices and sold them at a markup. On average, the company bought Cleveland-area properties for about $17,000. They sold them for more than triple the purchase price – around $53,000.

The sales happened quickly. SBAR Holdings generally held onto properties for about three and a half months. Some sales happened even faster. For example, SBAR Holdings purchased a property in Buckeye-Woodhill for $23,000 and sold that property for $52,611 four days later.

In total, the company paid about $2.7 million for 160 Cleveland-area properties, according to county property records. It sold 153 of the houses for a total of $8 million, an increase of $5.3 million over the purchase prices.

Johansson, the company owner, told Signal Cleveland that wasn’t all profit. He said much of the money went to renovations, utility costs and the cut taken by Solid Capital Group, the company that found Swedish buyers.

Below see the difference between the sale and purchase price totaled by the neighborhood the properties were located in.

Swedish buyers sell Cleveland homes for a loss

Real estate investors connected to the Swedish network bought more than 100 of the Cleveland-area homes from SBAR Holdings, according to a Signal Cleveland analysis. They hoped to make a steady income as landlords. Since then, most of them have sold those properties and lost money on those sales. A handful sold at a profit or still own their rentals.

On average, Swedish investors sold the properties in Cleveland for about $24,000 less than they paid for them. They often owned the properties for about three years.

Looking at purchase and sale prices

Below see the average price SBAR Holdings paid for the properties it sold to Swedish real estate investors. See how much they sold them for, and the next sale price for homes that have been resold.

Conditions decline as properties are repeatedly sold

Often, properties that SBAR Holdings bought to sell to investors were later sold again and again. One property has sold eight times. Overall, the conditions of the network investment properties have declined over time, based on a city wide survey conducted by Western Reserve Land Conservancy in partnership with Cleveland. (The surveys don’t account for the condition of the inside of the homes, since they are done from the sidewalk.)

From 2015 to 2023, the number of properties with an A or B rating has decreased 32 percentage points. The number of properties with a C, D or F rating increased 31 percentage points. Most of the properties had a C rating in 2023 (60%).

Overall, properties owned by out-of-state investors, identified using a tax mailing address outside of Ohio, had lower grades in the 2023 survey than properties considered locally owned, according to Western Reserve Land Conservancy.

Cleveland property surveys: 2015 and 2023

City records show that at least 14 of the properties were boarded up by the city at least once while SBAR Holdings or investors they sold to owned the properties. Two of the properties burned down, and demolition permits were issued for several.

Permit records for Cleveland (where 143 of the 160 homes were located) show SBAR Holdings and the investors did repairs or renovations on a small number of properties. City permits for 22 properties were mainly utility work, but other records detail more significant work done to correct violations. These include updates to wiring, installing furnaces, hot water heaters, plumbing, and bringing one condemned home up to code, records show. The permit records estimate the total value of the work at $120,000.

Johansson estimated that he spent almost $1.7 million renovating properties he sold to Solid Capital Group clients.

Explore the data

Below see each property SBAR Holdings purchased. Properties are displayed by the date of the sale and the amount of the sale. Use the menu to see the purchase price for each home for, the price SBAR Holdings sold each home for, and the price the next buyer sold the property for.

Signal Cleveland reporter Nick Castele and editor Rachel Dissell contributed to this analysis. Computational Journalist Ilica Mahajan provided an independent review of the data analysis.

How we traced properties, owners and conditions for this story

We used Cuyahoga County property transfer records to look at properties SBAR Holdings owned and subsequent sales of these properties. The Center on Poverty and Community Development helped us identify properties purchased by SBAR Holdings using its records of transfers in Cuyahoga County. From this file, we removed records that didn’t reflect property transfers, for example refile deeds and some types of affidavits. The resulting data set contains property addresses, sales dates, sales prices, buyers, and sellers.

We examined property deeds, business filings and emails to identify Swedish investors. When many Swedish investors later sold their houses, their deeds were notarized in Sweden. We also reviewed an email thread that included names of investors who worked with Solid Capital Group.

We mapped SBAR Holdings properties and generated neighborhood-level counts and attributes using Cuyahoga County open spatial data. Permit records come from City of Cleveland open data. Property use, vacancy, and condition records come from the Western Reserve Land Conservancy.

Properties in a small number of instances were sold in bundles with one transaction price listed in sale in records. We counted the entire amount because the individual sales prices were not included in records. This creates minimally higher estimates in average purchase and sale prices.